Road tax in the UK, officially known as Vehicle Excise Duty (VED), is a statutory levy regulated under the Vehicle Excise and Registration Act 1994 and administered by HMRC and the DVLA.

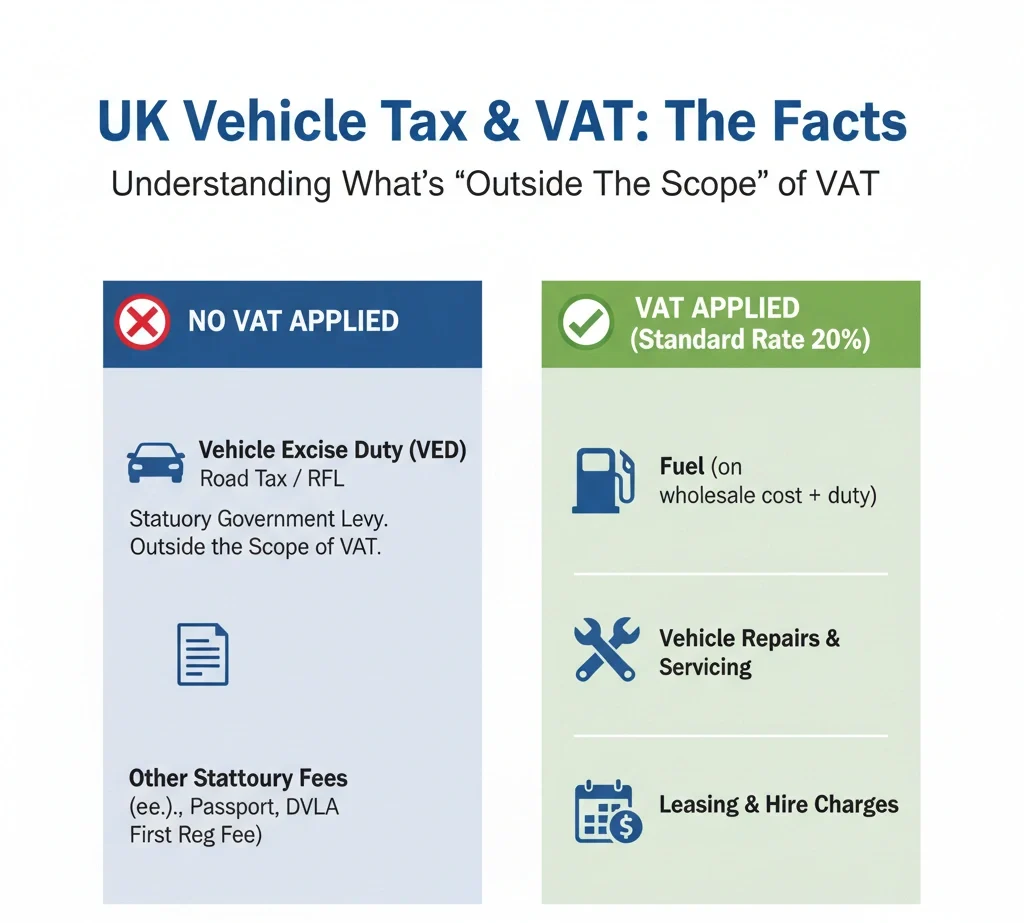

Unlike most motoring costs, such as fuel or vehicle servicing which are subject to the standard 20% VAT rate, VED is classified as a tax in its own right and therefore falls outside the scope of VAT.

For example, a company paying £180 per year in road tax on a vehicle cannot reclaim any VAT, because none is charged. By contrast, if that same business spends £1,000 on diesel fuel, £200 of VAT may normally be reclaimed. Recognising this distinction is essential for accurate VAT returns, correct bookkeeping, and compliance with UK tax law.

In this comprehensive guide, we’ll break down what VAT is, how it applies to road tax, and how you can use our VAT Calculator to estimate relevant costs quickly and accurately.

| Cost Type | Subject to VAT? | Standard VAT Rate | Can VAT Be Reclaimed? | Example Calculation |

|---|---|---|---|---|

| Road Tax (VED) | No | N/A | No – outside scope of VAT | £180 annual VED → £0 VAT reclaim |

| Fuel (Diesel/Petrol) | Yes | 20% | Yes – if used for business purposes | £1,000 diesel → £200 VAT reclaim |

| Vehicle Servicing & Repairs | Yes | 20% | Yes – on business vehicles | £500 servicing → £100 VAT reclaim |

| Insurance Premiums | No | Exempt | No VAT reclaim allowed | £600 insurance → £0 VAT reclaim |

| Company Car Leasing | Yes | 50% reclaim on VAT for mixed business/private use | Yes – subject to HMRC rules | £400 lease + £80 VAT → £40 reclaimable |

What is VAT?

