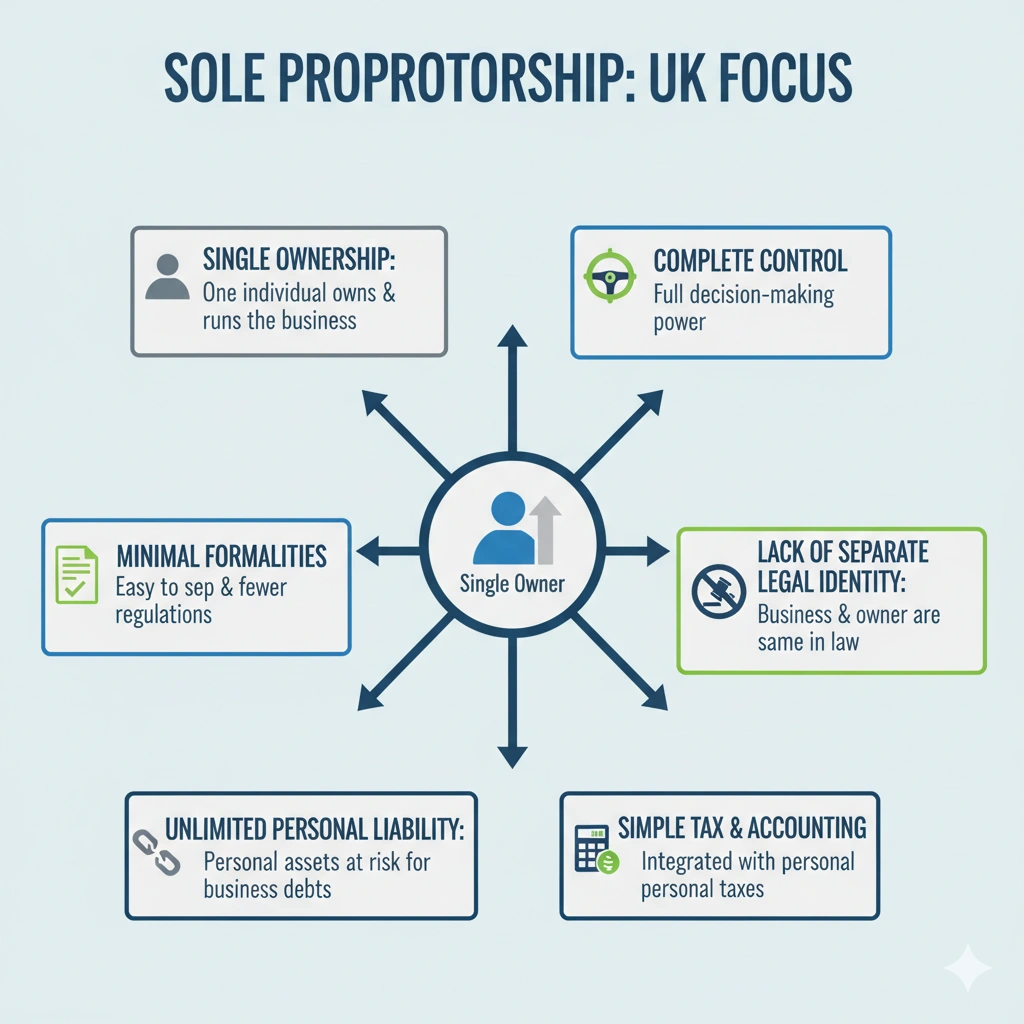

A sole proprietorship in the UK, also called a sole trader business, is the most common form of self-employment where one individual owns and manages the business directly.

It is widely chosen by freelancers, consultants, and small retailers because it is simple to register with HM Revenue & Customs (HMRC), cost-effective to run, and requires minimal administration compared to a limited company.

As of 2024, more than 3.1 million sole traders operate in the UK, representing around 56% of all small businesses, making this structure the backbone of the self-employed sector.

However, the sole trader is personally liable for all debts, tax obligations, and legal responsibilities, making it vital to understand the financial risks alongside the flexibility and independence this model provides.

What is Sole Proprietorship?

At its core, a sole proprietorship is the simplest legal form a business can take in the UK. Legally, the structure does not create any separation between the owner and the business itself. The owner is the business.

When an individual decides to start working for themselves and registers with HMRC for Self-Assessment, they are effectively establishing a sole proprietorship.

This process is straightforward: there is no formal incorporation process, no Companies House registration required (unless a specific trading name is chosen and certain criteria are met), and the administrative burden is minimal compared to that of a limited company.

