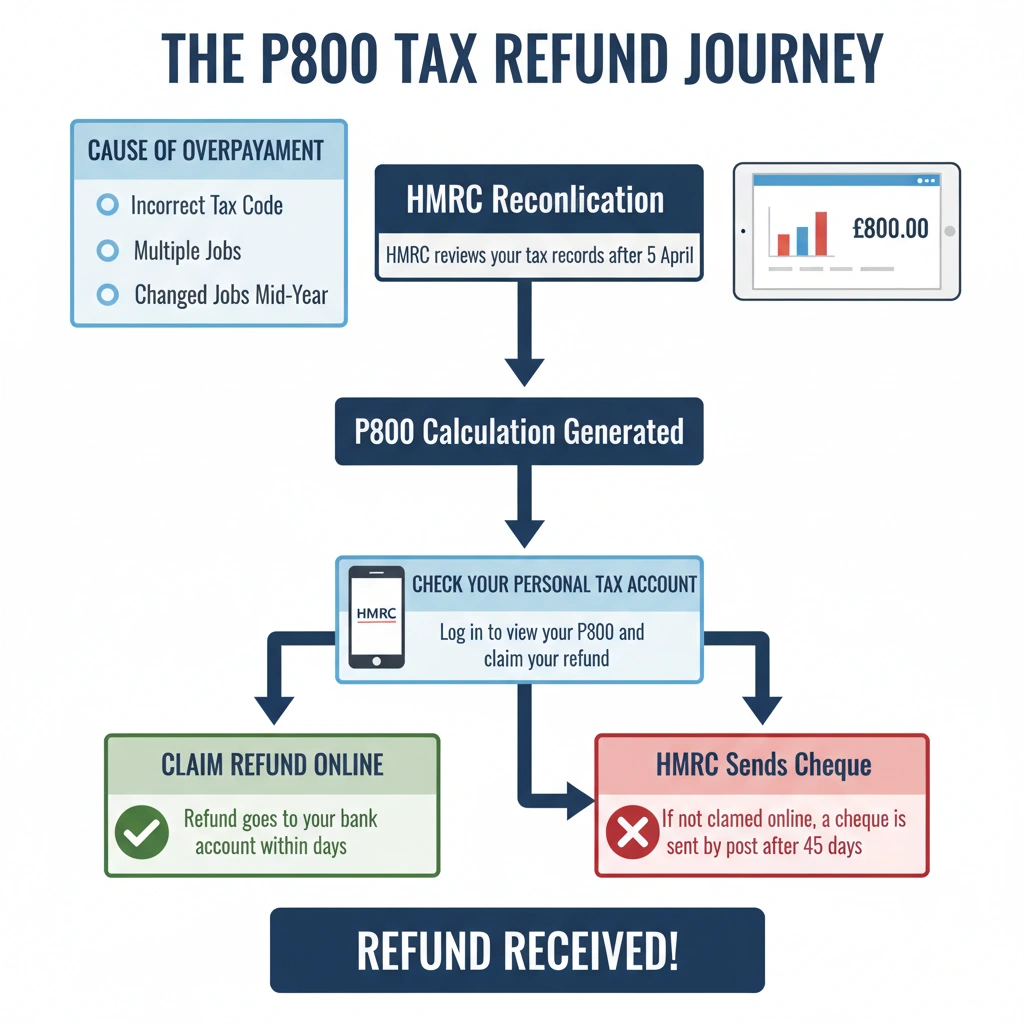

A P800 tax refund is a repayment from HM Revenue and Customs (HMRC) issued when you have overpaid Income Tax through PAYE or Self Assessment.

The repayment is confirmed in a P800 Tax Calculation letter, which shows how your income, tax code, and deductions were calculated for the tax year.

Many taxpayers become eligible for a P800 refund due to tax code errors, changes in employment, having multiple jobs, claiming work-related expenses, or receiving taxable benefits such as company cars.

To check your HMRC tax refund eligibility, you can log in to your Personal Tax Account and view your P800 online.

Eligible taxpayers can then claim a P800 refund online through the HMRC portal or receive payment automatically if the amount is small.

