Salary Tax Calculator UK

Enter Your Details

Results

Explore Our Free Tax Calculators and Tools

>Accurately Calculate Your Take-Home Pay with Our UK Salary Tax Calculator

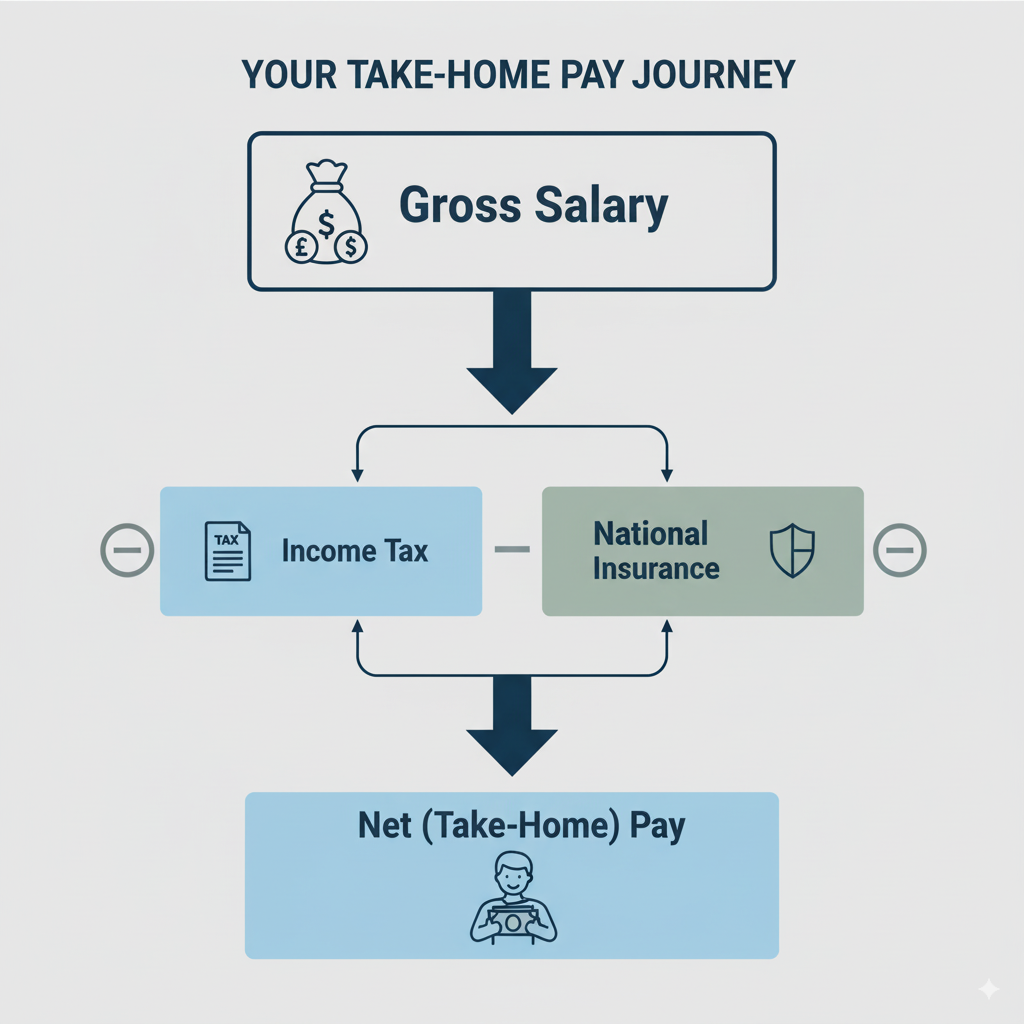

A UK salary tax calculator is an online tool designed to give employees, self-employed professionals, and Skilled Worker Visa holders a clear estimate of their take-home pay after taxes and deductions. By entering your annual or monthly income, the salary tax calculator UK applies the latest HMRC income tax bands, National Insurance contributions, and other statutory deductions to show your gross pay, taxable income, and net salary.

