Payslip Calculator

Explore Our Free Tax Calculators and Tools

>Payslip Calculator UK (2025/2026)

The UK payslip calculator for the 2025/2026 tax year is an online tool that estimates your take-home pay after Income Tax, National Insurance, student loan repayments, and pension contributions. Designed for employees, contractors, and part-time workers, the calculator uses HMRC’s latest tax bands and thresholds to give an accurate forecast of your net salary. Use it to check payroll deductions, plan your finances, and confirm that your employer is applying the correct rates for the new tax year.

See how much of your bonus is yours to keep. Try our Bonus Tax Calculator and get your after-tax earnings in seconds!

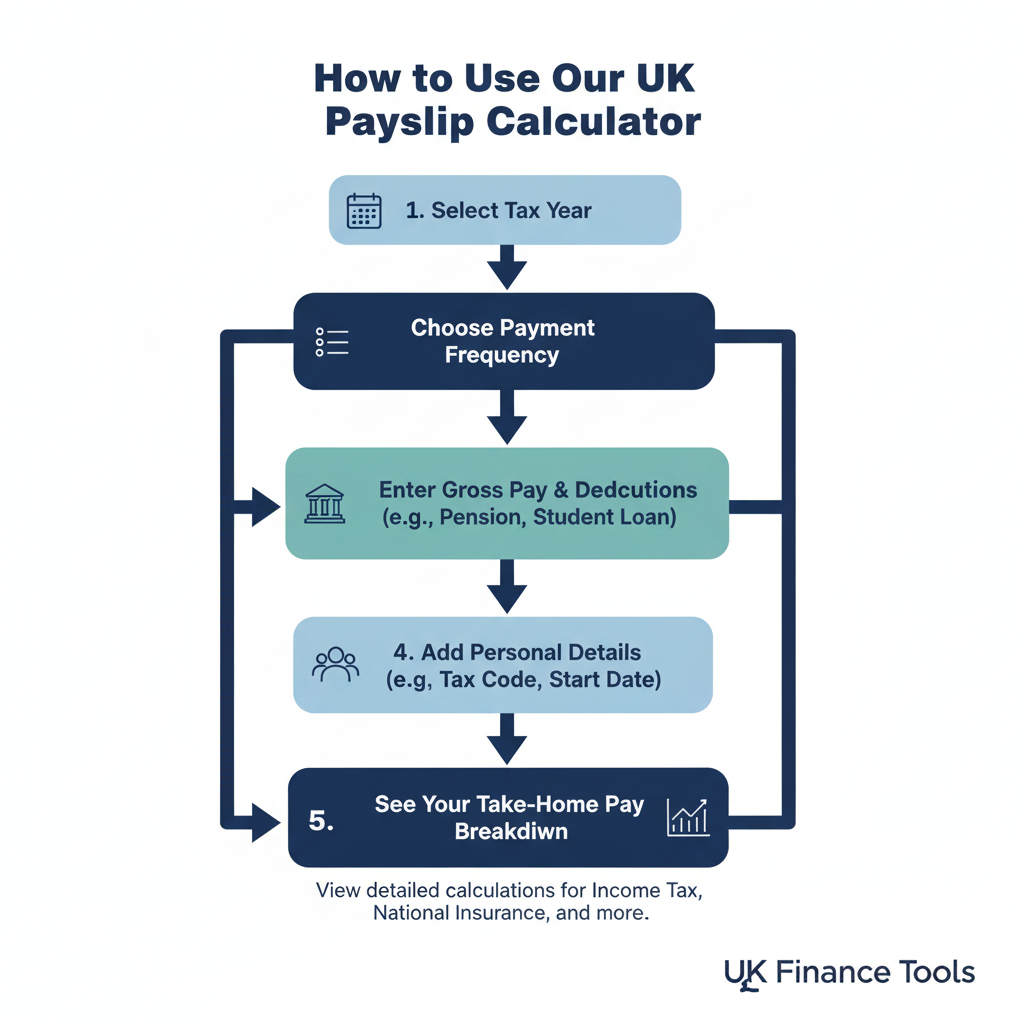

How to Use Our Payslip Calculator UK

Using our UK payslip calculator is quick and simple. Just follow these steps to get a detailed breakdown of your take-home pay:

Select the Tax Year: Choose the current tax year, which in the UK runs from April 6th to April 5th of the following year.