In the UK, the term ‘sole proprietorship’ is often used interchangeably with ‘sole trader’ or ‘self-employed’. However, for clarity and compliance with the focus keyword criteria, we shall predominantly use the term what is sole proprietorship.

From a UK tax perspective, the individual reports all business income and expenses on their annual Self-Assessment tax return.

The profits derived from the business are treated as the individual’s personal income and are subject to Income Tax and two forms of National Insurance Contributions (NICs). This fundamental integration of the business and personal identity is the defining feature of the sole proprietorship model.

The Seven Essential Characteristics of Sole Proprietorship

Understanding the structure requires a deep dive into the characteristics of sole proprietorship that set it apart from other business forms like partnerships or limited companies. These characteristics directly influence your risk, tax obligations, and administrative duties.

Here are the seven fundamental traits that define this business model:

1. Single Ownership and Operator (The Unitary Nature)

A sole proprietorship is, by definition, owned and operated by one person. There can be no partners or shareholders. This single ownership simplifies decision-making entirely, as the proprietor is the final authority on all matters—from product development and pricing to hiring decisions and strategic direction.

Whilst you can hire employees, the proprietorship itself remains firmly tied to the sole individual. If you wish to bring in a co-owner who shares profits and liabilities, the structure immediately ceases to be a sole proprietorship and becomes a partnership.

2. Unlimited Personal Liability (The Critical Risk Factor)

This is arguably the most significant, and most dangerous, of the characteristics of sole proprietorship. Because the business and the individual are legally inseparable, there is no shield protecting the owner’s personal assets.

If the business incurs debt, faces legal action, or is unable to meet its financial obligations, the proprietor’s personal assets such as their home, savings, or investments can be seized to cover these liabilities.

Unlike a limited company, where shareholder liability is typically limited to the value of their shares, the sole proprietor faces unlimited personal liability.

HMRC views the tax debt of the business as the personal debt of the individual. Failure to pay Income Tax or NICs will result in HMRC pursuing the individual directly, making a robust understanding of allowable expenses and tax deadlines paramount.

3. Minimal Regulatory and Administrative Formalities

The ease of setup and operation is a major reason why many new UK entrepreneurs choose this structure.

To establish a sole proprietorship, the individual merely needs to register with HMRC for Self-Assessment (usually within three months of starting to trade).

There is no requirement to file annual accounts with Companies House, no need for complex statutory registers, and fewer mandatory public filings. This low administrative overhead is one of the most appealing characteristics of sole proprietorship.

While the formalities are minimal, the requirement to maintain accurate business records for at least five years after the 31 January submission deadline for the relevant tax year remains mandatory for HMRC compliance.

4. Complete Control and Managerial Autonomy

The proprietor enjoys absolute operational freedom. All decisions are their own, without the need for board meetings, shareholder votes, or complex governance structures. This ability to pivot quickly and react immediately to market changes is a huge advantage.

The downside to this autonomy is that the sole proprietor bears the weight of all responsibilities, often finding themselves needing to be the chief executive, accountant, marketer, and cleaner all at once.

5. Direct Access to All Business Profits

In a sole proprietorship, profits are not subject to Corporation Tax. Instead, after deducting all allowable business expenses, the residual profit is treated as the proprietor’s personal income. The owner can withdraw money from the business at any time often called ‘owner’s drawings’ without formality or further tax.

This differs greatly from a limited company, where money is extracted via salaries (subject to PAYE) and dividends (subject to dividend tax). For a sole proprietor, the entire profit is taxed once via Self-Assessment, irrespective of whether the money is left in the business bank account or drawn by the owner. See HMRC’s guide on withdrawing money from your business.

6. Simple Tax and Accounting Requirements

The tax system for a sole proprietorship is comparatively straightforward. The business runs on the tax year (6 April to 5 April), and the profits are calculated using either the traditional accounting method (accruals) or the simpler cash basis accounting method.

The final calculation is submitted via the annual Self-Assessment Tax Return (SA100 form, plus the SA103 supplementary form for business income).

This simplicity significantly reduces the cost and complexity of professional accounting services for many micro-businesses. For this reason, the administrative ease of the sole proprietorship remains a key factor in its popularity.

7. Lack of Separate Legal Identity

The definitive answer to what is sole proprietorship lies in its lack of separate legal standing. The law does not distinguish between Dave Jones, the man, and Dave Jones Carpentry, the business.

This means:

- The business cannot enter into a contract; the owner enters into it personally.

- The business has no independent legal life. It ceases to exist legally when the owner dies, retires, or stops trading.