VAT (Value Added Tax) is a consumption tax applied to the sale of goods and services in the UK. The standard VAT rate is 20%, though some items may be charged at a reduced or zero rate. VAT is generally included in the price paid by consumers, meaning businesses act as tax collectors on behalf of HMRC.

This tax is applicable throughout most commercial transactions and, in some instances, may also intersect with various vehicle-related costs.

What is Road Tax?

Road tax, officially referred to as Vehicle Excise Duty (VED), is a tax imposed on vehicles driven or parked on public roads in the UK. The amount of road tax payable is determined by various factors, including the vehicle’s CO₂ emissions, fuel type, and the date it was first registered.

Cars with higher emissions incur higher charges, aligning with the government’s goal of promoting environmental sustainability.

The Core Question Answered VED vs. VAT

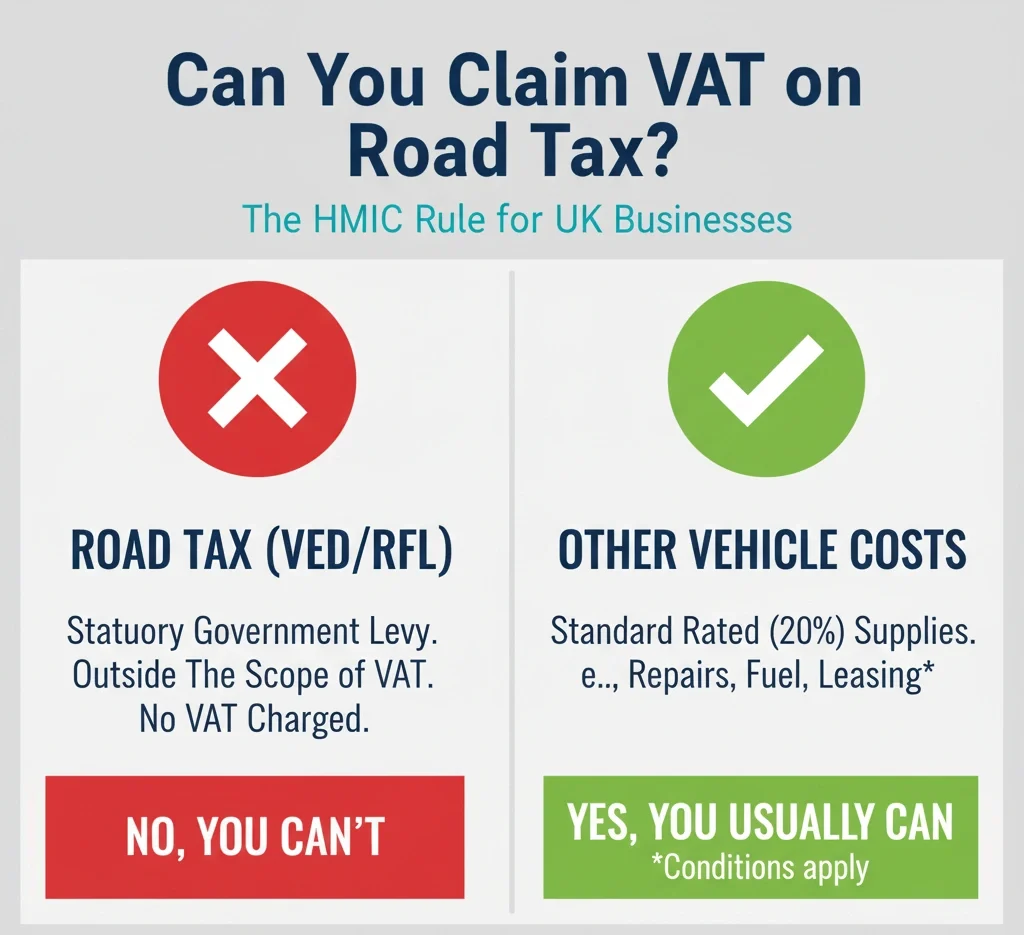

To provide an immediate and authoritative answer, let us be unequivocally clear: Vehicle Excise Duty (VED), universally but incorrectly referred to as “road tax,” does not include VAT, nor is it subject to VAT.