This makes it easier to understand exactly how much you keep after tax and whether you might qualify for a refund. The calculator is especially useful for people managing multiple income sources or moving to the UK on a Skilled Worker Visa. With accurate results updated to current tax year thresholds, the UK salary tax calculator helps you plan finances, stay compliant, and avoid costly mistakes.

Don’t let surprise deductions ruin your bonus joy—calculate exactly what you’ll pocket with our free Bonus Tax Calculator.

Understanding UK Income Tax

The UK uses a progressive tax system, meaning the more you earn, the higher the tax rate you pay on portions of your income. The amount of tax you owe depends on your income and tax allowances.

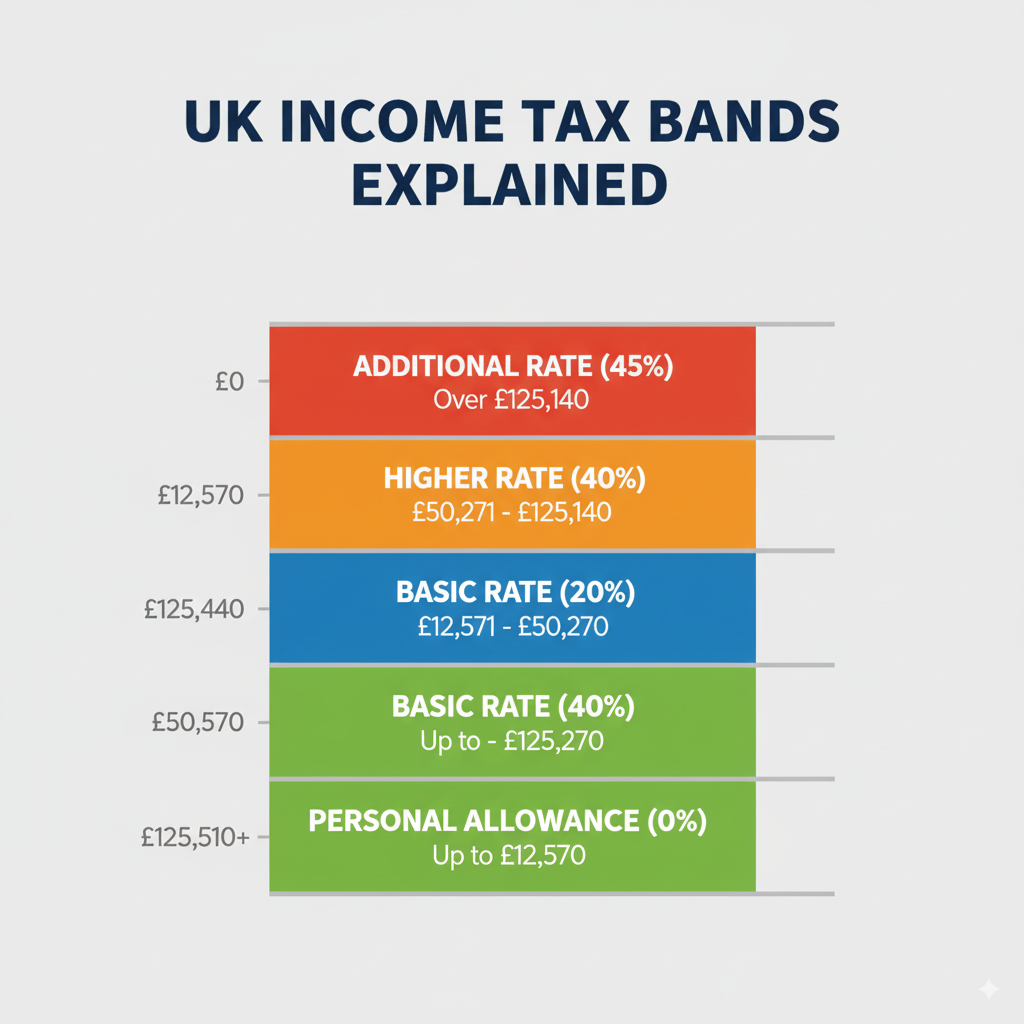

Income Tax Rates & Bands (2025/26)

| Tax Band | Taxable Income | Rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 to £50,270 | 20% |

| Higher Rate | £50,271 to £125,140 | 40% |

| Additional Rate | Above £125,140 | 45% |

Note: The Personal Allowance is reduced by £1 for every £2 of income over £100,000.

