Dividend Tax Calculator

Estimate your dividend tax liability instantly. Clean, modern design in #180c54 theme.

This calculator applies UK dividend tax rules: Personal allowance → Dividend allowance → Basic rate 8.75% → Higher rate 33.75%.

Avoid HMRC Fines — File Your Self-Assessment Tax Return in 48 Hours

Avoid costly fines and late charges. Complete your Self-Assessment tax return in minutes and stay fully HMRC compliant before the deadline hits.

Explore Our Free Tax Calculators and Tools

>Dividend Tax Calculator UK: Easily Calculate Your Tax on Dividends Online

The UK Dividend Tax Calculator is an online tool for quickly estimating how much tax you will pay on dividend income under current HMRC rules. Dividends are payments made by companies to shareholders from their profits, and in the UK they are taxed separately from salary or interest. This calculator factors in the £500 dividend allowance, your income tax band, and the latest HMRC rates for basic, higher, and additional rate taxpayers. Using it gives you a clear picture of your after-tax dividend income, helping you plan investments, avoid unexpected liabilities, and optimise your tax position.

Don’t let surprise deductions ruin your bonus joy—calculate exactly what you’ll pocket with our free Bonus Tax Calculator.

Understanding dividend and UK tax basics .

A dividend is a share of a company’s profits paid to its shareholders. In the UK, these payments are not subject to National Insurance contributions, but they are subject to a separate dividend tax.

Your dividend tax bill is determined by two main factors:

Your total taxable income: This includes your salary, rental income, and any other earnings.

Your total dividend income: The amount you receive from shares.

The UK tax system provides a tiered structure, including tax-free allowances, to determine the rate you pay.

Stop guessing your take-home pay—let the Taxman tell you! Try the Listen to Taxman Calculator for quick and reliable salary breakdowns.

Overview of UK Dividend Tax Rates (Latest for 2025)