Payment Frequency: Tell us how you’re paid—monthly, weekly, 4-weekly, or daily. This helps us apply the correct tax-free allowances for your specific pay period.

Payslip Date: Enter the payslip date. This is useful for checking past payslips or for budgeting for a future one.

Enter Gross Pay Details: Include all your income sources, such as your basic salary, overtime, bonuses, and commissions. For overtime, you can enter the hours worked at different rates (1x, 1.5x, 2x, etc.).

Benefits in Kind (BiK): If you receive non-cash benefits like a company car or private health insurance, input their cash value here. The calculator will add these to your taxable income.

Cumulative Earnings and Tax Paid: If you’re calculating a payslip in the middle of the tax year, enter your total gross earnings and tax paid so far for the most accurate results.

Your Tax Code: Input the full tax code from your most recent payslip. Common tax codes include 1257L, BR, D0, D1, and various K codes.

Student Loan & Pension: Tick the box if you have a student loan, and enter your pension contributions as either a percentage or an amount. You can also specify if your pension is a salary sacrifice or auto-enrolment scheme.

National Insurance Category: Select your National Insurance category. The most common category is ‘A’.

Company Director: If you are a company director, tick this option as National Insurance is calculated differently for you.

Advanced Options: You can choose to calculate on a ‘Month 1’ basis (non-cumulative), or include any carried-over tax or payroll giving deductions.

Want to hear how much you actually earn after tax? Use the Listen to Taxman Calculator and stop the confusion!

