Value Added Tax (VAT) in the UK is a consumption tax applied to most goods and services, representing around 20% of the final purchase price. As one of the largest revenue sources for HM Revenue & Customs, VAT contributes roughly a third of total government income. Every consumer pays VAT on retail, online, and high-street purchases, while businesses are responsible for charging, collecting, and reporting it through VAT returns. Understanding VAT is essential for both individuals and companies to comply with UK tax regulations and avoid costly errors.

Taxes in the UK often seem complex, and VAT is one of the least understood despite its everyday impact. Shoppers on the high street and online rarely notice that VAT is already included in the price, while businesses must carefully track VAT on sales and purchases to stay compliant.

Accurate VAT accounting is vital for maintaining profit neutrality, as errors in VAT identification or reporting can lead to serious compliance issues and financial penalties.

💡 Not sure how much VAT you need to charge or reclaim? Use our free VAT Calculator to get accurate results in seconds!

What is VAT and How Does it Work?

Implemented in the UK in 1973, Value Added Tax (VAT) is a consumption tax applied to goods and services. It’s a key concept for businesses and consumers alike.

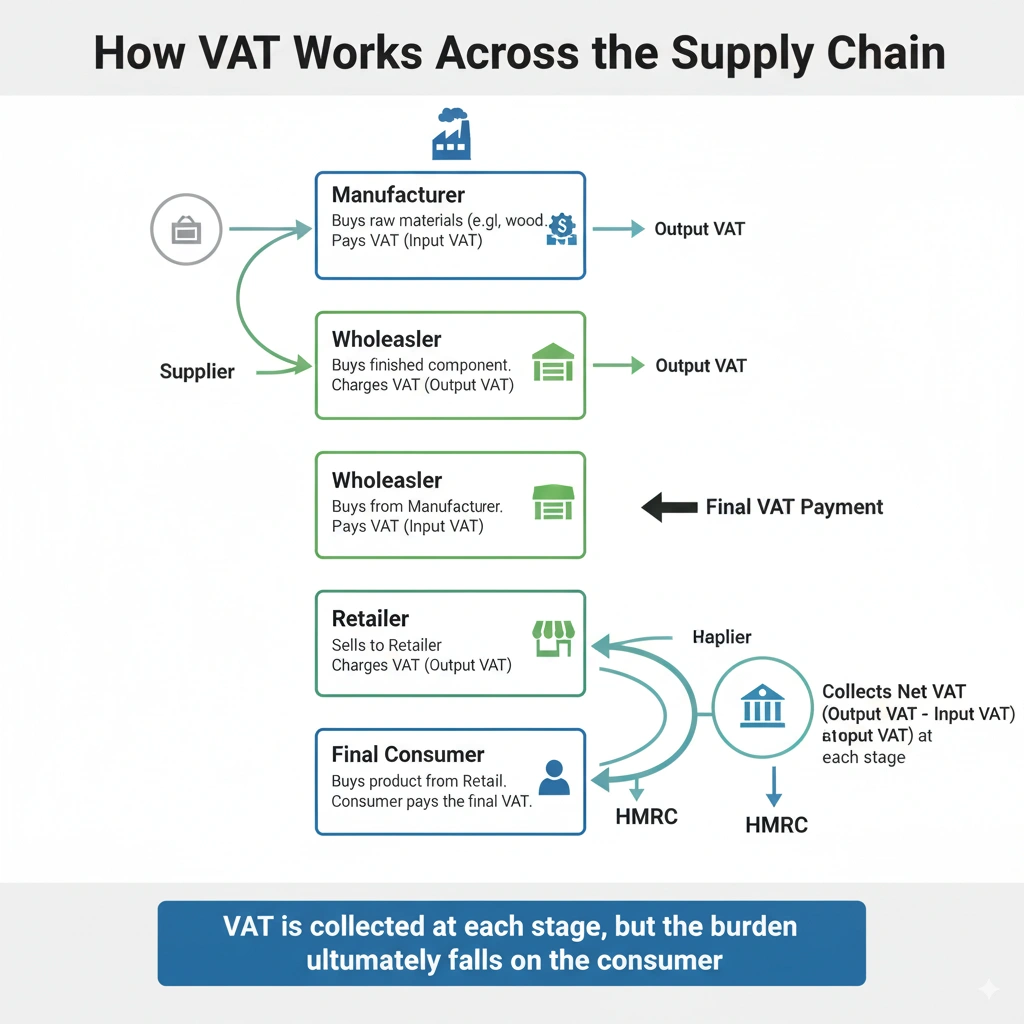

Businesses act as tax collectors on behalf of the government, adding VAT to the price of their goods and services. While consumers ultimately bear the cost, VAT-registered businesses can reclaim the VAT they’ve paid on their business expenses. Failure to properly account for VAT can lead to financial penalties and legal consequences.

How to Calculate UK VAT

VAT calculation is a straightforward process. To determine prices that include VAT, you simply multiply the price without VAT by the appropriate rate. For example, to add the standard 20% VAT, you multiply the price by 1.2. To add the reduced 5% VAT, you multiply by 1.05.

Conversely, to determine prices that exclude VAT, you divide the total price (including VAT) by the corresponding rate. For example, to remove the standard 20% VAT, you divide the total price by 1.2.

Let’s look at some practical examples:

- Example 1: Adding Standard VAT

- A business sells a product for £100 (excluding VAT).

- To find the price with VAT, you calculate: £100 x 1.2 = £120.

- The VAT amount is £20.

- Example 2: Adding Reduced VAT

- A company is selling home insulation for £500 (excluding VAT).

