PIP Back Pay Calculator UK

Previous daily pay rate (gross)

£0

New daily pay rate (gross)

£0

Amount of backdated salary due (gross)

£0

Explore Our Free Tax Calculators and Tools

>PIP Back Pay Calculator – Easily Estimate What You're Owed

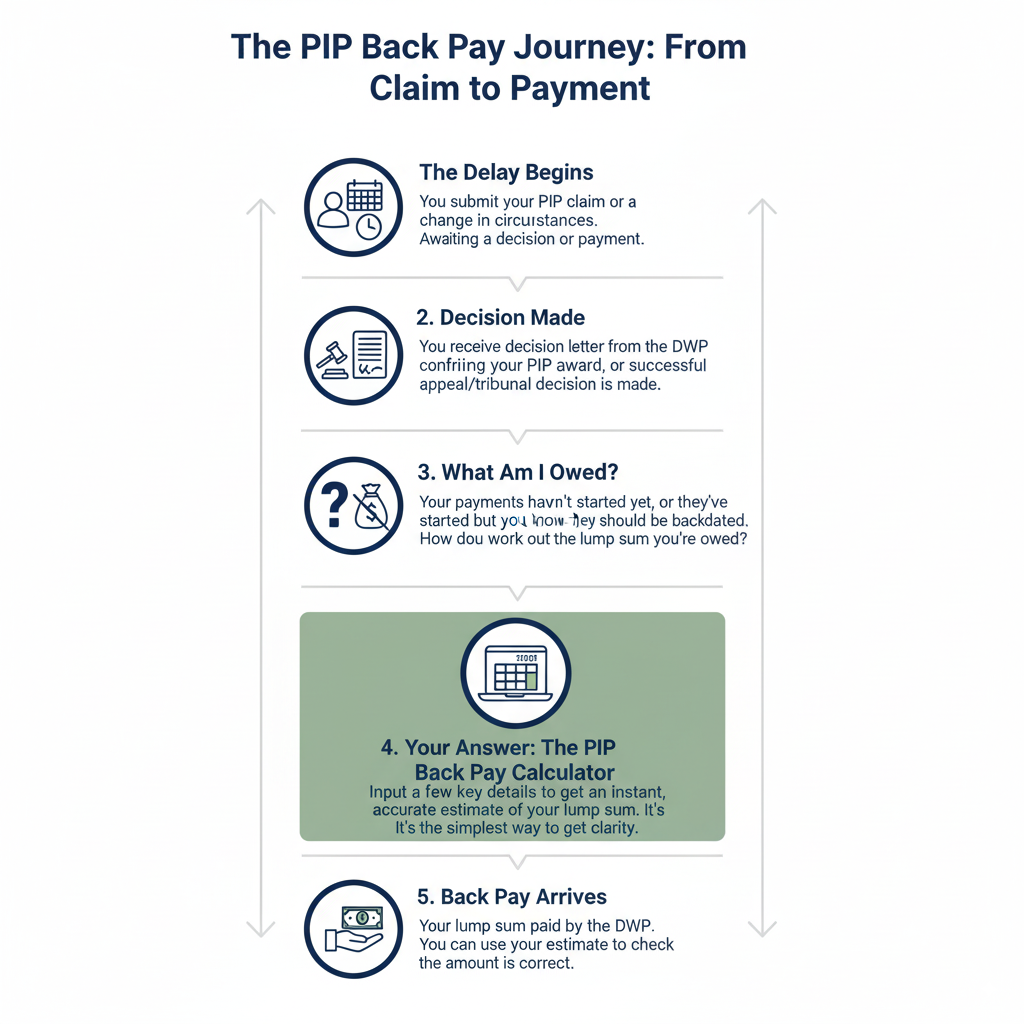

The PIP Back Pay Calculator provides a quick estimate of the Personal Independence Payment arrears you may be owed after a successful claim, tribunal, or review. PIP back pay refers to the lump sum of unpaid benefits covering the period between your original application date and the decision date. By entering your award details, payment frequency, and assessment outcome, the calculator shows an accurate projection of potential arrears, helping claimants understand entitlements and plan next steps.