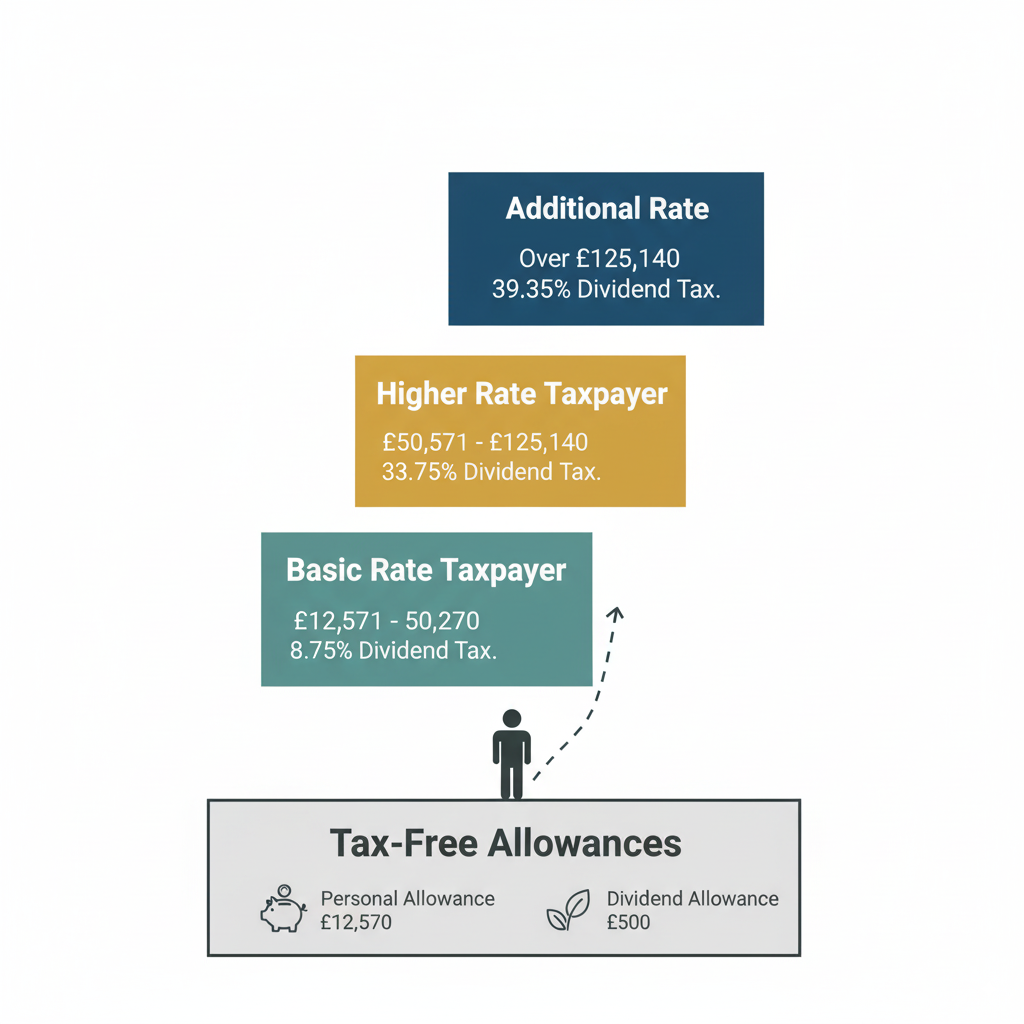

The following figures are correct for the 2024-2025 tax year, as set by HM Revenue & Customs (HMRC).

Dividend Allowance: £500

This is the amount of dividend income you can receive tax-free each year. It is a separate allowance and applies on top of your standard Personal Allowance.

Personal Allowance: £12,570

This is the amount of all your income (salary, dividends, etc.) you can earn without paying any Income Tax.

Important: Your dividend income is taxed after all other forms of income. This means your tax band is first determined by your salary and other earnings, with dividends then added on top.

Dividend Tax Rates by Tax Band (2025):

| Income Tax Band | Taxable Income (England, Wales & N. Ireland) | Dividend Tax Rate |

| Basic Rate | £12,571 – £50,270 | 8.75% |

| Higher Rate | £50,271 – £125,140 | 33.75% |

| Additional Rate | Over £125,140 | 39.35% |

Whether you’re negotiating a job offer or just budgeting, calculate your actual income with our trusted Salary Tax Calculator.