Understanding how to claim a tax refund from HMRC and the common scenarios that trigger repayments helps ensure you do not miss out on money you are entitled to.

What Exactly Is a P800 Tax Calculation?

A P800 tax calculation is an official statement issued by HMRC (Her Majesty’s Revenue and Customs) (Source: HMRC – Check your Income Tax for past years). Its primary purpose is to inform you that you have either overpaid or underpaid income tax for a specific tax year. This calculation is a crucial part of the PAYE (Pay As You Earn) system, the method by which most employees in the UK pay their income tax.

Unlike a payslip, which shows a snapshot of your tax for a single pay period, a P800 provides a holistic, end-of-year summary. It reconciles the tax you actually paid with the amount you should have paid based on your total income and tax-free allowances.

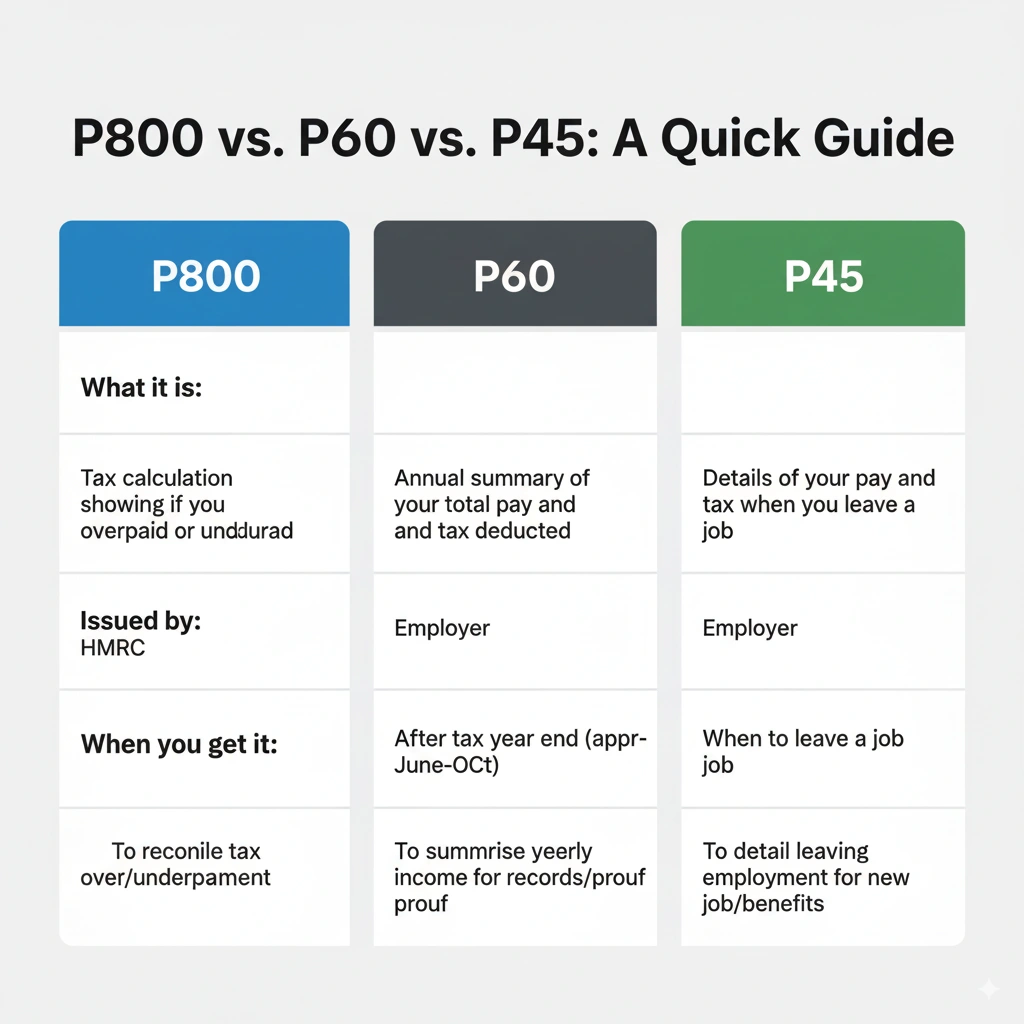

P800 vs. Other Tax Forms

It’s easy to get confused by the many tax forms you might encounter. Here’s how the P800 stands apart:

- P60: Your employer provides a P60 at the end of each tax year (by 31 May). It summarises your total pay and tax deductions from that single job.

