Bonus Tax Calculator UK

Explore Our Free Tax Calculators and Tools

>Bonus Tax Calculator UK

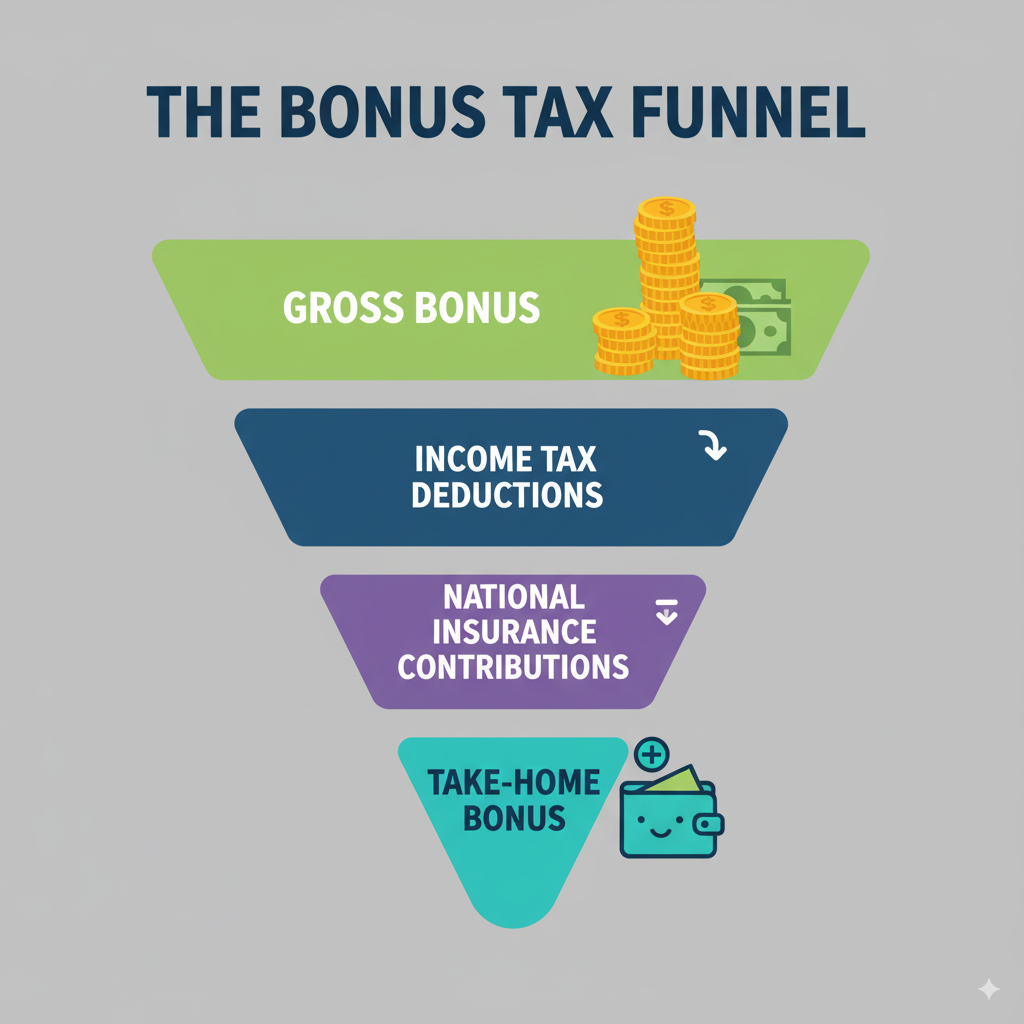

Bonus Tax Calculator UK is a financial tool that shows how much of your bonus you keep after UK tax deductions. In the United Kingdom, all bonuses are treated as income and taxed under the Pay As You Earn (PAYE) system, alongside your salary. This means your bonus is subject to Income Tax and National Insurance contributions at the same rates as regular earnings. Our calculator provides an instant breakdown based on your tax code, annual salary, and the bonus amount, so you can see the exact take-home pay. By using it, employees can plan ahead, avoid surprises, and understand how HMRC rules affect different bonus sizes—for example, a £5,000 bonus for a higher-rate taxpayer versus a basic-rate taxpayer.

