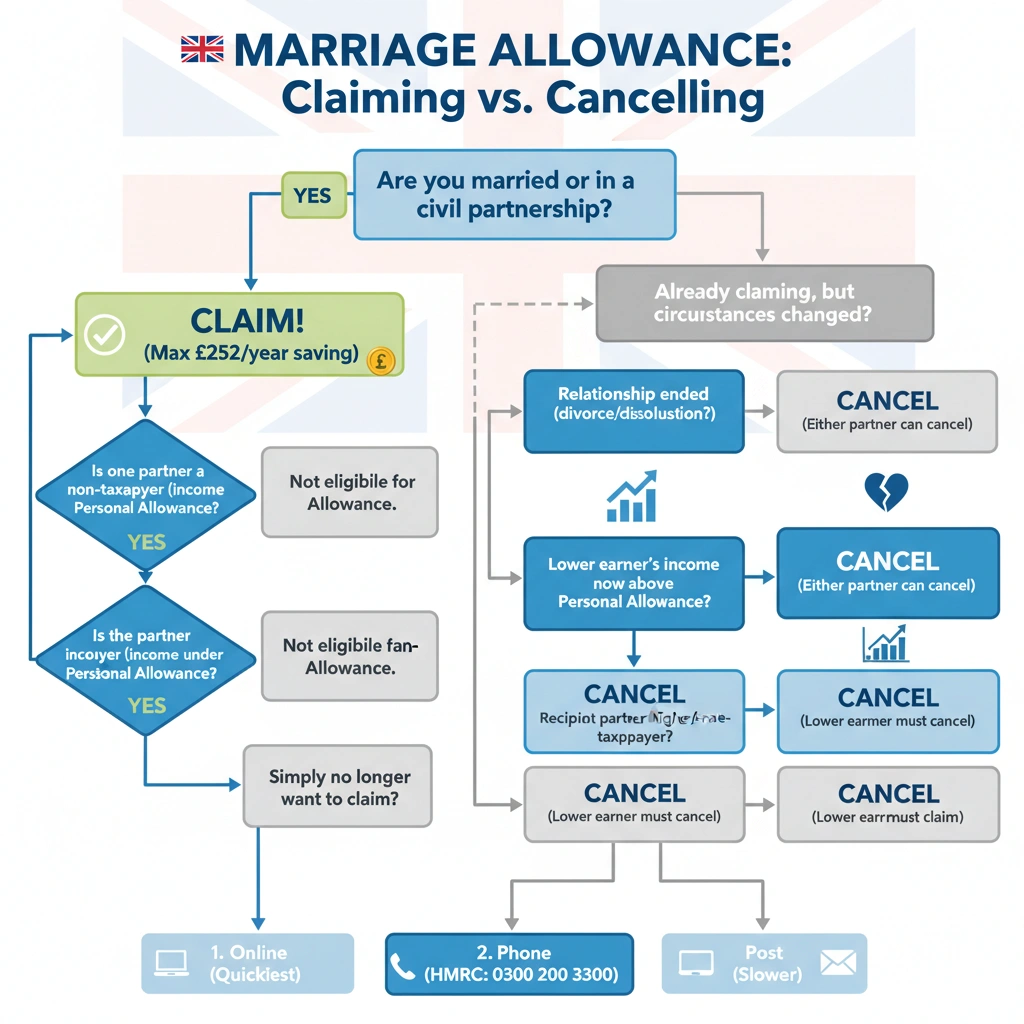

Marriage Allowance is a UK tax benefit that lets one spouse or civil partner transfer up to 10% of their personal allowance to the other, reducing the couple’s annual tax bill by as much as £252.

If your circumstances change such as divorce, separation, death of a partner, or changes in income, you may need to cancel your Marriage Allowance through HMRC.

Cancelling ensures that your tax records remain accurate and prevents unexpected bills or overpayments in future tax years. This guide explains when cancellation is required and how to complete the process step by step.

What exactly is Marriage Allowance?

Marriage Allowance is designed for couples where one earns less than their personal allowance (£12,570 for 2025/26) and the other pays basic rate tax. If there is unused allowance, the lower earner can give up to 10% to their partner which can help lower the couple’s tax bill.

This should be noted: Marriage Allowance is not the same as the Married Couple’s Allowance which is for married couples when one partner was born before 6 April 1935.

Need guidance in working out how much tax you’ll save whether you cancel Marriage Allowance now or later? You can use our simple Income Tax Calculator at no charge right now!

Read Our more Detailed Guides on Taxation:

PIP Rates 2025: Guide to PIP Rates in the UK

What is P800 Refund? How to Claim P800 Refund

What is Withholding Tax? Guide for UK Taxpayers

How to Pay Council Tax Online?