Confused about how bonuses are taxed in the UK? Use our Bonus Tax Calculator to make smarter financial decisions.

What is PIP Back Pay?

Personal Independence Payment (PIP) is a UK benefit designed to help people with long-term health conditions or disabilities with their daily living or mobility needs. A common query for claimants is “What is back pay?”

PIP back pay is a lump-sum payment of benefit that you were entitled to but have not yet received. This can happen for several reasons:

A successful appeal or tribunal decision: If your initial claim was denied and you successfully challenged the decision, your PIP entitlement will be backdated to the start of your original claim.

A change in your award: Following a review or reassessment, your award level might increase. The back pay would cover the difference between the old and new rates from the date the change was decided.

Delays in processing your initial claim: Due to administrative delays at the DWP, the time between your entitlement start date and your first payment can be lengthy, leading to a back pay lump sum.

Miscalculated or underpaid amounts: In rare cases, the DWP may have underpaid your benefit, and a back payment will correct the error.

If you’ve been underpaid or awarded PIP at a later stage, you might be owed a significant lump sum. To get an accurate estimate, our PIP Back Pay Calculator is a vital tool for UK claimants.

Want to hear how much you actually earn after tax? Use the Listen to Taxman Calculator and stop the confusion!

Why Use a PIP Back Pay Calculator?

Calculating back pay manually is a complex process. It requires you to know historical PIP rates, understand the specific dates your entitlement began, and account for any payments already made. Our PIP Back Pay Calculator simplifies this, providing a fast, reliable estimate.

With a few key details, such as your entitlement start date and awarded rates, the calculator instantly computes your owed amount. It’s designed for clarity, allowing you to bypass confusing DWP paperwork and administrative complexities.

Understand every penny of your payslip with our easy-to-use Salary Tax Calculator—perfect for UK taxpayers!

