Value Added Tax (VAT) on food in the UK depends on how HMRC categorises the product. Most everyday essentials, such as bread, milk, vegetables, and fruit, are zero-rated (0%), meaning no VAT is charged.

By contrast, items like confectionery, crisps, ice cream, soft drinks, and alcoholic beverages are subject to the standard VAT rate of 20%. Hot takeaway food and meals served in restaurants also attract VAT under the “supply of catering” rules, which cover everything from fish and chips to pizza delivery.

These distinctions often create confusion and have led to famous disputes, such as the Jaffa Cakes case, where courts ruled that the product was a cake (zero-rated) rather than a biscuit (standard-rated).

Understanding these rules is vital for food retailers, café owners, and consumers, as VAT affects pricing, compliance, and profit margins.

This article provides a clear breakdown of which foods are zero-rated, which fall under the standard rate, and how the rules apply to catering and takeaway businesses, based on HMRC Notice 701/14.

The Foundational Principle: Zero-Rating vs. Standard-Rating

Before addressing specific products, it is essential to understand the principle guiding VAT on food items in the UK. The UK government, by historical tradition dating back to the Second World War, aims to ensure that staple, essential foodstuffs remain affordable by imposing a zero-rate of VAT.

The official source for this guidance is HMRC VAT Notice 701/14: Food, which provides the legal framework used by tax professionals and businesses alike.

The Zero-Rate (0%)

Most basic food consumed by people is not “exempt” from VAT (an important distinction for accounting purposes), but is zero-rated.

This means the supply is still taxable, but the tax rate is 0%. This treatment allows businesses selling zero-rated goods to reclaim any input VAT paid on their costs (such as equipment, utilities, and general expenses), which is highly beneficial.

What foods are 0% VAT? The list primarily covers unprocessed goods and ingredients intended for home preparation, including:

- Raw meat, poultry, and fish.

- Fresh fruit and vegetables (unless ornamental).

- Milk, cheese, butter, and eggs.

- Bread, flour, and cereals.

- Tea (loose leaf or bags), coffee (beans or ground), and cocoa.

- Chilled or frozen ready meals that require significant further cooking (e.g., a frozen pizza base that needs cooking, or a chilled meal requiring reheating).

The Standard Rate (20%)

The 20% standard rate applies to exceptions—items deemed ‘luxury’ or those supplied in a manner considered ‘catering’. This is where the complexities truly begin and where the question, Is there VAT on food in the UK?, usually leads to a ‘yes’.

Examples include:

Quick Summary of VAT Rates on Food:

| Food Type | VAT Rate | Notes |

|---|---|---|

| Raw meat and fish | Zero-rated | Fit for human consumption |

| Vegetables, fruits, pulses, and cereals | Zero-rated | Unprocessed and edible |

| Cakes and plain biscuits | Zero-rated | Unless chocolate-coated |

| Chocolate-covered biscuits | Standard-rated | Treated as confectionery |

| Hot takeaway food | Standard-rated | If sold to be eaten hot |

| Ice cream, sorbets, frozen desserts | Standard-rated | Designed to be eaten while frozen |

| Sandwiches | Zero-rated | Unless sold as part of catering |

| Confectionery (sweets, chocolates, etc.) | Standard-rated | Includes sweet snack bars, candies, etc. |

| Non-alcoholic beverages (milk, tea, coffee) | Zero-rated | Most natural drinks |

| Soft drinks and carbonated beverages | Standard-rated | Cola, lemonade, tonic, etc. |

| Alcoholic beverages | Standard-rated | Wine, beer, cider, etc. |

The Three Pillars of Standard-Rated Food: Exceptions and Ambiguities

The UK VAT system defines two primary categories for food to become standard-rated: the product itself (Excepted Items) and the manner of its sale (Catering and Temperature).

Pillar One: The Excepted Items (Luxury Goods)

These food items are standard-rated at 20% regardless of whether they are bought in a supermarket or a corner shop, and regardless of whether they are eaten immediately or taken home. They are seen as non-essential comforts or treats.

The main categories of excepted food items subject to standard VAT on food items include:

1. Confectionery (The Cake vs. Biscuit Debate)

This category is infamous. Confectionery includes sweets, chocolates, biscuits partially or wholly covered in chocolate (with the famous exception of cakes), and sweetened baked goods generally eaten with the fingers.