- P45: You receive a P45 when you leave a job. It details your earnings and tax paid up to your last day of employment, helping your new employer or HMRC get your tax code right.

- P800: HMRC issues a P800, not your employer. It’s a final calculation that takes into account all your income sources from a single tax year to determine if you owe tax or are due a refund.

A P800 essentially acts as a final check, catching any discrepancies that the routine PAYE system might have missed.

Why the P800 Refund Matters

Understanding the P800 refund process is crucial because you could be missing out on hundreds—or even thousands—of pounds. The P800 isn’t just a notification; it’s your opportunity to reclaim money that rightfully belongs to you.

If you’re due a refund, HMRC will either send it directly to your bank account (if they have your details) or offer a simple process to claim it online.

You can also read our more guides on Personal Tax:

What is a Sole Proprietorship? Things You Should Know

How Much Will I Pay Tax on My Bonus in the UK?

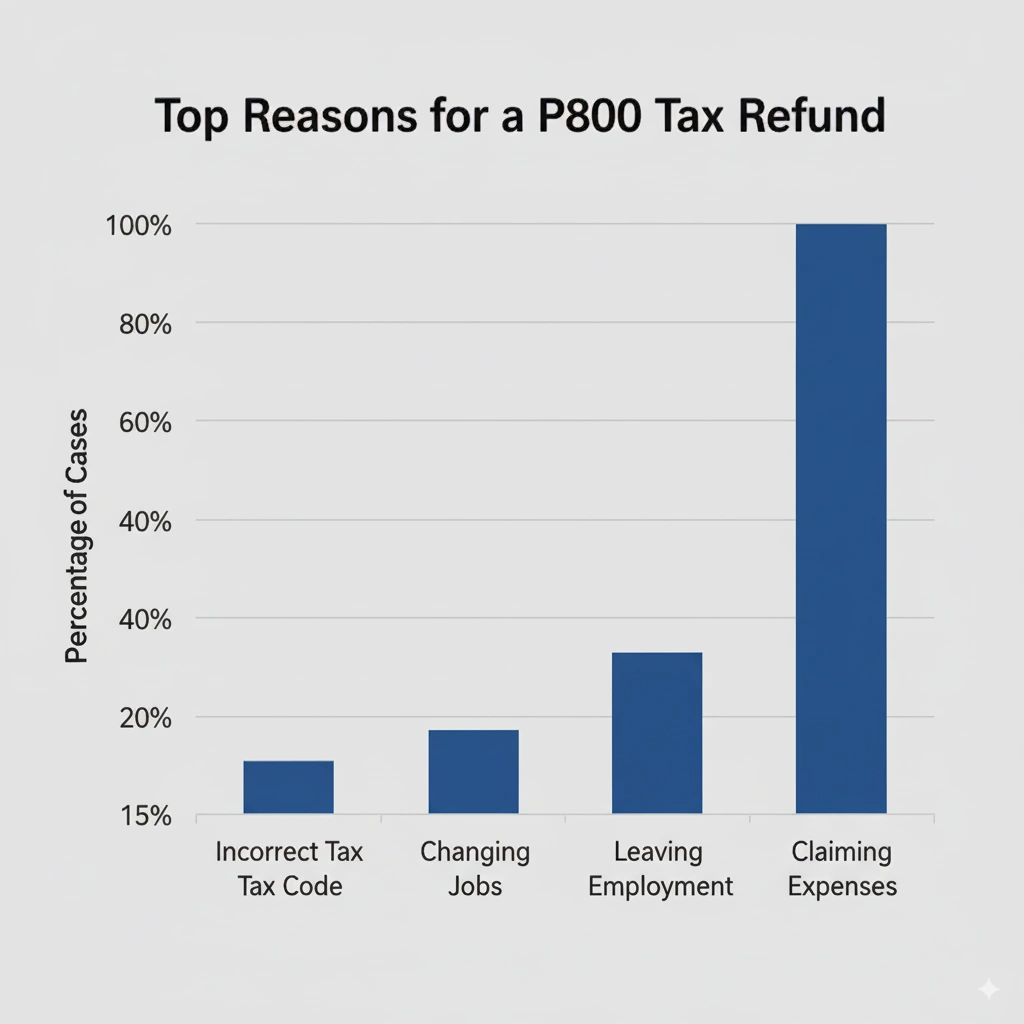

The Common Reasons You Might Receive a P800 Refund

Why do people overpay tax in the first place? It’s not usually due to a single, obvious mistake. Instead, it’s a culmination of common life events and administrative oversights.

HMRC’s system isn’t always instantaneous, and these lags can lead to discrepancies that are only caught at the end of the tax year.

Here are the most frequent reasons for an overpayment that result in a P800 refund:

1. Incorrect or Emergency Tax Codes

Your tax code is a series of letters and numbers that tells your employer how much tax to deduct from your pay. This code is based on your tax-free Personal Allowance and any other deductions or reliefs you’re entitled to.

- Starting a New Job: If you start a new job and don’t provide a P45, your new employer may put you on an emergency tax code. This code often assumes you have a higher Personal Allowance than you’re entitled to, which can lead to over-taxation until HMRC corrects it.

- Multiple Jobs: If you have more than one job, HMRC might apply an incorrect tax code to one or more of them. The system can sometimes fail to correctly split your Personal Allowance across different employers, causing you to pay too much tax at a basic rate.

2. Changing Jobs During the Tax Year

When you switch jobs, there’s a risk of administrative miscalculation. For example, your P45 might not be processed correctly by your new employer, or the timing of your pay cycles could lead to you being taxed at an inaccurate rate. This is one of the most common reasons for a P800 refund.