What You’ll Need Before Using the PIP Back Pay Calculator

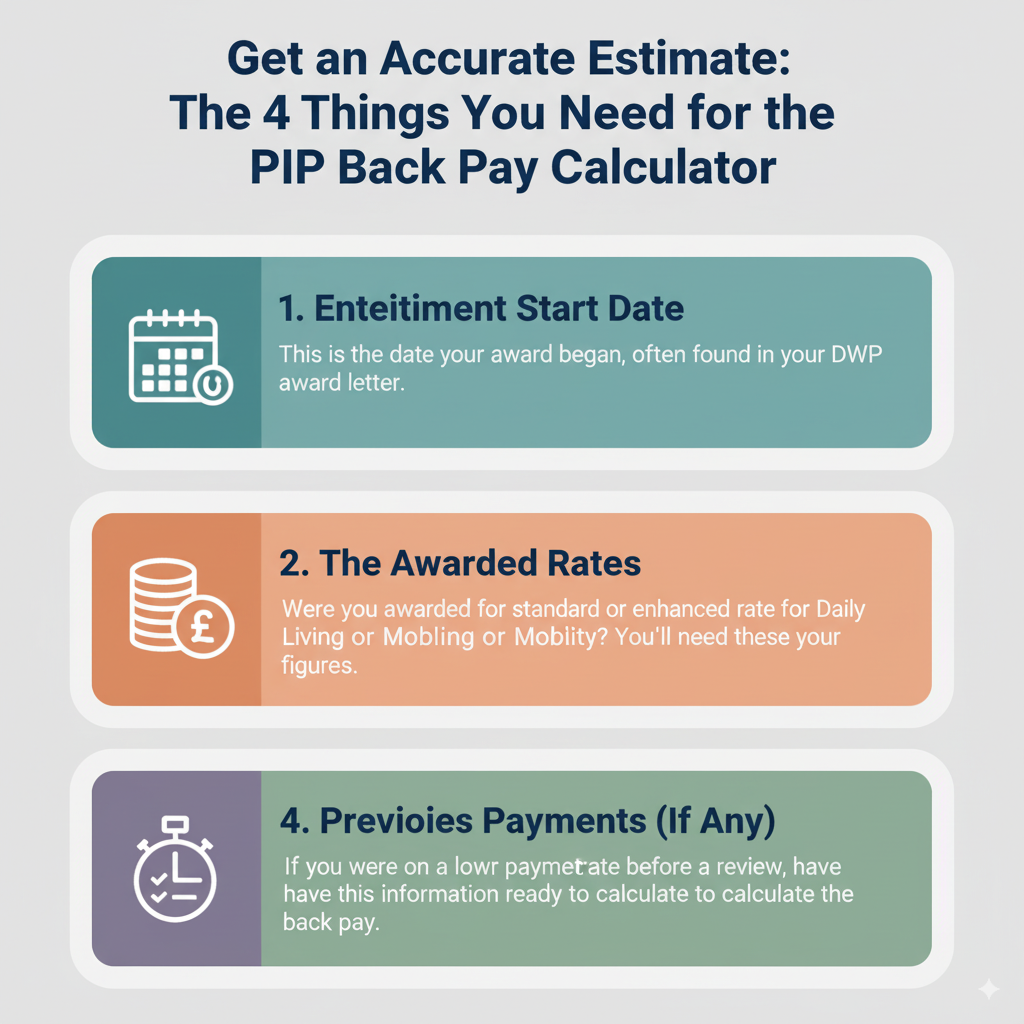

For the most accurate result, please have the following information to hand:

The specific date your PIP entitlement began: This is often the date you first submitted your claim or the date a tribunal decision was made.

The date your regular payments started or were adjusted: This is the date of your first payment following your successful claim.

Your awarded daily living and/or mobility rate: You can find this on your official award letter from the DWP.

Details of any previous payments received: If you were already receiving a lower rate, you will need to input this to calculate the difference.

Our PIP Back Pay Calculator automatically accounts for weekly rates, the duration of missed payments, and historical rate changes to provide a comprehensive estimate.

Planning a raise or new role? Use our Reverse Tax Calculator to see what gross income delivers your ideal net pay.

How Does the PIP Back Pay Calculator Work?

The calculator uses the official weekly rates provided by the Department for Work and Pensions (DWP). Our tool is regularly updated to reflect the latest government-approved rates, ensuring your estimate is as accurate as possible. The process involves these simple steps:

Determining your weekly rate: This is based on whether you were awarded the standard or enhanced rate for each component.

Calculating the number of eligible weeks: The calculator works out the exact number of weeks between your entitlement date and the start of your payments.

Multiplying the rate by the weeks: The weekly rate is multiplied by the number of weeks to get a total figure.

Subtracting any payments already received: If you were on a lower rate, this step ensures the back pay is a true reflection of the owed amount.

If you were awarded both the daily living and mobility components, the calculator adds the two totals together for a single, combined lump-sum estimate.

From savings to investments, understand your earnings better with our user-friendly Interest Calculator.