- All assets and debts are held personally by the owner.

The combination of the characteristics of sole proprietorship specifically the lack of legal separation and the resultant unlimited liability is what compels many successful sole traders to eventually transition to a limited company structure as their business grows.

Tax Compliance for the UK Sole Proprietor

For deep and clear understanding, a detailed discussion of the specific UK tax obligations is essential. The tax structure of a sole proprietorship involves three main components: Income Tax, Class 2 National Insurance Contributions (NICs), and Class 4 NICs.

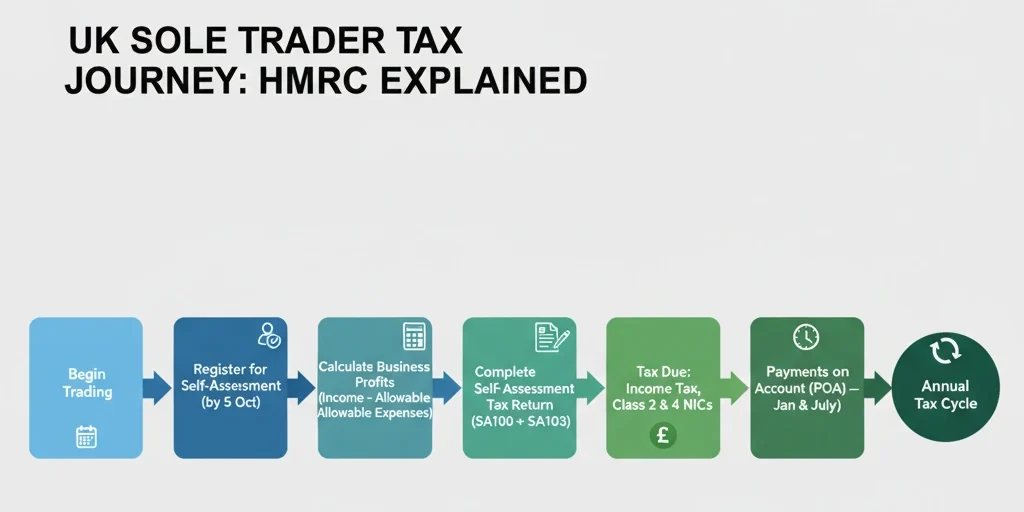

A. Registering with HMRC

Any individual starting a sole proprietorship must register for Self-Assessment (SA) by 5 October following the end of the tax year in which they started trading. Failure to do so can result in penalties. This is the official notification to HMRC of the new self-employed status.

B. Income Tax Calculation

The business profits (revenue minus allowable expenses) are added to any other personal income (e.g., employment income, rental income, investment income). This total taxable income is then taxed at the UK’s prevailing Income Tax rates (currently the basic, higher, and additional rates), using the standard Personal Allowance.

C. National Insurance Contributions (NICs)

Sole proprietors are liable for two classes of NICs:

- Class 2 NICs: A small, flat weekly rate paid if profits exceed the Small Profits Threshold. These contributions are important as they count towards entitlement to the State Pension and certain benefits.

- Class 4 NICs: Calculated as a percentage of profits above a lower limit and up to an upper limit, and then a lower percentage on profits above that upper limit. These are levied purely to fund the NHS and state benefits and are essentially an additional income tax on business profits.

D. Payments on Account (POA)

Once a sole proprietor’s tax bill exceeds a specific threshold (currently £1,000, and less than 80% of the tax liability has been deducted at source), HMRC will require them to make Payments on Account.

Payments on Account are advance payments towards the next year’s tax bill, made in two instalments:

- First Payment: Due 31 January (alongside the previous year’s tax balance).

- Second Payment: Due 31 July.

This often surprises new sole traders, resulting in a large lump sum payment due in January, which includes the previous year’s full balance plus the first Payment on Account for the current year. This is a critical financial planning point that highlights the need for expert advice when running a sole proprietorship.

Read Our more Detailed Guides on VAT:

PIP Rates 2025: Guide to PIP Rates in the UK

What is P800 Refund? How to Claim P800 Refund

What is Withholding Tax? Guide for UK Taxpayers

How to Pay Council Tax Online?

How to Setup Personal Tax Account with HMRC?

