VAT on car parking is a UK tax applied at the standard rate of 20% to most paid facilities, including local authority car parks, private operators, and commercial premises. This charge affects motorists, employers providing staff parking, and businesses reclaiming input tax.

However, certain facilities such as NHS hospital car parks, some educational institutions, and on-street parking managed by councils are VAT exempt.

Knowing when VAT applies or does not apply helps drivers calculate real costs and enables businesses to manage compliance and reclaim opportunities effectively.

In this article, we’ll explore when VAT applies to car parking, HMRC’s guidance on VAT and the different types of facilities affected, and the financial consequences for businesses and consumers.

If you need clarity on how much VAT you’re paying or can reclaim, don’t forget to try our VAT Calculator , a simple tool to estimate VAT on various services, including parking.

What Does VAT on Car Parking Mean?

VAT (Value Added Tax) is a consumption tax applied to many goods and services in the UK, and car parking is no exception. When you pay to park in a commercial or privately managed facility, it’s likely that VAT is included in the fee – typically at the standard rate of 20%.

This means that if you’re charged £6 for a parking session, £1 of that amount is VAT (20% of £5). (HMRC VAT Rates) Understanding how and when VAT applies can help you make smarter spending decisions, especially if you’re operating a business where car parking is a regular expense.

Read Our more Detailed Guides on VAT:

What is VAT and How VAT Works?

What is VAT Exempt in the UK: All VAT Exempt Items

Are Books VAT Exempt in the UK? A Complete Guide for 2025

Is VAT Chargeable on Alcohol in the UK?

Is There VAT on Flowers in the UK?

How to Find VAT Number of a Business?

Is There VAT on Stamp Duty in the UK?

VAT Deregistration: A Complete Guide

VAT on Entertainment Expenses: Guide for UK Businesses

Is There VAT on Food Items? Find Zero-Rated Items

The Core Rule: What VAT Rate is Car Parking?

The standard VAT rate in the UK is 20%. This is the rate generally applied to any supply of parking that is considered a taxable business activity.

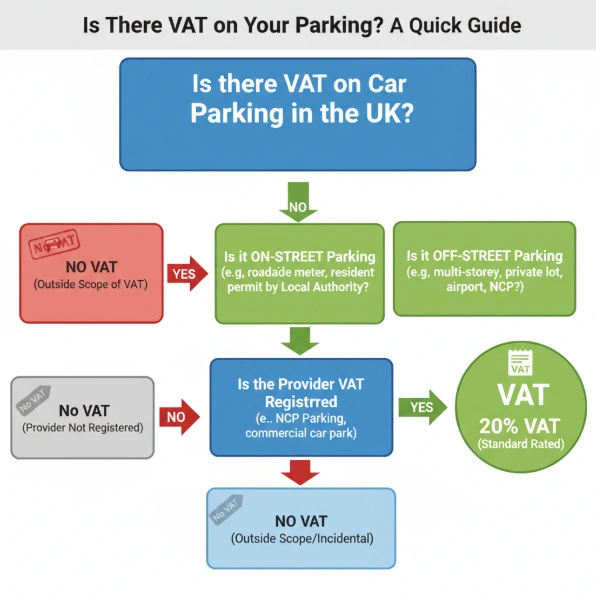

However, the key distinction in VAT law lies in the nature of the supply. HMRC makes a fundamental separation based on the location and control of the parking facility:

1. Off-Street Parking: Standard Rated (20% VAT)

In almost all cases, parking services supplied in off-street car parks—such as multi-storey car parks, private surface lots, car parks at airports, railway stations, shopping centres, and, critically, those run by major operators like NCP—are subject to the standard rate of VAT (20%).

This applies whether the car park is operated by a private company (like NCP Parking) or a Local Authority.

- Private Operators (e.g., NCP): If a company is VAT-registered (which major providers like NCP parking will be), they are required to charge 20% VAT on their parking fees. The question, is there VAT on NCP parking? is definitively answered with a resounding yes. (HMRC VAT Registration)

- Local Authority Off-Street Parking: Following landmark rulings (such as Isle of Wight Council), even off-street parking provided by Local Authorities is generally considered a business activity that competes with the private sector, and is therefore standard-rated. This ensures a level playing field and means the standard VAT rate is car parking regardless of whether the council or a private firm owns the site.

2. On-Street Parking: Outside the Scope of VAT (No VAT)

On-street parking—paid via meters, ‘pay and display’ machines on the roadside, or resident permits administered by a Local Authority—is typically treated as a non-business, statutory activity.

- Outside the Scope: This means the local authority is not supplying a commercial service; they are exercising a public power as a highway authority under laws like the Road Traffic Act. Therefore, there is no VAT to pay, and the income is Outside the Scope of VAT. [HMRC VAT Notice 749: Local authorities]

Expert Insight: The difference between “Outside the Scope” (on-street) and “Exempt” (some specific long-term land leases) is vital. Outside the Scope means the transaction doesn’t even enter the VAT system, while Exempt means it is a formal supply of goods or services but is legally exempt from VAT.