Understanding PIP Back Pay Components

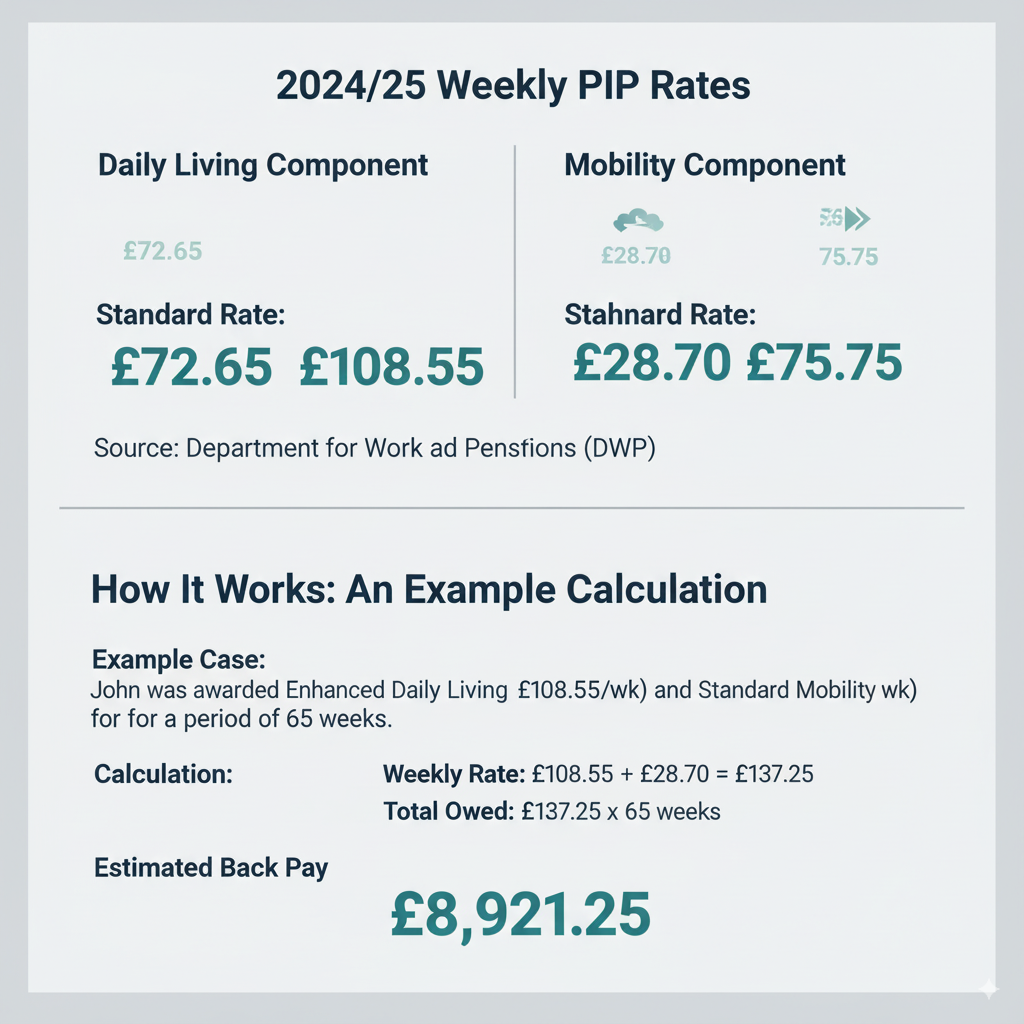

Your PIP back pay calculation is based on the two core components of the benefit. Knowing which rates you were awarded is crucial for an accurate estimate.

Daily Living Component This is for help with everyday tasks such as preparing food, washing, dressing, or managing medication.

Standard Rate: £72.65 per week (2024/25 rate)

Enhanced Rate: £108.55 per week

Mobility Component This covers difficulties with getting around, such as planning a journey or moving outdoors.

Standard Rate: £28.70 per week (2024/25 rate)

Enhanced Rate: £75.75 per week

The calculator will ask you to specify which components you were awarded and at what rate.

Make smarter buying and selling decisions with our reliable VAT Calculator—perfect for UK businesses.

Example Calculation: A Real-World Scenario Using the PIP Back Pay Calculator

Let’s walk through a typical example to show how our calculator works:

Your PIP entitlement began on: 1st January 2024

Your first payment was made on: 1st April 2025

You were awarded: Enhanced Daily Living (£108.55/week) and Standard Mobility (£28.70/week)

Calculation Breakdown:

Total Missed Weeks: 65 weeks

Combined Weekly Rate: £108.55 + £28.70 = £137.25

Estimated Back Pay: £137.25 x 65 weeks = £8,921.25

Our calculator would instantly display this breakdown, giving you a clear financial picture and allowing you to plan with more certainty.