A Note on Scottish Tax Bands

Scotland has its own income tax rates. Here’s a quick look at the rates for the 2025/26 tax year:

| Tax Band | Taxable Income (Scotland) | Rate |

| Starter Rate | £12,571 to £14,876 | 19% |

| Basic Rate | £14,877 to £26,561 | 20% |

| Intermediate Rate | £26,562 to £43,662 | 21% |

| Higher Rate | £43,663 to £75,000 | 42% |

| Advanced Rate | £75,001 to £125,140 | 45% |

| Top Rate | Above £125,140 | 48% |

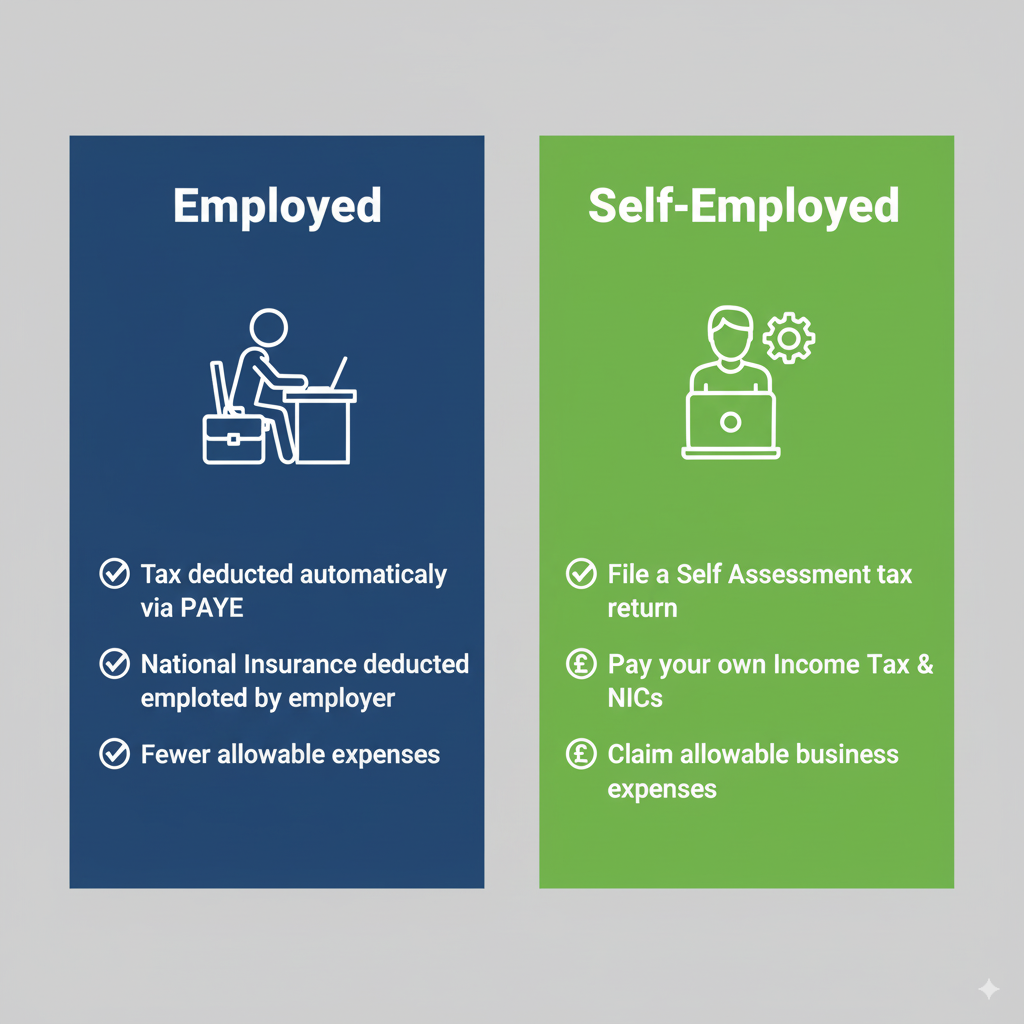

Employed vs. Self-Employed Tax

Your tax obligations differ depending on your employment status.