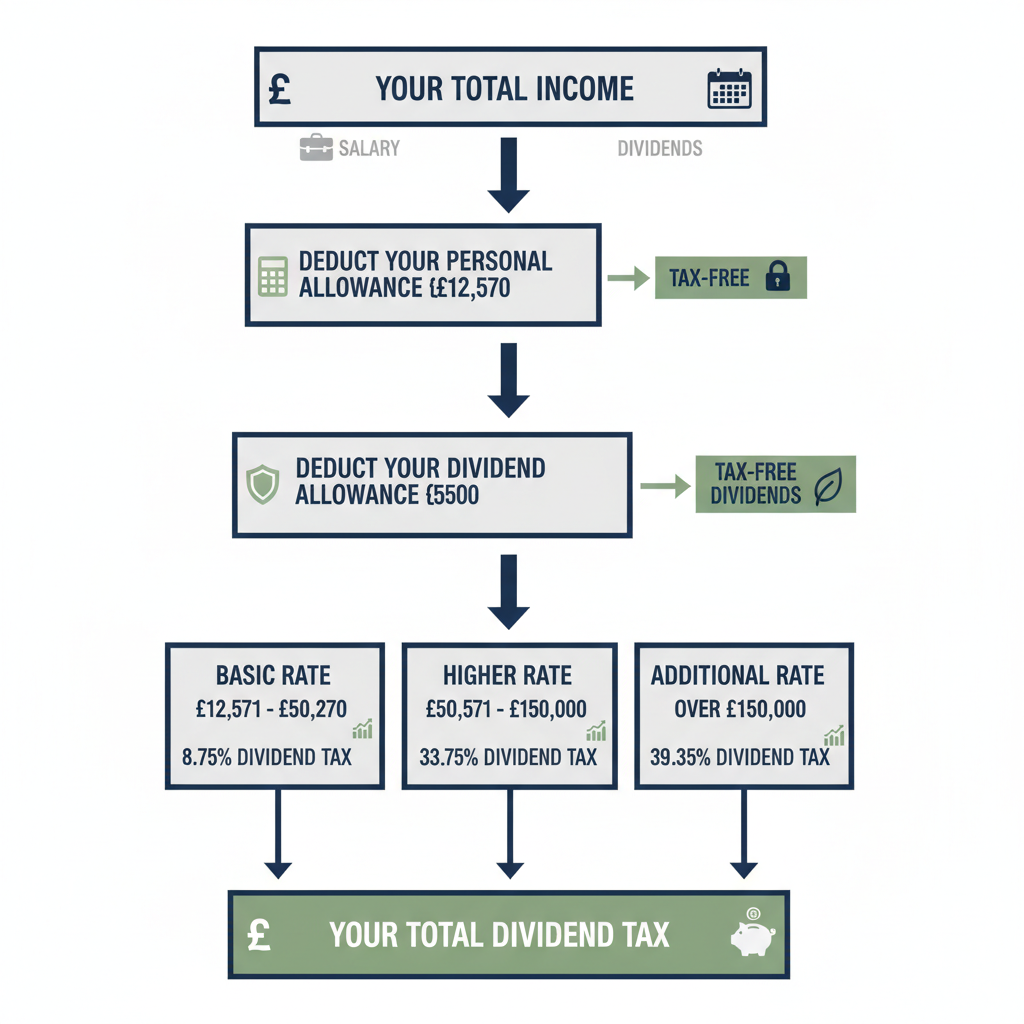

How to Calculate Dividend Tax Manually

For a transparent understanding of how your tax is calculated, here is the manual process:

Add all your income: Combine your salary, any other earnings, and your total dividend income.

Deduct your Personal Allowance: Subtract your Personal Allowance (£12,570) from your total income.

Determine your tax band: Based on the remaining amount, identify whether you are a basic, higher, or additional rate taxpayer.

Apply your dividend allowance: Subtract the £500 Dividend Allowance from your total dividends.

Calculate the tax: Apply the correct dividend tax rate to the portion of your dividend income that falls within your tax band after all other income has been accounted for.

Example Calculation:

Imagine you earn a salary of £40,000 and receive £3,000 in dividends.

Total Income: £40,000 (salary) + £3,000 (dividends) = £43,000

Taxable Income: £43,000 – £12,570 (Personal Allowance) = £30,430

Tax Band: Your total taxable income of £30,430 falls within the Basic Rate band (£12,571 – £50,270).

Taxable Dividends: £3,000 (total dividends) – £500 (Dividend Allowance) = £2,500

Tax Due: £2,500 x 8.75% (Basic Rate) = £218.75

This example shows how all your income is grouped and taxed together. In this case, your entire dividend payment is taxed at the basic rate because your combined income does not push you into a higher band.

Why Use an Online Dividend Tax Calculator?

While a manual calculation is useful for understanding the process, an online tool offers significant advantages:

Accuracy and Speed: It eliminates human error and provides an instant result, especially for complex situations where your income might span multiple tax bands.

Convenience: You can quickly model different scenarios, such as the impact of a salary increase or a larger dividend payment on your take-home pay.

Accessibility: A good tax on dividends calculator UK is always up-to-date with the latest HMRC rates and thresholds, ensuring your estimate is reliable.

Don’t leave money on the table. Calculate your potential PIP back pay quickly and easily with our online PIP Back Pay Calculator.

Features to Look for in a Good Dividend Tax Calculator

Observe the following while selecting a dividend tax calculator:

- * Support for UK Tax Bands: Verify that the calculator takes into account the most recent tax rates and bands in the UK.

- * Columns for Entering Income and Dividends: For precise computations, the calculator should let you enter both your income and dividend amounts.

- * Automatic Annual Updates: A decent calculator should be updated every year to account for modifications to tax regulations and exemptions.

- * Real-Time Calculation: Seek out a calculator that gives you information as soon as you enter it. This facilitates scenario preparation and simple modifications.

Conclusion

Understanding your dividend tax obligations is a fundamental part of managing your personal finances in the UK. While the rules can seem complex, a reliable UK dividend tax calculator empowers you to quickly estimate your liability and make more informed investment decisions. We encourage you to use our free tool to see your post-tax returns clearly and confidently.

Common Questions About Dividend Tax in the UK (FAQs)

Q1: How much dividend income is tax-free in the UK? For the 2024-2025 tax year, the first £500 of dividend income is tax-free under the Dividend Allowance. This is on top of your Personal Allowance.

Q2: Do I have to declare dividend income to HMRC? Yes, if your dividend income exceeds the £500 Dividend Allowance, or if you are already registered for Self Assessment for other reasons, you must declare it. This is typically done through a Self Assessment tax return.

Q3: Does the tax on dividends change if I reinvest them? No. Your tax liability is based on the dividend income you receive, regardless of whether you spend it or reinvest it to buy more shares. You must still declare and pay tax on the dividend payment itself.

Q4: Are dividends from an ISA tax-free? Yes. Any dividends you receive from shares held within an Individual Savings Account (ISA) are completely tax-free and do not count towards your Dividend Allowance.

Planning a raise or new role? Use our Reverse Tax Calculator to see what gross income delivers your ideal net pay.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.