How to Setup Personal Tax Account with HMRC?

How to Register as Self Employed: A Complete Guide for 2025

Is Marriage Allowance Available to All?

If you and your partner want to qualify, you have to meet the following requirements:

- If you are married or in a civil partnership, you should study this information.

- Neither partners receive more than the annual personal allowance.

- The other partner is considered a basic rate taxpayer in the event that they earn between £12,571 and £50,270 this year.

- Both of them came into the world on or after 6 April 1935.

People should claim the child element online on the HMRC website, and if eligible, they can backdate it for up to four years.

Understanding When You Must Cancel Your Marriage Allowance

The Marriage Allowance is not automatically cancelled if your circumstances change; it continues to apply automatically each tax year once claimed.

Therefore, it is critical to proactively cancel your Marriage Allowance if you no longer meet the eligibility criteria. Failing to do so could result in you or your partner having an incorrect tax code, potentially leading to an underpayment of tax that HMRC will later seek to reclaim.

You must cancel your Marriage Allowance if:

- Your Relationship Ends: This includes divorce, annulment, or the dissolution of a civil partnership. If your relationship has ended, either partner can initiate the cancellation.

- Your Income Changes: The lower earner’s income has increased above the Personal Allowance threshold (e.g., £12,570 for the 2024/25 tax year).

- Your Partner’s Tax Rate Changes: The recipient partner becomes a higher-rate or additional-rate taxpayer, as the allowance is only available where the recipient is a basic-rate taxpayer (or starter/basic/intermediate rate in Scotland).

- You Simply No Longer Want to Claim: Perhaps your joint tax position has shifted, and you’ve determined that is it worth claiming Marriage Allowance has changed to is it worth continuing the claim.

If the cancellation is for reasons other than the end of the relationship, the partner who originally transferred the allowance (the lower earner) must be the one to cancel your Marriage Allowance.

Want to see how the new change could impact your taxes? Keep yourself informed by using our UK Tax Calculator

Step-by-Step Guide: How to Cancel your Marriage Allowance

The process for cancelling the Marriage Allowance is straightforward, but it must be done through official HMRC channels. This ensures your and your partner’s tax codes (which use the suffixes ‘M’ and ‘N’ to denote the transfer) are updated correctly.

Method 1: Cancel Your Marriage Allowance Online

The quickest and most convenient option for most taxpayers is to cancel your Marriage Allowance online via the official Government Gateway portal.

Can I cancel my Marriage Allowance online? Yes, this is the preferred method for speed and efficiency.

The Online Cancellation Process:

- Access the HMRC Portal: Navigate to the official GOV.UK website section for Marriage Allowance. You will need to sign into your Government Gateway account. If you do not have an account, you will be prompted to create one, which requires identity verification using information held by HMRC (e.g., National Insurance number, P60/payslip data, passport).

- Locate the Marriage Allowance Section: Once logged in, search or navigate to the area where you manage your tax allowances or Personal Tax Account.

- Initiate Cancellation: Follow the instructions to manage your Marriage Allowance claim. You will be asked to confirm that you wish to cancel your Marriage Allowance and provide the reason (e.g., change in circumstances, relationship breakdown).

- Confirm Identity: HMRC will ask you to verify your identity to ensure the claim is being cancelled by the correct individual.

- Submission and Confirmation: Once submitted, HMRC will process the request. You should receive confirmation that your claim has been stopped, and the tax codes for both you and your partner will be adjusted.

Expert Note: Cancelling your Marriage Allowance online is typically the fastest way to get your tax code updated, which is crucial to avoid building up an underpayment of tax.

Method 2: Cancel Your Marriage Allowance by Telephone

For those who prefer a direct conversation or encounter issues with the online portal, you can cancel your Marriage Allowance by calling HMRC.

How do I contact the HMRC Marriage Allowance?

The most direct line is the HMRC Income Tax Enquiries for Individuals, Pensioners and Employees helpline.

- HMRC Marriage Allowance Enquiries Telephone: 0300 200 3300 (Lines are typically open Monday to Friday, 8 am to 6 pm).

- From outside the UK: +44 135 535 9022

What to Have Ready for the Call:

To ensure the call is efficient when you contact the HMRC Marriage Allowance line, have the following information to hand for both partners:

- Full Name

- National Insurance Number (NINo)

- Date of Birth

- Reason for cancellation

Explain clearly that you wish to cancel your Marriage Allowance. The HMRC agent will process the request and confirm the effective date of the cancellation and what will happen next regarding the tax code adjustments.