Employees: Your employer automatically deducts income tax and National Insurance Contributions (NICs) from your pay through the PAYE (Pay As You Earn) system.

Self-Employed: You are responsible for calculating your own tax and NICs and submitting a Self Assessment tax return to HMRC annually.

The easiest way to accurately estimate your liability is to use a salary tax calculator, which accounts for your specific situation.

Get the full picture of your salary with the Listen to Taxman Calculator. Your net pay, tax, and deductions—explained clearly and instantly!

How to Use an Salary Tax Calculator UK

Our calculator provides a detailed breakdown of your tax, National Insurance, and take-home pay.

Enter Your Annual Salary: Input your gross annual income.

Add Deductions: Include any pre-tax deductions like pension contributions or student loan repayments.

Get Your Breakdown: The calculator instantly provides a clear, detailed report of your net pay, tax, and deductions.

Example Calculations

Employee on £35,000/year:

Taxable Income: £22,430 (£35,000 – £12,570 Personal Allowance)

Income Tax: £4,486 (20% of £22,430)

NICs: £2,919

Estimated Take-Home Pay: £27,595

Employee on £60,000/year:

Taxable Income: £47,430 (£60,000 – £12,570)

Income Tax: £8,605 (20% on £37,700 and 40% on £9,730)

NICs: £5,229

Estimated Take-Home Pay: £46,166

These examples highlight how different income levels are affected by the progressive tax system and how a calculator helps you see the precise impact on your take-home pay.

Self-Employed Income Tax Calculator UK

Calculating taxes as a self-employed individual can be tricky, as you need to account for business expenses and different classes of National Insurance. Our self-employed calculator simplifies this process.

Key Inputs:

Gross Income: Your total earnings before any expenses.

Allowable Expenses: Costs incurred wholly and exclusively for your business, such as office supplies, travel, and professional fees.

Other Deductions: Pension contributions or charitable donations.

Our calculator automatically applies the correct tax bands and calculates both Class 2 and Class 4 National Insurance Contributions to give you an accurate estimate of your tax bill.

Whether you’re negotiating a job offer or just budgeting, calculate your actual income with our trusted Salary Tax Calculator.

UK Skilled Worker Visa Salary Tax Calculator

If you are a non-UK resident on a Skilled Worker Visa, you are typically taxed on your UK earnings in the same way as a resident. However, tax treaties with your home country may prevent double taxation.

Our calculator helps you estimate your take-home pay, which is especially useful when negotiating a job offer, as you need to meet minimum salary requirements to qualify for the visa. It is important to note that the Immigration Health Surcharge (IHS), a separate fee, is a required payment for your visa and is not a tax deduction from your salary.