The Jaffa Cake Precedent: In the early 1990s, the VAT tribunal case between HMRC and McVitie’s established the famous ‘Jaffa Cake rule’. HMRC argued Jaffa Cakes were standard-rated chocolate-covered biscuits; McVitie’s successfully argued they were zero-rated cakes.

The defining test? Cakes stale; biscuits go soft. The Jaffa Cake hardens when left out, proving its cake status and securing its 0% VAT rate. The VAT status hinges not on the ingredients, but on how it is generally marketed, consumed, and legally defined.

2. Crisps and Savoury Snacks

Potato crisps, extruded snacks (like Wotsits and Quavers), and most roasted or salted nuts are standard-rated. However, plain, unprocessed nuts (in their shells) are zero-rated, as are specific savoury baked products like Twiglets and certain types of plain vegetable crisps. This distinction can baffle laypeople and challenge seasoned accountants alike.

3. Ice Cream and Similar Frozen Confections

Any product designed to be eaten frozen, such as ice cream, ice lollies, and sorbets, is standard-rated. The VAT Notice 701/14 explicitly details that this includes mixes for making these products at home. However, frozen cheesecake or frozen yoghurt intended to be thawed and then eaten is typically zero-rated.

4. Beverages (The Drink Divide)

Most non-alcoholic beverages are standard-rated, including soft drinks, fizzy drinks, and bottled water. Zero-rated exceptions include essential milk and milk-based drinks (like unflavoured milkshakes), tea, coffee, and cocoa (provided they are not ‘ready-to-drink’ and are simply ingredients).

Pillar Two: The Consumption Location (Catering)

If food is supplied in the course of catering, it is always standard-rated. Catering, for VAT purposes, encompasses the supply of prepared food and drink with a significant element of service.

If a customer consumes any food or drink on the premises of the supplier (restaurant, café, dedicated seating area), it is considered a supply of catering and attracts the standard 20% VAT, regardless of whether the item is hot or cold.

This is why, when you buy a cold can of fizzy drink in a café, the price is often lower if you choose “takeaway” versus “eat in.” The minute you utilise the supplier’s facilities, the supply changes from selling a zero-rated grocery item (in the case of a cold sandwich) to supplying a standard-rated catering service.

Food supplied in the course of catering is always standard-rated. HMRC defines catering in VAT Notice 709/1: Catering and Takeaway Food.

Pillar Three: The Temperature Test (Hot Takeaway Food)

This is perhaps the most contested area of UK food VAT, famously dubbed the ‘Pasty Tax’ during a government consultation.