Method 3: Cancel Your Marriage Allowance by Post

While the slowest method, cancellation by post remains an option if you are unable to use the telephone or online services.

You should write a letter to HMRC, stating clearly that you wish to cancel your Marriage Allowance. Ensure the letter includes:

- The full names and National Insurance numbers of both you and your partner.

- The effective date from which you wish to cancel your Marriage Allowance.

- The reason for the cancellation (e.g., divorce, income change).

- Your signature and the current date.

Send the letter to the main HMRC address for PAYE and Self Assessment. Check the latest GOV.UK guidance for the current correct address, but typically it is: Pay As You Earn and Self Assessment, HM Revenue and Customs, BX9 1AS.

What Happens After You Cancel Your Marriage Allowance?

Once you cancel your Marriage Allowance, HMRC will update the tax codes for both you and your partner.

- If you cancel due to a change of income or simply no longer wanting to claim, the allowance will continue to run until the end of the current tax year (5 April). This is because the claim is locked in for the full year. Your tax code will be adjusted for the next tax year to remove the allowance.

- If you cancel because your relationship has ended, the change can be backdated to the start of the current tax year (6 April). More on Marriage Allowance Backdating.

The Tax Code Adjustment:

- The recipient partner (who had the extra allowance) will have their tax code changed from one ending in ‘M’ (e.g., 1383M) back to the standard code (e.g., 1257L).

- The transferring partner (who gave up the allowance) will have their tax code changed from one ending in ‘N’ (e.g., 1131N) back to the standard code (e.g., 1257L).

If the cancellation leads to an underpayment of tax for the current year (which can happen if the basic-rate partner was benefitting for several months before cancellation), HMRC will typically collect the outstanding amount through an adjustment to the following year’s tax code. This is usually managed via the PAYE system, so you should not have a sudden lump sum to pay.

Is it Worth Claiming Marriage Allowance in the First Place?

Before you cancel your Marriage Allowance, it’s worth reviewing the core benefit. This popular question, is it worth claiming Marriage Allowance?, almost always has a positive answer for eligible couples.

The allowance permits the lower-earning partner (whose income is below the Personal Allowance, currently £12,570) to transfer unused tax allowance to a spouse (the higher earner) of £1,260. This transfer reduces the higher earner’s tax bill by 20% of the transferred amount, which equates to a maximum saving of £252 per tax year.

In short, yes, it is worth claiming Marriage Allowance if:

- You are married or in a civil partnership.

- One of you is a non-taxpayer (income under the Personal Allowance).

- The other is a basic-rate taxpayer (income between the Personal Allowance and the higher-rate threshold).

Many couples, in fact, discover the allowance late and are eligible to backdate their claim for up to four tax years, leading to a substantial lump sum refund.

Can My Wife Transfer Her Unused Tax Allowance to Me?

Yes, absolutely. The benefit is gender-neutral. If your wife (or husband/civil partner) is the lower earner whose income is below the Personal Allowance, she can transfer her unused tax allowance to you, provided you are a basic-rate taxpayer. The lower-earning partner is the one who must make the initial claim to transfer the allowance.

The question of “Can my wife transfer her unused tax allowance to me?” highlights the reciprocal nature of the scheme. The lower earner transfers a portion of their allowance, and the higher earner receives a tax reduction as a result.

What If Your Partner Dies?

The Marriage Allowance will be cancelled when your partner dies. Your tax code will be changed if you are the surviving partner.

In a few situations, you might be permitted to use your late partner’s leftover personal allowance for this tax year.

You should get in contact with HMRC when you want to claim.

- The deceased person’s National Insurance number

- Died on

- Additional details if needed

What Happens If Your Marriage or Civil Partnership Ends?

After divorce or dissolving your civil partnership, you won’t be eligible for Marriage Allowance. It’s important to contact HMRC right away so your tax code can be corrected.

If you wait to cancel, there might be mistakes made when calculating your tax return, so you should do it right away if your situation changes.

What Should You Do if You Cancel Before Your Course Begins?

Once you cancel your Marriage Allowance, you can reapply in the future if you meet the eligibility criteria again. But if you cancel your policy because of events like separation or bereavement, you may find that you’re not eligible to claim a new one.

If a couple’s income changes, they may have the chance to reapply in a future tax year.

Final Thoughts

If your circumstances change, knowing how to cancel your Marriage Allowance immediately is crucial. The longer an incorrect claim runs, the larger the potential tax underpayment could be.

Whether you cancel your Marriage Allowance online for speed, or choose to contact the HMRC Marriage Allowance line directly for tailored advice, maintaining accurate records and ensuring HMRC has the correct details for both you and your partner is essential for your financial health.