Quick and Easy Online VAT Calculator for Your Business

The UK VAT calculator is an online tool for businesses and individuals to quickly add or remove Value Added Tax at the current UK standard rate of 20% or any custom rate. This calculator supports net-to-gross and gross-to-net conversions, making it easy to adjust invoices, receipts, and payments. It also provides guidance on VAT rates, including reduced and zero-rated categories, and explains options such as the Flat Rate Scheme for small businesses. With instant results and adjustable rates, the VAT calculator ensures accurate tax calculations in seconds.

To use the UK VAT calculator, enter any net or gross amount and select whether you want to add or remove VAT. The tool instantly calculates the corresponding value using the standard 20% VAT rate or any custom rate you set. With dedicated Add VAT and Remove VAT options, you can convert between net and gross amounts in seconds. The calculator also allows you to adjust rates for reduced or zero-rated goods, ensuring accurate results for all types of transactions.

Get a crystal-clear breakdown of your bonus tax deductions before payday hits. Try our Bonus Tax Calculator now. Break down your earnings the easy way. Listen to the Taxman Calculator and understand your take-home pay today!

Explore Our Free Tax Calculators and Tools

>

Why Choose This Online VAT Calculator UK?

This tool is more than just a calculator; it’s a financial companion built for clarity and compliance. Whether you’re a new entrepreneur, a seasoned accountant, or a private individual, it empowers you to:

Quickly add VAT to a net amount to determine the gross price.

Instantly remove VAT from a gross total to find the original net value.

Understand the breakdown of the net amount, VAT amount, and final gross total in seconds.

No more paycheck surprises! Use the Salary Tax Calculator to see what hits your account each month.

An Expert's Perspective on UK VAT

According to financial experts and official HMRC guidelines, a solid grasp of VAT is crucial for maintaining compliant business records. VAT, which stands for Value Added Tax, has been a cornerstone of the UK’s tax system since its introduction in 1973. It is a consumption tax applied to most goods and services, serving as one of the government’s primary revenue streams.

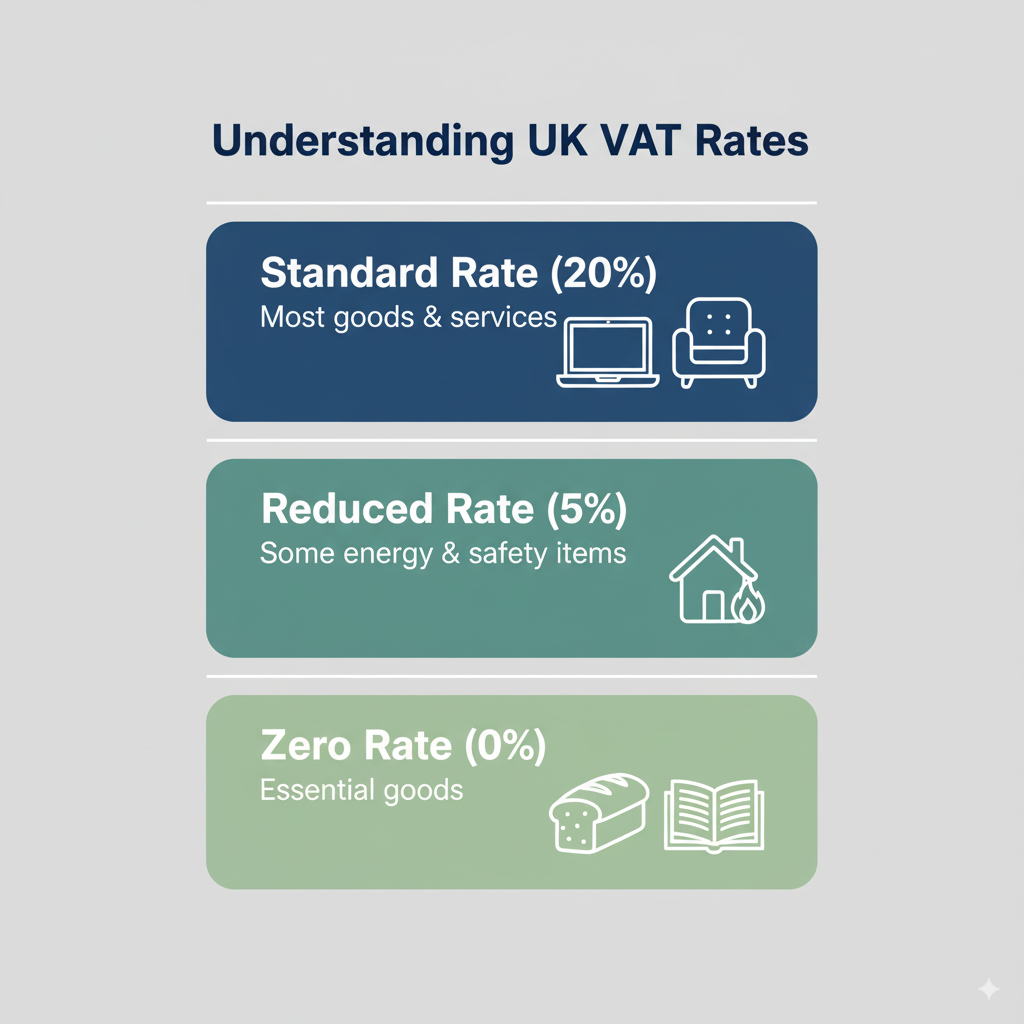

The Three UK VAT Rates:

Understanding the different rates is paramount for correct pricing and invoicing. As per HMRC, the rates are:

Standard Rate (20%): The most common rate, applied to the majority of goods and services, from electronics to professional services.