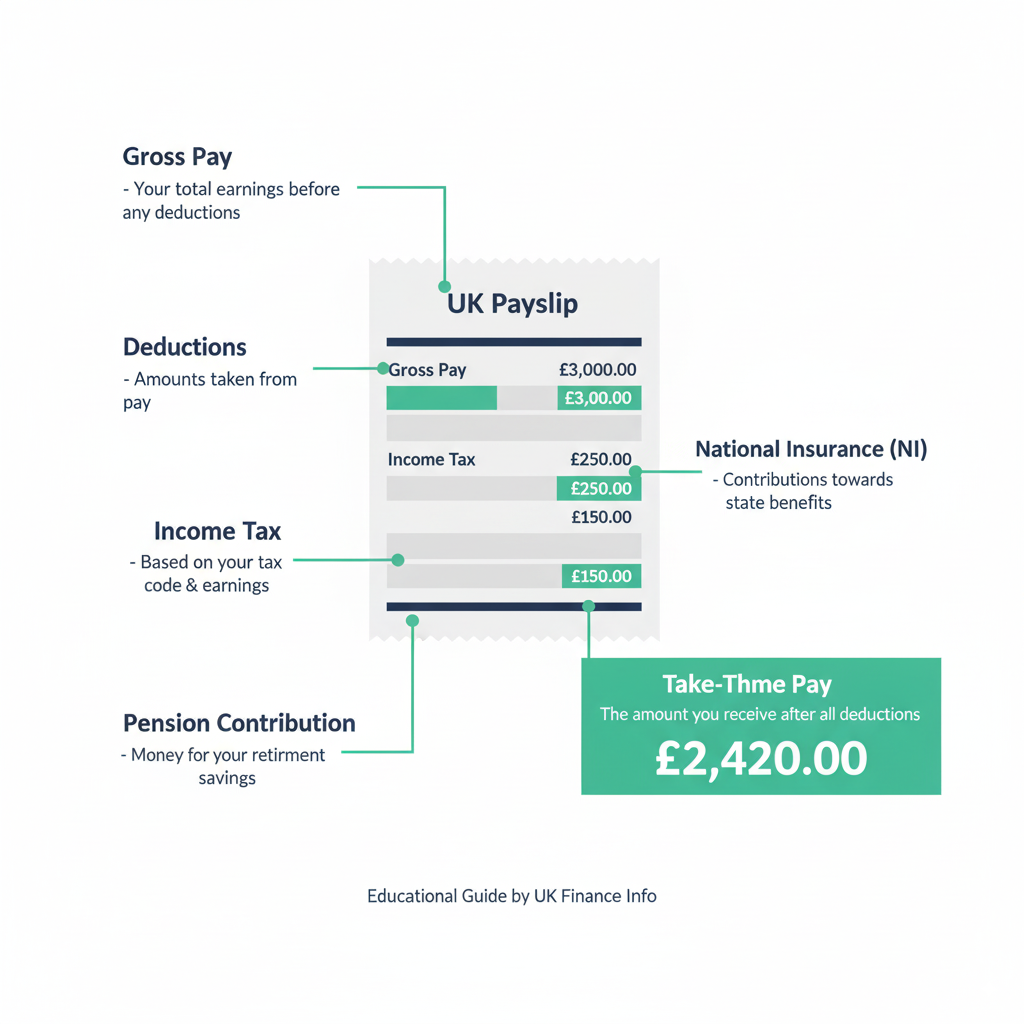

Key Deductions on Your Payslip

Our payslip calculator shows a clear breakdown of the following statutory deductions:

Income Tax: Your income tax is calculated based on the PAYE (Pay As You Earn) system. The calculator applies the correct tax bands for your personal allowance and tax code, including the basic rate (20%), higher rate (40%), and additional rate (45%).

National Insurance (NI): NI contributions are a compulsory deduction. Our calculator uses the latest HMRC thresholds and applies the correct percentage for your NI letter category to ensure a precise result.

Pension Contributions: We support both auto-enrolment and salary sacrifice pension schemes. The calculator adjusts your take-home pay accordingly and shows you any applicable tax relief.

Student Loan Deductions: The calculator includes deductions for all student loan types: Plan 1, Plan 2, Plan 4, and Postgraduate loans.

Whether you’re negotiating a job offer or just budgeting, calculate your actual income with our trusted Salary Tax Calculator.

Real-World Scenarios Where This Calculator Helps

Forecast Future Payslips

Forecast Future Payslips: Planning for a bonus or a raise? Enter your expected earnings into our payslip calculator UK to see how much extra you’ll take home.

Verify Employer Calculations: If the tax on your payslip seems too high, you can use our calculator to verify if your employer’s payroll is accurate.

Understand Tax Code Changes: If HMRC changes your tax code mid-year, our HMRC-compliant payslip calculator lets you see how it affects your take-home pay.

Plan Job Transitions: Considering a new job with different pay? Simulate various scenarios to make an informed decision.

Budgeting and Financial Planning: Get an accurate forecast of your take-home pay to plan your savings and expenses with confidence.

Reclaim what’s rightfully yours. Our PIP Back Pay Calculator helps you estimate how much you could be entitled to.

Benefits of Using a Payslip Calculator

Financial Planning: Get a clear picture of your net income to help you anticipate expenses and savings.

Clarity and Transparency: Understand exactly where your money goes and what each deduction means.

Error Detection: Quickly identify any discrepancies in your employer’s calculations.

Tax Compliance: Ensure you’re paying the correct amount of tax, avoiding underpayments or overpayments.

Common Tax Codes and Their Meanings

Understanding your tax code is vital because it directly impacts your take-home pay. Here are some of the most common codes:

1257L: The standard tax code for most individuals, representing the personal allowance of £12,570.

BR: All income is taxed at the basic rate (20%).

D0: All income is taxed at the higher rate (40%).

D1: All income is taxed at the additional rate (45%).

K Codes: This indicates you have income not being taxed elsewhere, and your personal allowance is reduced.

Understanding your tax code is crucial, as it directly affects your take-home pay. If unsure, consult HMRC or use our payslip calculator to assess its impact. The Sun

Stay Updated with Tax Changes

Tax regulations can change annually. Our payslip calculator uk is regularly updated to reflect the latest HMRC guidelines, ensuring accurate calculations for the 2025/2026 tax year.

Figure out your dividend earnings after tax in just seconds—try our user-friendly Dividend Tax Calculator today!

Frequently Asked Questions About UK Payslip Calculator

Is this payslip calculator accurate?

Yes, our calculator is updated to reflect the latest HMRC tax thresholds and National Insurance rates for the 2025/2026 tax year.

Can I use it for past tax years?

Currently, our UK payslip calculator is designed for the 2025/2026 tax year. Support for previous years is being added soon.

Does it include Scottish Income Tax bands?

Yes, if you are a Scottish taxpayer, the calculator will apply the correct Scottish tax bands for your location.

What if I have multiple income streams?

This calculator is designed for a single primary employment. For complex scenarios involving multiple incomes, we recommend consulting a professional financial adviser.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.