How a UK Skilled Worker Visa Income Tax Calculator Helps

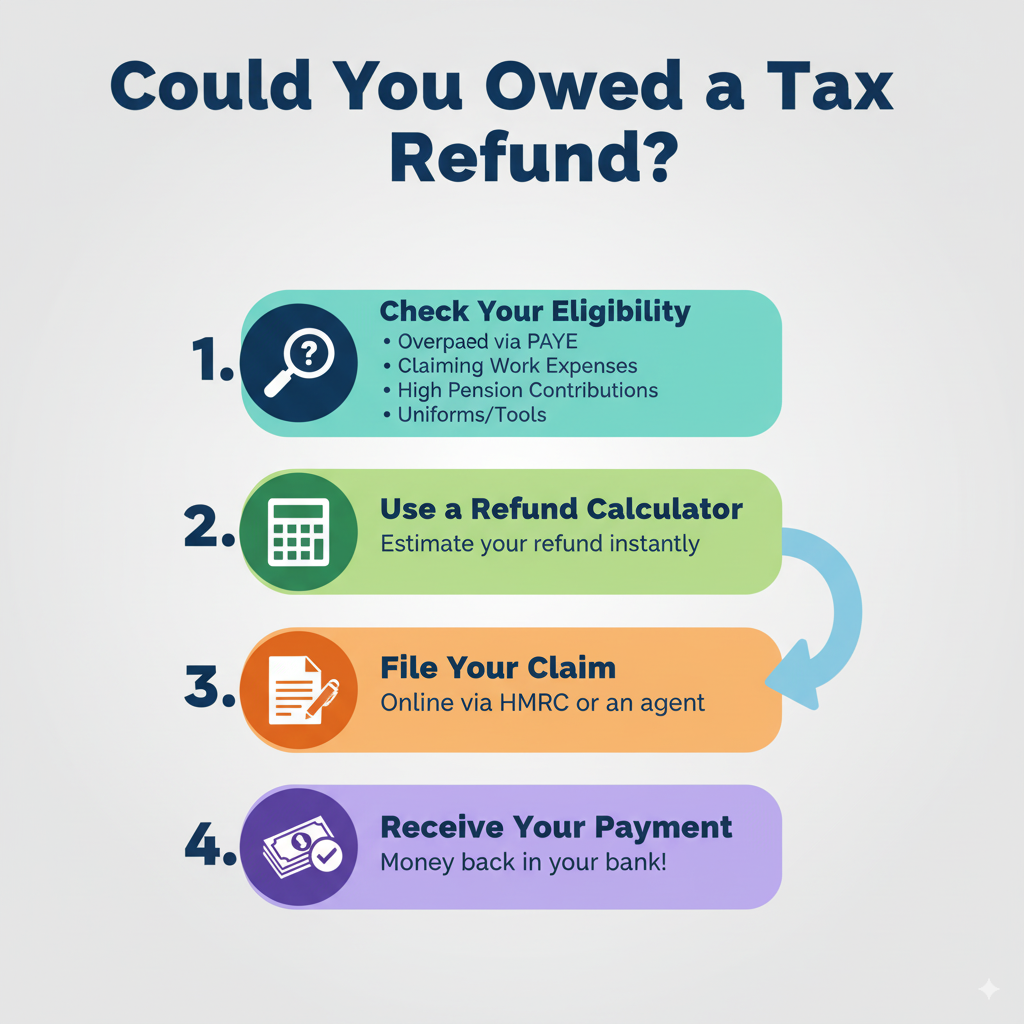

You may be eligible for a tax refund if you’ve overpaid. Common reasons include:

Starting a new job part-way through the tax year on an emergency tax code.

Leaving the UK and not working for the full tax year.

Claiming work-related expenses not reimbursed by your employer.

A refund calculator can help you check your eligibility by comparing your payments with your actual tax liability. If you believe you are owed a refund, you can file a claim directly with HMRC.

Use Our Tax Calculators Now

Ready to check your take-home pay? Use our UK Salary Tax Calculator now to get a precise estimate.

We also offer specialised calculators to help you with your finances:

Bonus Tax Calculator: Don’t let surprise deductions ruin your bonus joy.

VAT Calculator: Add or remove VAT with precision.

Dividend Tax Calculator: Find out exactly how much you keep after tax on your dividends.

Frequently Asked Questions

How do I calculate how much tax I pay in the UK?

You can calculate your tax by finding your taxable income (gross salary minus your Personal Allowance) and then applying the relevant tax rates (20%, 40%, or 45%) to the income that falls within each band. For a quick and accurate result, it’s easiest to use a reliable online tax calculator.

At what salary do you start paying 40% tax in the UK?

You begin paying the 40% higher rate of tax on any taxable income that exceeds £50,270 for the 2025/26 tax year.

How can I legally reduce my taxable income?

There are several legal ways to reduce your taxable income, including making pension contributions, which extend your basic rate band, or making charitable donations via Gift Aid. If you’re self-employed, you can also claim allowable business expenses.

Are UK tax calculators updated annually with new tax bands?

Our calculators are updated annually to reflect the latest tax bands, Personal Allowance, and National Insurance rates, ensuring you get the most accurate and up-to-date estimates for the current tax year.

Where can I find official UK tax information?

For official and detailed information on income tax and National Insurance, always refer to the official GOV.UK website.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.