3. Fluctuating or Intermittent Income

If your income isn’t consistent throughout the year—perhaps you worked part-time for a few months, or you had a period of unemployment—your employer might have used a tax code that didn’t accurately reflect your total annual income. The PAYE system often works on the assumption of a full year’s work, and any deviation from this can lead to an overpayment.

4. Retirement

The transition from working to retirement can often result in a tax refund. If you received a pension lump sum or had a final payout from your employer, your tax might have been calculated using an emergency tax code.

5. Claiming Tax Reliefs and Expenses

Many employees are eligible to claim tax relief on work-related expenses (See official list: Claim tax relief for your job expenses – GOV.UK), such as:

- Work-related travel costs (if you use your own vehicle)

- Professional subscriptions and fees

- Uniforms and protective clothing

- Working from home expenses

If you didn’t claim these expenses via your tax code during the year, your P800 might be the first time these reliefs have been factored into your tax position.

6. Starting or Stopping Work Part-way Through the Tax Year

Similar to fluctuating income, beginning or ending your employment part-way through the tax year can result in an overpayment. The standard PAYE system assumes you’ll work for the full year, so the deductions made on your early payslips may be too high.

When Will I Receive a P800 Form from HMRC?

HMRC conducts its annual PAYE reconciliation after the tax year ends on 5 April. The vast majority of P800 tax calculations are issued between June and October (Source: GOV.UK – PAYE reconciliation process). This is HMRC’s main period for checking the tax records of millions of individuals.

However, a P800 can be issued at any time of the year if HMRC identifies a tax issue. It’s therefore wise to keep an eye on your post and your HMRC Personal Tax Account throughout the year.

What’s Included in a P800 Form?

The P800 form outlines:

- Your total income for the tax year

- The amount of tax paid

- Your tax-free Personal Allowance

- Any tax reliefs or deductions claimed

- The calculation determining if you’ve underpaid or overpaid tax

This breakdown gives you a clear overview of your tax position and whether you’re due a P800 refund.

How to Check for and Claim Your P800 Refund Online

HMRC has made the process of checking for and claiming a P800 refund straightforward. The most efficient way is to use your Personal Tax Account, a secure online portal that gives you a complete overview of your tax records.