Stop guessing your take-home pay—let the Taxman tell you! Try the Listen to Taxman Calculator for quick and reliable salary breakdowns.

Understanding Tax on Bonuses in the UK

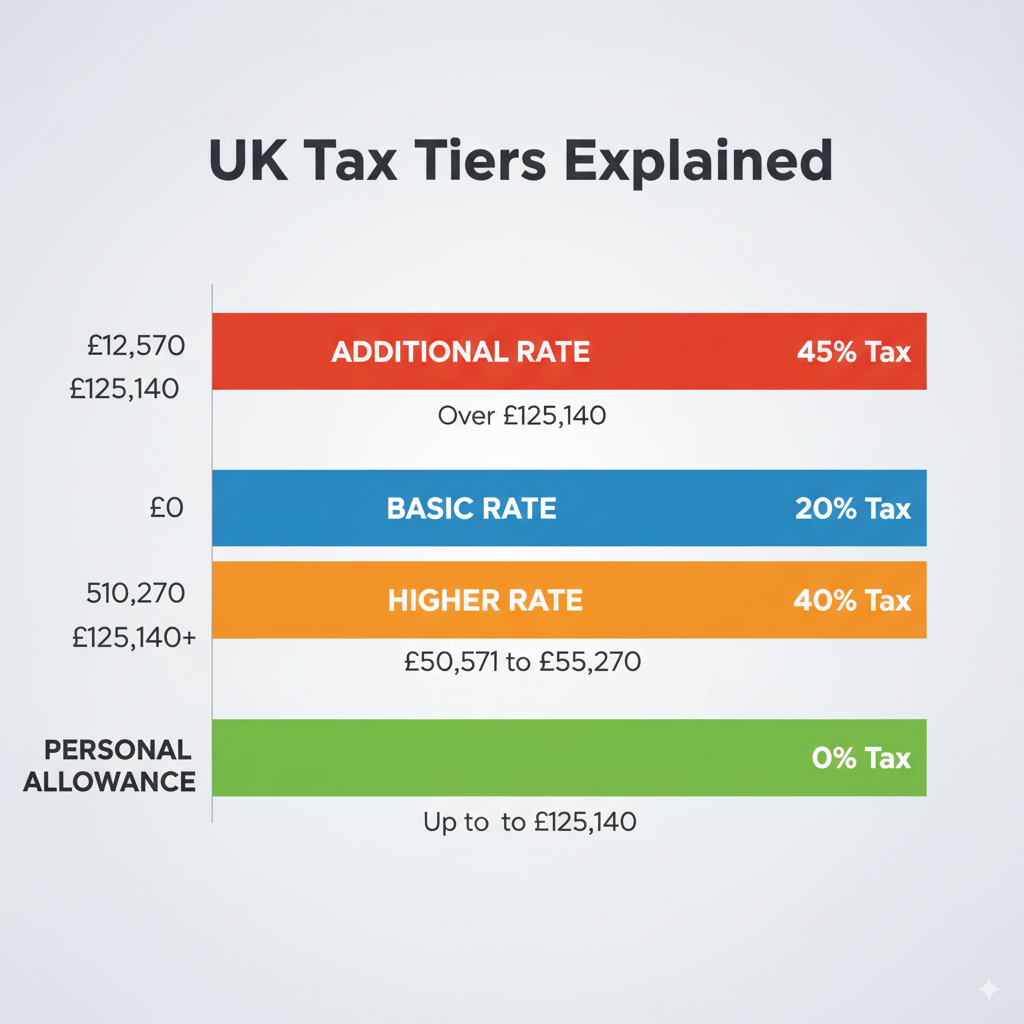

In the UK, a bonus payment is not a separate, specially taxed item. Instead, it is simply added to your total income for the tax year. This is a crucial point for understanding how your bonus is taxed. Unlike some countries with special flat rates for bonuses, the UK system is progressive. This means your bonus could potentially push a portion of your income into a higher tax bracket.

Our Bonus Tax Calculator UK is built to account for this. It helps you accurately calculate tax on a bonus so you are fully prepared for how your payday will look.

Discover how much tax and NI you’re really paying—get a clear salary breakdown with our UK Salary Tax Calculator.