How to Register as Self Employed: A Complete Guide for 2025

How to Cancel your Marriage Allowance? A Complete Guide

Advantages of a Sole Proprietorship

Despite the risks, a sole proprietorship offers multiple benefits:

- Easy setup and closure: No complex registration procedures

- Full control: Make decisions without consulting partners or directors

- Fewer reporting obligations: Less paperwork and administrative burden

- Privacy: Financial details are not publicly disclosed

- Direct tax filing: Submit your Self Assessment to HMRC as an individual

It’s an ideal option for small-scale businesses such as independent shops, salons, personal trainers, tradespeople, and freelancers.

Disadvantages of a Sole Proprietorship

Here are a few limitations to be mindful of:

- Unlimited personal liability

- Limited access to funding

- Lack of continuity: The business may cease to exist upon the owner’s death

- Restricted growth potential: Scaling the business can be difficult alone

- High personal responsibility: You’re accountable for all legal and financial matters

Sole Proprietorship vs. Limited Company

The question of what is sole proprietorship is often best answered by comparing it to the limited company, its primary alternative.

Choosing between the two is a crucial strategic decision based on risk, profit levels, and administrative tolerance. The distinction is built around the characteristics of sole proprietorship we have already explored, particularly liability and tax.

For entrepreneurs with lower predicted profits or those offering services with minimal financial risk (e.g., simple consulting), the administrative simplicity of the sole proprietorship often makes it the preferred starting point.

However, as profits rise into the higher tax bands (often over £40,000-£50,000) and the risk of liability increases, the financial and legal protection offered by the Limited Company structure often outweighs the increased administration.

For further information or registration you incorporate limited company from here. Understanding the characteristics of sole proprietorship is the first step toward this transition.

Advanced Bookkeeping and Allowable Expenses

A common pitfall for those operating a sole proprietorship is incorrectly classifying expenses. For HMRC purposes, an expense must be “wholly and exclusively” incurred for the purpose of the trade.

Key Allowable Expenses for the Sole Proprietor:

- Use of Home as Office: Sole traders can claim a proportion of household bills (heating, lighting, broadband) or use the simplified flat rate, currently £10 per week for 25-50 hours of work per month, £18 per week for 51-100 hours, and £26 per week for 101+ hours. We recommend keeping detailed records to see if the actual costs claimed through a justifiable calculation provide a greater deduction.

- Motor Expenses: A sole proprietor can claim either the actual costs (insurance, fuel, repairs, depreciation) or the HMRC flat rate mileage allowance (e.g., 45p per mile for the first 10,000 miles, 25p thereafter). This choice needs careful analysis.

- Capital Allowances: While fixed assets like equipment or vehicles cannot be claimed as a direct expense, the sole proprietor can use Capital Allowances (like the Annual Investment Allowance) to deduct the full cost of the asset from profits in the year of purchase.

The simplicity of the bookkeeping rules is one of the positive characteristics of sole proprietorship, but it requires vigilance.

The Dynamics of Self-Employment and IR35

While IR35 legislation is primarily focused on contractors operating through a limited company (off-payroll working rules), the concept of ’employment status’ remains vital to the sole proprietorship.

HMRC is constantly vigilant in ensuring that individuals claiming self-employed status truly are operating a genuine business, rather than being a ‘disguised employee’. The key tests revolve around:

- Control: Does the client control how the work is done? (A feature inconsistent with a sole proprietorship).

- Substitution: Can the sole proprietor send an alternative person to do the work?

- Mutuality of Obligation: Is the client obliged to offer work, and is the sole proprietor obliged to accept it?

A genuine sole proprietorship should be able to demonstrate a high degree of autonomy and commercial risk, confirming their independent status to HMRC. Employment Status Rule by HMRC explained here.

If you’re planning to provide a specialised service or sell goods on a small scale, a sole proprietorship might be your best starting point. It’s especially suitable if you want to avoid complex legal structures and prefer operating independently.

For continued growth and to future-proof your financial well-being, regular consultation with a UK tax professional is essential to assess whether the simplicity of the sole proprietorship still serves your best interests or if a more complex, but better-protected, limited company structure is necessary.

By adhering to best practice bookkeeping, proactively managing your tax liabilities, and fully understanding the seven core characteristics of sole proprietorship, you position yourself for sustainable success in the dynamic UK business landscape.

Final Thoughts

The sole proprietorship remains the go-to legal structure for starting a business in the UK. Its inherent simplicity, ease of setup, and low administrative cost are powerful advantages, allowing entrepreneurs to focus their efforts and capital on building their business rather than managing compliance.

However, the advantages must be weighed against the significant disadvantage of unlimited personal liability. Understanding the characteristics of sole proprietorship is non-negotiable for success. The proprietor must be acutely aware that they and their business are one entity in the eyes of the law and HMRC.