How Far Back Can PIP Back Pay Go?

In most cases, PIP back pay is calculated from the date your entitlement began. This can extend back months or even years, particularly in cases of successful appeals or when the DWP corrects a long-standing error.

Specific situations where back pay may be extensive include:

Backdated to the claim date: If there were DWP delays in assessing your initial claim.

Backdated to the date a condition worsened: If a review finds your needs have increased, the new, higher award may be backdated to the date you reported the change.

Backdated from a successful tribunal or appeal ruling: An independent tribunal can rule that you should have been awarded PIP from a much earlier date.

Our PIP Back Pay Calculator allows for flexible date inputs to accommodate these varying scenarios.

Perfect for employees and freelancers—our Payslip Calculator gives you a clear view of your income.

What If You’re Claiming NHS or Salary Back Pay Too?

While you’re using the PIP Back Pay Calculator, you might also be owed other forms of back pay. If you’re employed and recently received a raise or correction to your salary, our salary back pay calculator can help. It’s designed to show how much extra pay you’re owed from your employer for underpayments or delayed raises.

Similarly, if you work in the healthcare sector, our NHS back pay calculator can assist you in checking any unpaid NHS salary increments due to contract updates or pay band changes. These tools work side by side with the PIP Back Pay Calculator, giving you clarity on your total backdated earnings.

Will PIP Back Pay Affect My Other Benefits?

This is a critical consideration. A large lump-sum back payment may be treated as capital and could affect your entitlement to means-tested benefits like Universal Credit or Housing Benefit.

To manage this, it’s essential to:

Contact the DWP: Inform them about any large lump sum payments you receive.

Seek independent advice: An expert from Citizens Advice or a welfare rights organization can help you understand how the payment might impact your specific benefit situation.

Understand the “Deprivation of Capital” rules: Be aware of the rules concerning what is considered capital and how it can affect your benefit claims.

Our PIP Back Pay Calculator helps you anticipate the amount, so you can prepare and seek advice well before the payment arrives.

Whether you’re a shareholder or director, our Dividend Tax Calculator gives you clear, up-to-date results.

Common Issues to Watch Out For.

Using the PIP Back Pay Calculator gives you peace of mind, but there are a few things you should be cautious about:

Incorrect award dates: Always double-check your award letters.

Misunderstood award levels: Ensure you know whether you’re on standard or enhanced rates.

Previous underpayments: If unsure, request a full benefits history from the DWP.

If your calculated amount is significantly different from what you received, it’s wise to contact DWP or a welfare support agency.

What to Do After Using the PIP Back Pay Calculator

Once you’ve used the calculator and received an estimated figure, here are some actionable next steps:

Verify the amount: Compare the estimated figure with the actual payment you receive from the DWP.

Contact the DWP if there are discrepancies: If the payment is significantly different from your calculation, contact the DWP to request a full breakdown of your back pay.

Plan your finances: Since PIP back pay is a lump sum, consider how you will use it. Many recipients use it to pay off debts, purchase mobility aids, or make home improvements.

PIP is non-taxable: Remember that PIP is a non-taxable benefit. The lump sum you receive will not be subject to income tax.

Summary: Know What You're Owed with Confidence

Navigating the complexities of PIP can be overwhelming, especially when dealing with underpayments or delays. Our user-friendly PIP Back Pay Calculator is a powerful tool designed to provide you with a clear, accurate estimate of what you’re owed. By providing a transparent and easy-to-use service, we empower you to:

Know your exact entitlement: Understand how much PIP back pay you should receive.

Anticipate the payment: Prepare for a significant lump sum and seek advice if needed.

Plan your next steps: Use the information to take control of your financial situation with confidence.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.