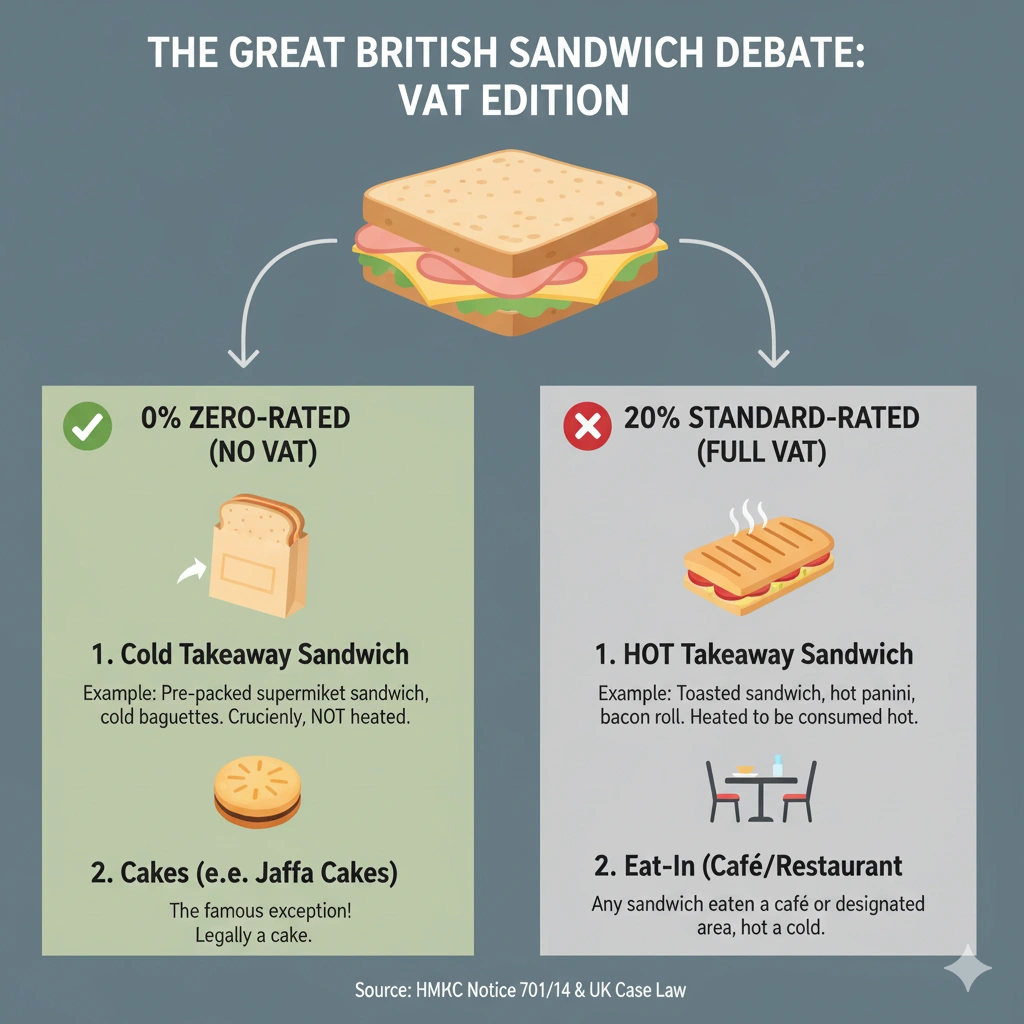

The question of Is VAT charged on sandwiches? or pasties depends critically on the temperature.

Cold takeaway food, provided it is not an ‘excepted item’ (like a soft drink or crisps), is zero-rated. However, food sold as ‘hot takeaway’ is always standard-rated at 20%.

HMRC employs five specific tests to determine if a food item is ‘hot food’ (only one of which must be met):

- It has been heated to be consumed hot.

- It has been kept hot after being cooked.

- It is offered as hot food.

- It is provided to the customer in packaging designed to retain heat (e.g., foil-lined bags).

- It has been heated to order.

The Sandwich Conundrum (The Subway Case)

A classic example illustrating the temperature test is the VAT treatment of sandwiches.

A cold sandwich or wrap, purchased from a supermarket or a cold counter for takeaway, is typically zero-rated (0% VAT).

However, a toasted sandwich, a hot panini, or a baked potato sold to take away is standard-rated (20% VAT). This was definitively cemented in the famous Subway case, where HMRC successfully argued that the primary purpose of toasting a sandwich was to enable it to be consumed hot.

Therefore, even though the constituent parts (bread, meat, salad) are individually zero-rated, the final product, due to the heating process, becomes standard-rated hot food.

For businesses, this means that selling a cold, pre-packaged ham roll at the counter is 0% VAT, whilst warming that exact same ham roll in a grill for the customer makes it 20% VAT.

This seemingly trivial detail is where vast amounts of cash are won and lost in VAT tribunals. The compliance risk surrounding VAT on food items is significant here.

Read Our more Detailed Guides on VAT:

What is VAT and How VAT Works?

What is VAT Exempt in the UK: All VAT Exempt Items

Are Books VAT Exempt in the UK? A Complete Guide for 2025

Is There VAT on Car Parking in the UK?

Is VAT Chargeable on Alcohol in the UK?

Is There VAT on Flowers in the UK?

How to Find VAT Number of a Business?

Is There VAT on Stamp Duty in the UK?

VAT Deregistration: A Complete Guide

VAT on Entertainment Expenses: Guide for UK Businesses

Is VAT Applied to Supermarket Food?

The application of VAT in major supermarkets is an excellent example of the distinction between zero-rated and standard-rated products.

Supermarkets function largely as zero-rated retailers, selling basic groceries. However, they also sell many standard-rated items and operate catering services.

Zero-Rated Supermarket Items (0% VAT)

For the vast majority of products purchased for consumption at home, the zero-rate applies:

- Fresh produce (fruit, vegetables).

- Baking ingredients (flour, sugar, cooking oil).

- Chilled and frozen meats, fish, and dairy.

- Cold sandwiches, salads, and pasta pots bought for consumption away from the store’s designated seating.

- Cakes, plain biscuits, and plain bread/rolls.

This category ensures that when you shop for your weekly basics, Is VAT applied to supermarket food? is correctly answered with a ‘No, not on staples.’