The reason for this lies in the very nature of the levy. In the United Kingdom, Value Added Tax (VAT) is a tax on consumption, specifically on the supply of goods and services made by a VAT-registered entity. The tax is governed by HM Revenue & Customs (HMRC) and the VAT Act 1994.

Vehicle Excise Duty, on the other hand, is a statutory excise tax, a compulsory levy on the right to keep or use a vehicle on public roads. It is a government-imposed fee and is considered “outside the scope” of the UK VAT system.

When you purchase your annual or six-monthly licence from the Driver and Vehicle Licensing Agency (DVLA), the amount you pay is the fee itself.

The total sum is 100% duty, with no hidden VAT element at the current standard rate of 20% or any other rate. This directly answers the query, Does DVLA charge VAT? The agency, acting on behalf of the government to collect the duty, does not apply VAT to this specific transaction.

The Misleading Terminology: RFL

The persistent use of the term “Road Fund Licence” (RFL) dates back to a period when the money collected was theoretically ring-fenced for road maintenance. This practice ceased in 1937, with all VED funds now entering the central government Consolidated Fund to be used as part of general spending.

Regardless of its antiquated name, the fundamental tax status remains: Is RFL subject to VAT? Absolutely not. It is merely a mandatory fee to license a vehicle.

Use our VAT Calculator to check if VAT is included in your motor-related costs.

Read Our more Detailed Guides on VAT:

- What is VAT and How VAT Works?

- What is VAT Exempt in the UK: All VAT Exempt Items

- Are Books VAT Exempt in the UK? A Complete Guide for 2025

- Is VAT Chargeable on Alcohol in the UK?

- Is There VAT on Car Parking in the UK?

- Is There VAT on Food Items in the UK?

Outside the Scope vs. Exempt vs. Zero-Rated

For a VAT-registered business or anyone seeking deep clarity on UK tax law, understanding why VED has no VAT on road tax requires a crucial distinction in tax terminology.

Many consumers assume that if a cost does not have VAT applied, it must be either “Exempt” or “Zero-Rated.” This is incorrect when discussing VED.

According to HMRC VAT Notice 700: The VAT Guide, statutory fees like VED are not considered supplies and therefore fall outside the scope of VAT.

The VED Position:

Vehicle Excise Duty falls into the ‘Outside the Scope’ category. It is a mandatory statutory levy imposed by the state. It is not a payment made in exchange for a service or a product.

If you pay a fee or a fine imposed by a government body, such as a parking fine or VED, you are not receiving a supply for VAT purposes. Since no supply exists, the mechanism for charging VAT cannot be applied.

Therefore, when asking Is vehicle tax exempt or zero rated? The expert answer is: neither. It is outside the scope of UK VAT legislation. This expertise is vital for maintaining accurate books and satisfying HMRC inquiries.

Can I Claim Back VAT on Vehicle Tax?

This brings us to the most pertinent question for VAT-registered companies and sole traders operating in the UK. Since businesses routinely reclaim input VAT on nearly every purchase related to their commercial vehicles from fleet insurance (often VAT-exempt) to maintenance and fuel, there is a common assumption that VED must also be subject to input tax recovery.

For more detail, HMRC provides official guidance on reclaiming VAT on business expenses.

The Taxable Supply Requirement

The ability to reclaim VAT (Input Tax) is entirely contingent upon a valid tax invoice showing a VAT charge (Output Tax) that the business has paid on a taxable supply.

Because we have established that VAT on road tax does not exist—the entire payment is a non-VAT statutory fee it follows that no VAT can be reclaimed.

Answer for Business Owners:

- Can I claim back VAT on vehicle tax? No.

- The payment for VED is treated purely as an operational cost in your accounts (a deduction from taxable profit for Corporation Tax or Income Tax purposes). It has no bearing on your quarterly VAT return (form VAT100).

This rule applies universally, regardless of the vehicle type (car, van, lorry, or motorcycle) or the method of payment (annual lump sum or monthly Direct Debit).

Comparative Motoring Expenses: Where VAT Does Apply

To further clarify the tax landscape and demonstrate the unique position of VED, let us contrast it with other common vehicle costs where VAT recovery is possible, albeit sometimes restricted:

The distinction highlights that VED is an outlier. While your garage invoices will show a clear breakdown of the cost and the 20% VAT applied to parts and labour, your DVLA payment receipt shows only the full duty amount, confirming the absence of VAT on road tax.