When Does VAT Apply to Car Parking?

Whether VAT is chargeable on car parking depends on who provides the parking service and the nature of the facility. Below is a breakdown of when VAT on car parking applies:

1. Commercial Car Parks

If a private company or business runs the parking site, VAT is generally applied to the parking fee. These operators must register for VAT if their turnover exceeds the registration threshold. Examples include:

- Shopping centre car parks

- Airport or railway station parking

- Privately operated multi-storey facilities

2. Local Authorities & Non-Profit Operators

Parking services provided directly by local councils or non-profit organisations are often exempt from VAT, as they may not be classed as taxable supplies.

However, if a local authority leases its parking space to a private operator, VAT could apply depending on the lease agreement.

3. Inclusive Parking Services

Sometimes, parking is included as part of a broader service like a hotel stay or membership to a gym. In these cases, VAT treatment depends on how the service is packaged and whether parking is a distinct supply or simply part of the overall service.

Short-Term vs Long-Term Parking VAT Treatment

The length of time you use a parking facility can affect its VAT status:

- Short-Term Parking (typically under 24 hours): Usually subject to the standard 20% VAT rate when provided by a VAT-registered entity.

- Long-Term Parking: In some cases, this could attract different VAT treatment or may even be exempt, particularly when offered in conjunction with other services like seasonal contracts or resident permits. (HMRC VAT Notice 742: Land and Property)

Always check the provider’s VAT status if in doubt.

VAT on Country Park and Nature Reserve Parking

If you’re visiting a country park or a nature reserve, parking policies – and their VAT treatment – can vary widely. Many of these sites are operated by local councils or trusts, meaning they may not charge VAT on parking fees.

However, it’s always best to check the signage or speak to park officials. Some parks use third-party contractors to manage parking, which may result in VAT-inclusive charges.

When is Parking Exempt or Zero-Rated?

There are specific, narrow circumstances where parking may be VAT-Exempt or Zero-Rated:

- Incidental Parking (Exempt): If the parking is incidental to another Exempt land supply. For example, if you rent an office and the contract allows you to park one car on the forecourt, and the forecourt is not designated as a car park (e.g., just a bit of spare yard), the parking might be treated as part of the main Exempt lease.

- Parking Supplied with a Dwelling (Exempt/Zero-Rated):

- Sale of a New Dwelling: A parking space or garage sold with a new-build house or flat under a long lease is Zero-Rated as part of the overall dwelling sale.

- Letting a Garage/Space with a Dwelling: A garage or parking space let under a short-term tenancy with a residential dwelling for permanent residential use is Exempt from VAT.

- Stand-Alone Garage Rental: Renting a stand-alone garage or parking space separately from a dwelling is generally Standard-Rated (20% VAT), unless the space is not part of a clearly designated parking facility.

Expert Warning: Landlords often misunderstand this. If a business grants a licence to occupy a dedicated, designated parking space, that is a supply of a “facility for parking” and must be standard-rated, meaning VAT on car parking is due to HMRC.

Special Cases and VAT Complications

VAT on Airport and Train Station Parking

Despite the fact that air and rail transport are generally zero-rated for VAT, the parking facility is considered a separate supply of a “facility for the parking of vehicles.”

- Airport Parking: Short-stay, long-stay, and valet services are almost always Standard-Rated (20% VAT).

- Train Station Parking: Car parks run by Network Rail or associated operators are classified as off-street parking and are also Standard-Rated (20% VAT). If you are a business user, you can claim VAT on car parking for these expenses.

Parking Fines, Penalty Charge Notices (PCNs), and Excess Charges

This is arguably the most nuanced area and is often tested in tribunals.

- True Fines/Penalties (Outside the Scope): A true penalty charge (PCN) for an illegal act (e.g., parking on a double yellow line, or a fine issued by a Local Authority for a clear breach of statutory parking rules) is a punitive measure and is Outside the Scope of VAT. You cannot reclaim VAT on a parking fine. (HMRC Fine Guidance)

- Contractual Excess Charges (May be Standard-Rated): Where a private operator (like NCP parking) sets out clear contractual terms—for example, a tariff of £5 for one hour, with an extra £20 charge if you overstay—HMRC’s position (confirmed by case law) is that the additional £20 charge can be viewed as additional consideration for the extended use of the parking service, and therefore may be subject to Standard-Rate VAT (20%). However, if the contract explicitly states the excess charge is a penalty for breaching the terms, it may be argued as outside the scope. Given the complexity, businesses should treat true fines as outside the scope, but seek professional advice on large, systematic excess charges from commercial operators.