Step-by-Step Guide to Accessing Your P800:

- Log into Your Personal Tax Account: Navigate to the official HMRC website and log in using your Government Gateway ID and password. If you don’t have one, you’ll need to create an account. This is a one-time process and provides you with a single secure login for all your HMRC services.

- Find the Tax Calculation Section: Once logged in, look for the section titled “Income Tax” or “Check previous tax years.” This area holds your official tax records.

- View Your P800 Calculation: If you’re due a refund, a link to “View your P800 tax calculation” should be clearly visible. Click on this to see the breakdown of your income, tax paid, and the amount you’re owed.

- Claim Your Refund: If a refund is due and you’ve accessed it online, you’ll be given the option to claim it immediately. You’ll be prompted to provide or confirm your bank account details. The money should arrive in your account within a few business days.

It’s crucial to note that you have a four-year deadline to claim your tax refund. After this period, you lose your entitlement to the money. This is why checking your Personal Tax Account regularly is a smart move.

What if I Don’t Claim My Refund Online?

If HMRC has your correct bank details on file, they may automatically transfer the refund to you. However, if they don’t, or if you don’t claim your refund online within approximately 45 days, they may send a cheque to the address they have on record. For this reason, always ensure your address is up to date with HMRC.

Is a P800 the Same as a P60?

No, the two are entirely different documents:

| Document | Issued By | Purpose |

| P60 | Your employer | Summarises your total income and tax paid for the year |

| P800 | HMRC | Explains if you’ve overpaid or underpaid tax |

Understanding both documents is crucial to managing your tax records accurately.

Will HMRC Automatically Send My P800 Refund?

In many cases, yes, HMRC will send your P800 refund automatically. If they have your correct bank details, they’ll transfer the money. If not, a cheque will follow by post.

However, you must act quickly once you receive the P800. HMRC only gives you a 4-year window to claim tax refund. After that, the money is gone.

Staying Ahead: How to Minimise Future Tax Errors

While a P800 refund is a pleasant surprise, it’s even better to ensure your tax is correct from the start. By taking a proactive approach, you can avoid overpayments and keep your financial affairs in order.

- Register and Use Your Personal Tax Account: This is your central hub for all things tax. Regularly checking your account allows you to monitor your tax code and see an up-to-date summary of your income and tax payments.

- Keep Your Details Updated: Ensure HMRC has your current address, and importantly, your most recent bank details. This ensures any future refunds are processed without delay.

- Understand Your Tax Code: Take a moment to understand what your tax code means. If it seems wrong, don’t hesitate to contact HMRC. A quick check could save you a lot of hassle later.

- Claim All Your Eligible Expenses: Don’t miss out on valuable tax reliefs. Keep a record of any work-related expenses, such as professional fees or uniform costs, and claim them in your Personal Tax Account.

- Use HMRC’s Official Tools: The GOV.UK website has a wealth of information and tools to help you manage your tax, from checking your tax code to a guide on how to claim tax relief.

By following these best practices, you can become a more knowledgeable taxpayer and stay in control of your financial position.

Final Thoughts: Don’t Let Your Money Slip Away

A P800 tax calculation is more than just a form; it’s a statement that you are due money. Understanding this process is key to ensuring you don’t miss out on a refund that could be a significant boost to your finances.

While HMRC’s system is efficient, it isn’t flawless. Discrepancies can occur, and it’s your responsibility to check your tax position. By getting familiar with your Personal Tax Account and regularly checking your records, you empower yourself to manage your tax affairs effectively.

Don’t wait for a P800 to land on your doormat. Be proactive, stay informed, and reclaim what is rightfully yours.

Use Our Free Tools to Stay Tax-Savvy!

Try our Free VAT Calculator – Make quick and accurate VAT calculations for your business.

Check Your Income Tax with Listen to Taxman – See exactly how much tax you’re paying.

Reviewed & Verified Sources:

-

HMRC: Claim a Tax Refund

-

HMRC: Personal Tax Account

The content provided on TaxCalculatorsUK, including our blog and articles, is for general informational purposes only and does not constitute financial, accounting, or legal advice.

You can also visit HMRC’s official website for more in-depth information about the topic.