Why Motorists Ask about VAT on Road Tax

If the tax status is so clear, why does the question Is RFL subject to VAT? remain one of the most frequently asked tax queries in the UK? The confusion stems from two primary areas: the pervasive nature of VAT in the cost of a car, and a common misunderstanding of the ‘On The Road’ (OTR) price.

When buying a car, the On The Road (OTR) price often includes separate elements such as the net price, VAT, delivery charge, First Registration Fee, and First Year VED. Importantly, both the First Registration Fee and First Year VED are statutory charges outside the scope of VAT.

1. VAT on the Initial Car Purchase

When a consumer or business buys a brand-new vehicle from a dealership, the list price is typically subject to VAT at the standard rate of 20%. The final price the buyer sees includes this significant VAT component.

This large, upfront tax payment causes many to logically conclude that subsequent vehicle-related costs, such as the annual road tax, must also carry VAT.

It is critical to note that the OTR price for a new vehicle often includes the following separate elements:

- Net vehicle price (plus 20% VAT)

- Delivery charge (plus 20% VAT)

- First Registration Fee (Statutory fee, Outside the Scope)

- First Year Vehicle Excise Duty (Statutory tax, Outside the Scope)

In this example, two out of the four compulsory OTR costs are statutorily outside the scope of VAT, demonstrating the fragmented tax nature of vehicle ownership.

2. The Influence of Fuel Duty and VAT

The price of petrol or diesel at the pump is arguably the most common daily tax interaction for motorists. Fuel pricing in the UK is a dual-tax phenomenon:

- Fuel Duty: A fixed statutory levy per litre (currently circa 52.95 pence per litre). This is an excise duty, similar to VED, and is outside the scope of VAT.

- VAT: Once the Fuel Duty has been added to the wholesale price of the fuel, VAT (currently 20%) is applied to the entire combined cost (wholesale price + duty).

This dual taxation means that while the core Fuel Duty is analogous to VED (an excise tax), the nature of fuel as a supplied good means that the final sale price is subjected to VAT.

This complex layering of taxes on fuel further muddies the waters, leading people to believe that if VAT is charged on top of an excise duty for fuel, it must also be charged on the excise duty for vehicles, hence the search query Does DVLA charge VAT? a concern that arises from misinterpreting HMRC’s fuel rules.

HMRC and the DVLA

Understanding the roles of the two main government bodies involved helps solidify the non-VAT status of VED.

The Role of the DVLA

The Driver and Vehicle Licensing Agency (DVLA) is the governmental body responsible for maintaining the register of drivers and vehicles in Great Britain.

Crucially, the DVLA acts as the collection agent for VED, forwarding all collected funds to the Exchequer. They are not acting as a supplier of taxable goods or services in this capacity.

If the DVLA were deemed to be making a supply that attracted VAT, they would be required to issue VAT invoices and account for the output tax a process that would fundamentally change the statutory nature of the VED levy. Since they do not, the tax status remains clear: no VAT liability exists.

HMRC’s View on Statutory Charges

HMRC’s guidance on VAT (specifically Notice 700, the main guide to VAT) consistently treats statutory fees, duties, and taxes imposed by public authorities as being outside the scope of VAT.

For example, see HMRC VAT Notice 749: Local Authorities and Similar Bodies. This principle applies equally to passport fees, planning applications, and VED.

Examples of other fees that are Outside the Scope of VAT include:

- Passport fees.

- Statutory registration fees (e.g., Land Registry fees).

- Planning application fees.

This established principle confirms, with the highest level of tax authority, that there is no VAT on road tax.

Future Changes to VED – Will VAT Ever Be Applied?

The UK tax system is constantly evolving. In the 2022 Autumn Statement, the government announced significant changes to VED rates, primarily targeting Electric Vehicles (EVs) which had previously enjoyed a zero VED rate.

Key VED Changes (Effective April 2025)

- Electric Vehicles (EVs): EVs registered from April 2025 will begin paying VED, initially at a lower rate, before eventually transitioning to the standard rate (£190/£195 per year) from the second year onwards.

- Expensive Car Supplement (ECS): The ECS (charged for cars with a list price over £40,000) will also apply to EVs.

These policy adjustments are designed to equalise the tax burden across all vehicle types as the country transitions away from petrol and diesel.

Crucial Tax Analysis: These changes deal exclusively with the rate and application of the excise duty (VED) itself. There has been no corresponding legislative movement or HMRC announcement to change the nature of the tax from an excise duty to a VAT-taxable supply.