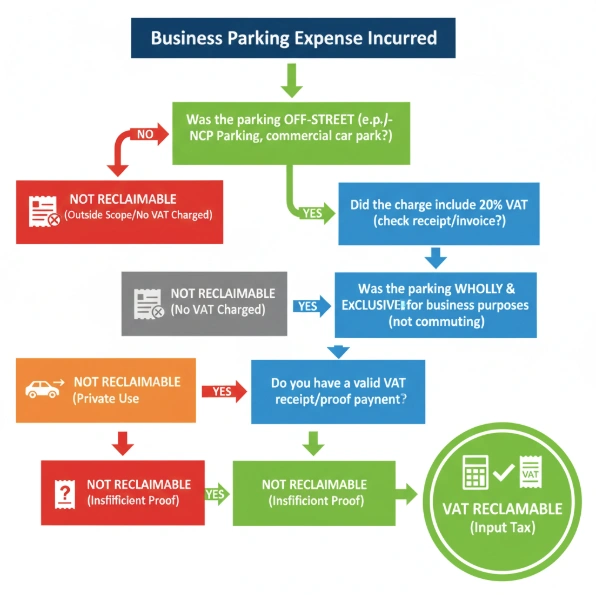

Can You Claim VAT on Car Parking? The Business Perspective

For VAT-registered businesses in the UK, reclaiming Input Tax is a critical part of financial management. The answer to can you claim VAT on car parking? depends entirely on whether VAT was charged in the first place, and if the expense was incurred wholly and exclusively for business purposes.

The Rules for Reclaiming Input Tax

- VAT Must be Charged: You can only reclaim VAT if the parking charge was standard-rated (20% VAT).

- ✅ Reclaimable: Off-street parking (private car parks, airport parking, multi-storeys, NCP parking). [HMRC Input tax guidance].

- ❌ Not Reclaimable: On-street parking (outside the scope of VAT) or parking fines/Penalties (outside the scope of VAT).

- Business Purpose: The parking must be for the purpose of your business. This is usually straightforward, such as parking for a client meeting, collecting business supplies, or attending a conference.

- Proof of Payment (VAT Receipt): You must have a valid record.

- For charges under £25, a less-detailed receipt or ticket is usually acceptable, provided you have evidence of the transaction and can satisfy HMRC that the parking was off-street (and thus subject to VAT).

- For charges over £25, a proper VAT invoice is technically required, though many car park tickets/receipts under £100 will suffice if they show the operator’s name, address, and VAT registration number. [HMRC invoicing rules].

Parking for Employees and Company Vehicles

The complexity increases when dealing with employee travel:

Key Takeaway: If the ticket is for NCP parking or any other commercial off-street facility, you can and should look to claim VAT on car parking incurred for business journeys. Always check the ticket for a VAT number or confirmation that VAT is included.

Penalty Charge Notices (PCNs) and VAT

It’s essential to distinguish between parking charges and penalty charges. If you receive a Penalty Charge Notice (PCN) due to a parking offence (e.g., overstaying or parking without payment), this charge is a fine, not a service fee. Therefore, VAT does not apply to PCNs.

These fines are issued by either local councils or private companies, and VAT isn’t recoverable or applicable in such cases.

Drawbacks of VAT on Car Parking

While VAT is a crucial component of public finance, its application on parking services does come with downsides:

- Increased costs: Consumers pay more out of pocket for parking due to the 20% VAT.

- Limited VAT recovery: Non-VAT registered businesses and individuals can’t reclaim it.

- Reduced affordability: Particularly impacts low-income groups and regular commuters.

The added financial pressure can also influence business operations, especially in urban areas where parking fees are already high.

How to Prepare for an HMRC Audit

To ensure you satisfy HMRC meticulous record-keeping is non-negotiable, particularly when answering the question, can you claim VAT on car parking?

- Develop a Clear Policy: Implement a staff expense policy that clearly differentiates between reclaimable (off-street, business-related, VAT-charged) and non-reclaimable (on-street, commuting, fine-related) parking.

- Mutilated Receipts Policy: While HMRC is often lenient on small, faded car park tickets, ensure staff capture a photograph of the receipt immediately after payment, paying special attention to the operator’s name and any visible VAT number. Always verify if the ticket is for NCP parking or another VAT-registered facility.

- Review Off-Street Local Authority Payments: Do not assume a council car park is exempt, off-street council parking is generally subject to the standard VAT rate is car parking, so these should be reclaimed.

- Confirming Does Your Parking Space Have VAT?: For long-term leases, always check the legal agreement or invoice from the landlord/operator. If you are receiving a “facility for the parking of vehicles,” the lease will likely be subject to 20% VAT, and you can recover this.

See HMRC VAT record keeping for detailed requirements.

Final Thoughts: Making Sense of VAT on Car Parking

To summarise, VAT on car parking is typically charged when the service is provided by a VAT-registered business, particularly in commercial or privately managed facilities. However, exemptions exist, especially when local councils or non-profit bodies are involved.

For individuals and businesses alike, understanding the VAT implications can make a real difference in planning and budgeting.