Why Use a Bonus Tax Calculator UK?

Here are a few compelling reasons why our calculator is an indispensable tool:

Accurate Estimates: Get a realistic view of your take-home pay, free from guesswork.

Smart Financial Planning: Knowing your net bonus helps you make informed decisions about spending, saving, or investing.

Simple & Easy to Use: You don’t need to be a tax expert. Just enter a few details and let the calculator do the work.

Real-Time Results: Instantly see the impact of Income Tax, National Insurance, and other optional deductions.

How Does the Calculator Work?

Our UK Bonus Tax Calculator is designed for simplicity and precision. Here’s a step-by-step guide:

Enter your regular salary: This helps the calculator determine your current tax bracket.

Input the bonus amount: The one-off bonus you have received or are expecting.

Choose the tax year: Ensures the calculations are based on the correct Income Tax thresholds.

Add optional deductions: Our “More Options” feature allows you to account for student loans, pension contributions, or other payroll deductions.

After you’ve entered the details, the calculator instantly provides your post-tax bonus, total deductions, and effective tax rate, making it easier than ever to calculate bonus after tax UK.

Want to reverse-engineer your take-home pay? Find out what your gross salary should be using our Reverse Tax Calculator!

Real-World Case Studies

To demonstrate the power of our calculator, let’s look at a couple of real-world scenarios.

Case Study 1: The Basic-Rate Taxpayer

Employee Profile: Sarah, a graphic designer, earns £30,000 annually.

Scenario: She receives a £2,000 performance bonus.

Without the Calculator: Sarah might assume she’ll get most of the £2,000.

With the Calculator: She enters her details and discovers her total income for the year is £32,000, which keeps her within the basic tax band. The calculator shows that she pays 20% Income Tax and 8% National Insurance on the bonus, leaving her with a take-home amount of approximately £1,440. This helps her realize the impact of deductions and plan her budget accordingly.

Case Study 2: The Higher-Rate Taxpayer

Employee Profile: David, a senior project manager, earns £48,000 annually.

Scenario: He receives a £5,000 bonus.

Without the Calculator: David might not realize that this bonus will push him into the higher tax bracket.

With the Calculator: The tool shows that his total income for the year is £53,000. The first £2,270 of his bonus is taxed at the 20% basic rate, while the remaining £2,730 is taxed at the 40% higher rate. The calculator provides a precise breakdown of his overall tax and National Insurance contributions, revealing that his take-home bonus is closer to £2,850. This clear picture helps him avoid a tax-time surprise and consider options like increasing pension contributions to reduce his tax liability.

How This Helps Employers and Employees

Transparency around bonus payments can significantly boost employee satisfaction. For employees, knowing the actual value of a bonus helps with personal finance decisions. For employers, providing a reliable tool like our Bonus Tax Calculator UK demonstrates a commitment to transparency and financial well-being, which can be a valuable recruitment and retention tool.

Who Can Use This Calculator?

Our tool is designed for anyone who needs to understand the financial impact of a bonus, including:

Salaried employees in the UK

Self-employed professionals receiving performance bonuses

HR and finance teams preparing payroll

Anyone planning for future income and taxes

Whether you’re in London, Manchester, Edinburgh, or anywhere else in the UK, our free online tool is here to help you gain financial clarity.

Take Control of Your Finances

Don’t let tax uncertainty diminish the value of your bonus. Use our Bonus Tax Calculator UK today to get clarity on your actual take-home amount. It’s fast, free, and built with UK taxpayers in mind.

Using a reliable tool makes it much easier to calculate bonus after tax UK, helping you make smart financial decisions and feel more secure about your earnings.

Try It Now and see what your bonus is really worth!

FAQs: Bonus Tax Calculator UK

Do bonuses push me into a higher tax bracket? Yes, they can. Your bonus is added to your total income. If this combined figure exceeds a tax band threshold, the portion that crosses the threshold will be taxed at the higher rate.

Is my bonus taxed differently from my salary? No, it’s taxed in the same way. The key is that your bonus can increase your overall taxable income, which can change the effective tax rate applied to it.

What other deductions might apply? In addition to Income Tax and NI, our calculator includes options to factor in deductions for student loans, pension contributions, or salary sacrifice schemes.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.