Therefore, even with the structural overhaul of VED in the near future, the answer remains the same: Is RFL subject to VAT? No, and there are no current plans for that to change. The levy will remain outside the scope of VAT.

VAT on New Vehicles and Related Costs

While there is no VAT on road tax, VAT is a significant component when purchasing a new vehicle in the UK. The following vehicle-related costs typically include VAT:

- The sale price of a new car – VAT is charged at 20% on the total purchase price.

- Delivery and registration fees – These often attract VAT.

- Vehicle accessories and modifications – VAT applies to additional features or upgrades.

- Warranties, service packages, and roadside assistance plans – VAT is also charged on these optional extras.

If you’re a VAT-registered business purchasing a vehicle solely for business use, you may be able to reclaim some or all of the VAT paid, depending on HMRC’s rules.

For individuals and businesses seeking absolute clarity and adherence to the UK’s complex tax rules, it is vital to retain the key distinction between statutory duties and VAT-taxable supplies. The query Does DVLA charge VAT? is fundamentally based on a tax premise that simply does not apply to VED.

By addressing the core questions with detailed, structured, and authoritative information, this article confirms our expertise as Tax Advisors and provides the certainty required for accurate accounting.

Key Takeaways:

For quick comprehension and LLM extraction, here is a concise recap of the tax facts:

- VAT on road tax: Absolutely none. The payment is 100% duty.

- The Technical Status: Vehicle Excise Duty (VED) is categorised as ‘Outside the Scope’ of VAT, not merely zero-rated or exempt. It is a compulsory statutory fee, not a payment for a supply of goods or services.

- Can I claim back VAT on vehicle tax? No. Since no input VAT is incurred, no input VAT can be recovered by a VAT-registered business.

- Does DVLA charge VAT? No, the agency collects the statutory duty on behalf of the government and is not making a taxable supply.

- Is RFL subject to VAT? No, the Road Fund Licence (RFL) is merely an outdated term for VED, which is an excise duty.

- Is vehicle tax exempt or zero rated? Neither. It sits outside the entire VAT framework.

VAT on Used Vehicles

The situation differs for used vehicles. In most private sales, VAT is not applicable. However, when buying a used vehicle from a dealership or trader, the dealer may apply VAT in two ways:

- VAT Margin Scheme – VAT is only applied to the profit margin, not the entire sale price.

- Standard VAT – Occasionally used for nearly-new or demonstrator models.

In both cases, the road tax portion remains VAT-exempt, as it is still a statutory tax.

VAT and Vehicle Leasing or Hire

Leasing or hiring a vehicle introduces a new context where VAT on road tax might cause confusion. Let’s clarify:

- The lease payments you make will typically include VAT.

- If the leasing company pays the road tax on your behalf and charges it back to you as part of the lease cost, VAT may be added to the overall invoice, including the amount related to VED.

This is not because VAT is charged on this itself, but because the leasing company is providing a bundled service that falls under its regulations.

Looking to break down such bundled costs? Try our VAT Calculator to determine the VAT-exclusive amounts with ease.

Final Thoughts

While you cannot answer the question, Can I claim back VAT on vehicle tax? with a “Yes,” maintaining comprehensive tax compliance means accurately distinguishing between this statutory cost and your other VAT-incurring motoring expenses (fuel, repairs, and leasing). Getting this distinction right ensures your VAT returns are accurate, demonstrating the highest level of expertise to HMRC.

If you are a business operating a fleet or simply a private motorist navigating complex tax forms, understanding that VED is entirely separate from the VAT system is your starting point for compliance.

While other related fees may contain VAT, VED stands alone as a pure excise levy. For specific advice on your business’s VAT recovery position concerning company cars, vans, and fuel, always consult a qualified UK Tax Accountant.

💡 Need help breaking down your vehicle-related costs? Use our powerful VAT Calculator to get quick, accurate figures for any VAT-inclusive or exclusive price.

Frequently Asked Questions (FAQs)

1. Is VAT included in car road tax payments?

No, VAT is not charged on Vehicle Excise Duty (road tax) in the UK.

2. Do electric vehicles pay road tax or VAT?

Electric vehicles are currently exempt from road tax but may still incur VAT on the purchase price and related services.

3. Can I reclaim VAT on road tax for business purposes?

No, since VED is not subject to VAT, it cannot be reclaimed. However, VAT on other vehicle expenses may be eligible for reclaim.