Standard-Rated Supermarket Items (20% VAT)

Supermarket items that do attract the 20% standard rate include:

- Excepted Goods: Any confectionery, soft drinks, crisps, or ice cream sold on the shelves.

- Hot Food Counters: Hot rotisserie chickens, hot pasties, sausage rolls, or pizza slices sold from a counter. These are standard-rated because they are sold hot, specifically to be consumed hot.

- Café Areas: Any food or drink consumed in the in-store café or designated seating areas.

The Meal Deal Complexity

The popular supermarket meal deal is a perfect microcosm of VAT complexity. A typical deal might include:

- Main (e.g., Cold Sandwich): 0% VAT

- Snack (e.g., Crisps): 20% VAT

- Drink (e.g., Soft Drink): 20% VAT

When a single price is charged for the deal, the retailer must legally apportion the VAT across the items. They calculate the total value of the standard-rated components versus the zero-rated components and apply the 20% rate only to the appropriate percentage of the deal’s overall price.

This requires robust accounting systems and clearly demonstrates why detailed knowledge of VAT on food items is crucial for retailers.

The Problem of Definition and Risk

The complexity inherent in the phrase Is there VAT on food in the UK? creates compliance risks. Consider these tribunal cases where HMRC definitions were challenged:

For food manufacturers and retailers, classifying products correctly especially when they introduce new lines like protein bars, health snacks, or prepared meals requires consulting HMRC VAT Notice 701/14 and, often, seeking professional advice. The entire discussion around VAT on food items depends on maintaining this accuracy.

My experience advises businesses to:

- Segregate Sales: Use Point of Sale (POS) systems capable of separating sales by VAT rate (0% and 20%) at the transaction level.

- Document Intent: Document the purpose of heating food. If an item like a loaf of bread is merely cooling down after baking (and no steps are taken to keep it hot), it remains 0% VAT. If it is placed under a heat lamp, it is 20% VAT.

- Review Notice 701/14 Regularly: This notice is the ultimate source of truth and is updated by HMRC to reflect new products and tribunal outcomes.

Professional support is available from Chartered Institute of Taxation or through specialist VAT advisors.

Frequently Asked Questions (FAQs)

Is there VAT on food in the UK?

Yes, but only on specific categories. Basic staples (groceries) are zero-rated (0% VAT), while luxury items, food consumed on premises (catering), and hot takeaway food are standard-rated (20% VAT).

What foods are 0% VAT?

Unprocessed foodstuffs for human consumption are zero-rated. This includes raw meat, fresh produce, milk, bread, cold takeaway sandwiches, cakes, and ingredients for home cooking.

Is VAT charged on sandwiches?

Cold takeaway sandwiches are zero-rated (0% VAT). Hot, toasted, or grilled sandwiches (for consumption hot) are standard-rated (20% VAT). All sandwiches eaten in a designated seating area are also 20% VAT.

Is VAT applied to supermarket food?

Most essential supermarket food is zero-rated. VAT is applied only to ‘excepted items’ (e.g., crisps, soft drinks, chocolate, ice cream) and any food sold hot or consumed in an in-store café.

The Bottom Line

The question, Is there VAT on food in the UK?, is a fantastic gateway into the intricate and often amusing details of the UK’s indirect tax regime.

From the perspective of a UK Tax Advisor, the key takeaway is that the distinction between 0% and 20% often rests not on the food’s nutritional content, but on the manner of its consumption and the intent of the supplier.

The system is built on an old principle of protecting basic necessities, yet the rules have been forced to twist and contort to fit modern consumption habits the age of hot food counters, meal deals, and gourmet prepared snacks.

For business owners, compliance requires far more than guesswork; it demands a thorough understanding of HMRC Notice 701/14 and, crucially, consistent application of the rules to avoid devastating tax liabilities.

The careful categorisation of items, ensuring that the 20% standard rate is correctly applied to excepted items and supplies of catering, is non-negotiable.

Whilst most retailers understand the concept of VAT on food items, the specific classification of products (cake versus biscuit, cold versus hot, snack versus ingredient) remains a permanent challenge.

The zero-rate is a valuable relief for consumers, ensuring that basic groceries remain affordable. However, the exceptions confectionery, soft drinks, and the standard rate applied to catering services are a testament to the fact that, in the UK, even a simple sandwich can become a subject of complex legal debate.

The ongoing vigilance required to stay compliant means the discussion around Is there VAT on food in the UK? will continue to evolve alongside our dietary habits and the legal precedents established in quirky tribunal cases.