Reduced Rate (5%): Applies to a limited number of items, such as children’s car seats and domestic energy.

Zero Rate (0%): Goods and services are considered taxable, but the rate of tax is 0%. This includes essential items like most food products, books, and children’s clothing.

It’s important to note that certain items, such as insurance and postage stamps, are classified as VAT exempt or “outside the scope of VAT” and are treated differently from zero-rated goods. Businesses with a taxable turnover exceeding the current VAT registration threshold of £90,000 must register for VAT with HMRC.

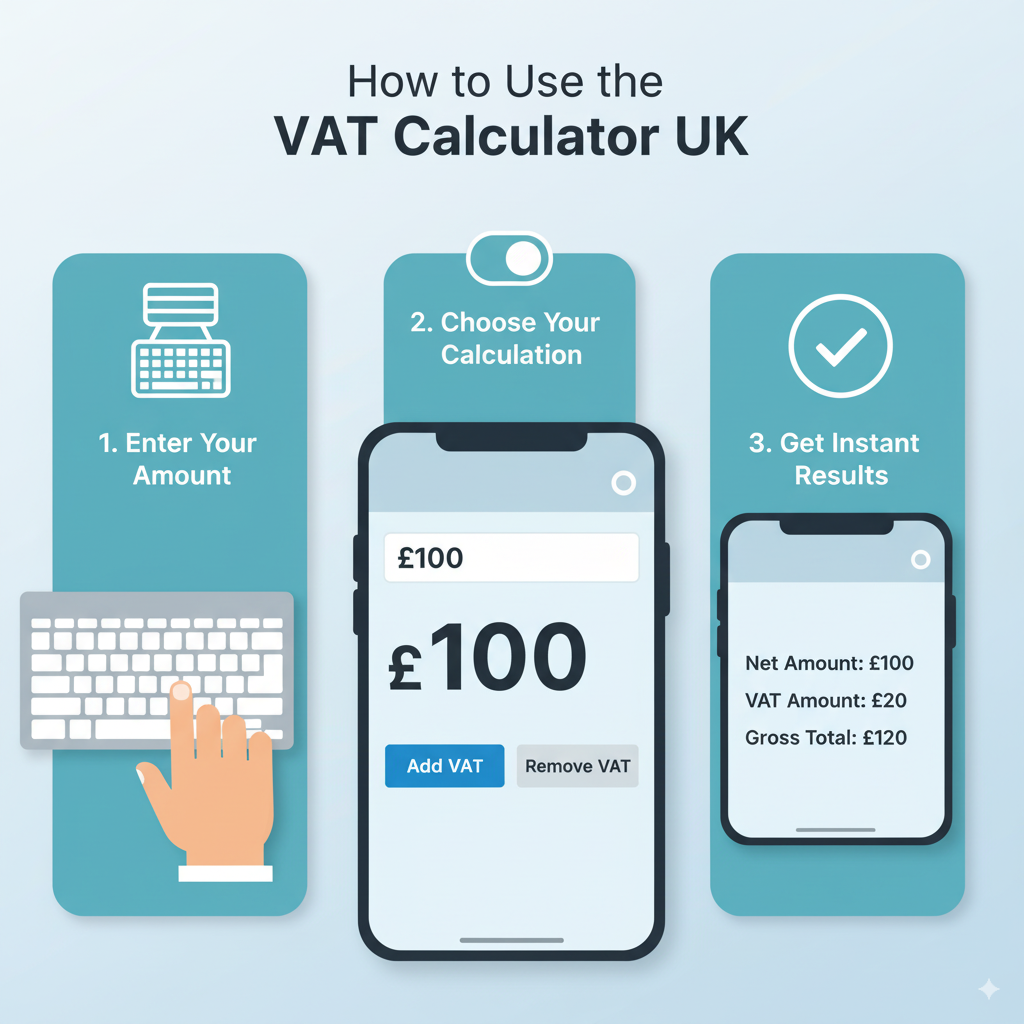

How to Use the VAT Calculator

Using our tool is straightforward and eliminates the potential for manual errors. Simply:

Enter the amount you wish to calculate.

Select whether you want to “Add VAT” or “Remove VAT.”

The results will instantly display the net amount, the VAT amount, and the gross total, providing a comprehensive overview of your transaction.

Stop wondering “how do I calculate VAT?” and start getting instant, accurate results. Our calculator is a testament to the idea that complex financial tasks can be made simple and accessible for everyone. Bookmark this page and rely on our robust tool to handle the numbers, ensuring you stay in control of your finances with confidence and accuracy.

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.