- To find the price with VAT, you calculate: £500 x 1.05 = £525.

- The VAT amount is £25.

- Example 3: Removing Standard VAT

- A consumer buys a laptop for £600 (including VAT).

- To find the price without VAT, you calculate: £600 / 1.2 = £500.

- The VAT amount is £100.

What is the UK VAT Rate?

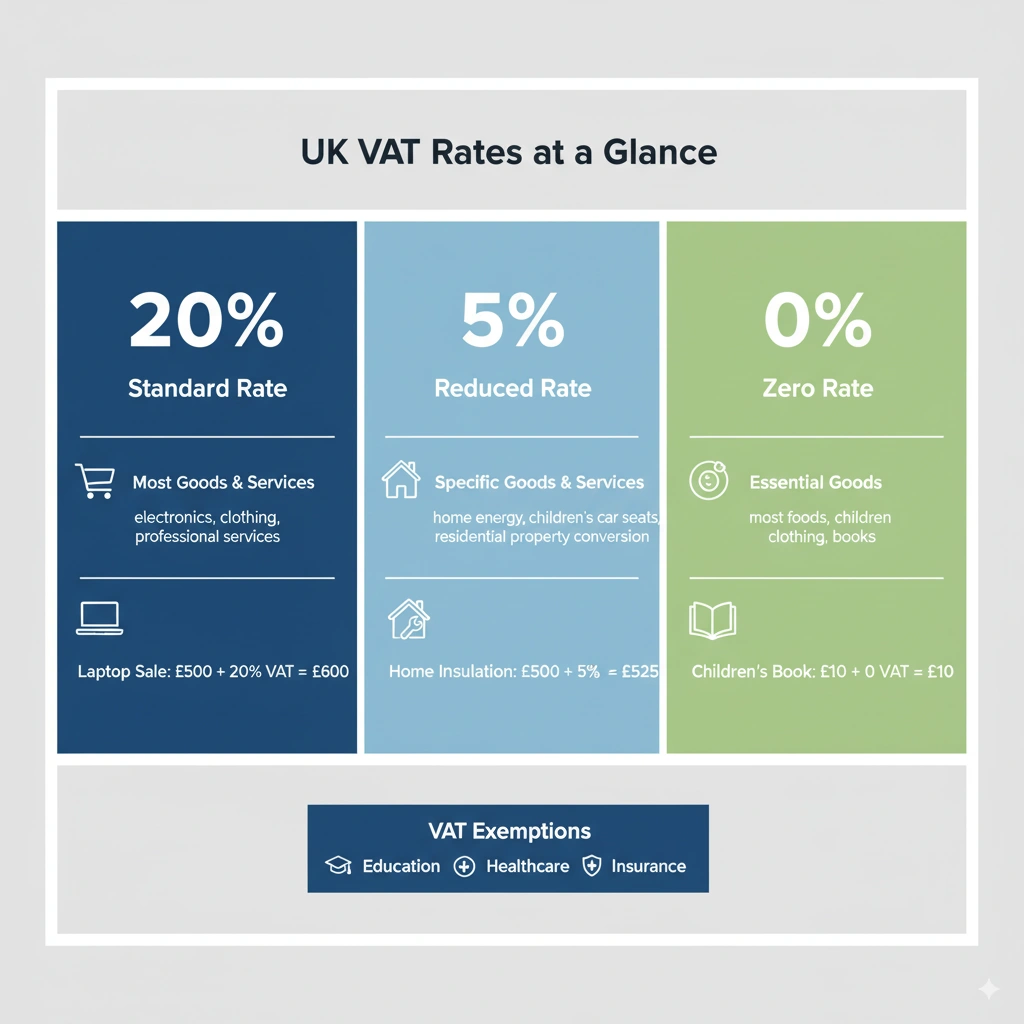

The UK has three main VAT rates, which vary based on the type of goods or services being offered. These rates are crucial for businesses to understand to ensure they are charging the correct amount.

- Standard Rate (20%): This is the most common rate, applying to the majority of goods and services. This includes items like clothing, electronics, and most professional services.

- Reduced Rate (5%): This rate applies to specific goods and services, such as children’s car seats, residential property conversions, and domestic fuel and power.

- Zero Rate (0%): This rate applies to essential items like most foods (excluding restaurant meals and some confectionery), children’s clothing, and books. While the rate is 0%, businesses must still record these sales and include them in their VAT returns.

It’s also important to be aware of VAT-exempt sales, such as education, healthcare, and insurance. These transactions are not subject to VAT, and businesses cannot reclaim VAT on related expenses.

A Brief History of VAT

The concept of a Value Added Tax originated in Europe, with Maurice Lauré, a French tax official, introducing it in 1954. The idea of taxing every step of the industrial process was first proposed in Germany a century earlier.

Today, most industrialised countries in the Organisation for Economic Co-operation and Development (OECD) have a VAT system, with the United States being a notable exception.

Research by institutions like the International Monetary Fund (IMF) suggests that while countries adopting VAT may initially experience lower tax receipts, it can improve government revenue and function effectively in the long run.

VAT Registration: Who Needs to Register?

Companies, partnerships, and sole proprietors are all subject to VAT. Businesses must register for VAT if their taxable turnover for the past 12 months has exceeded the registration threshold (currently £85,000) or if they expect it to in the next 30 days.

Upon successful registration, HM Revenue & Customs (HMRC) issues a VAT registration certificate, which contains the business’s unique nine-digit VAT number, the effective date of registration, and the due date for the first VAT return.

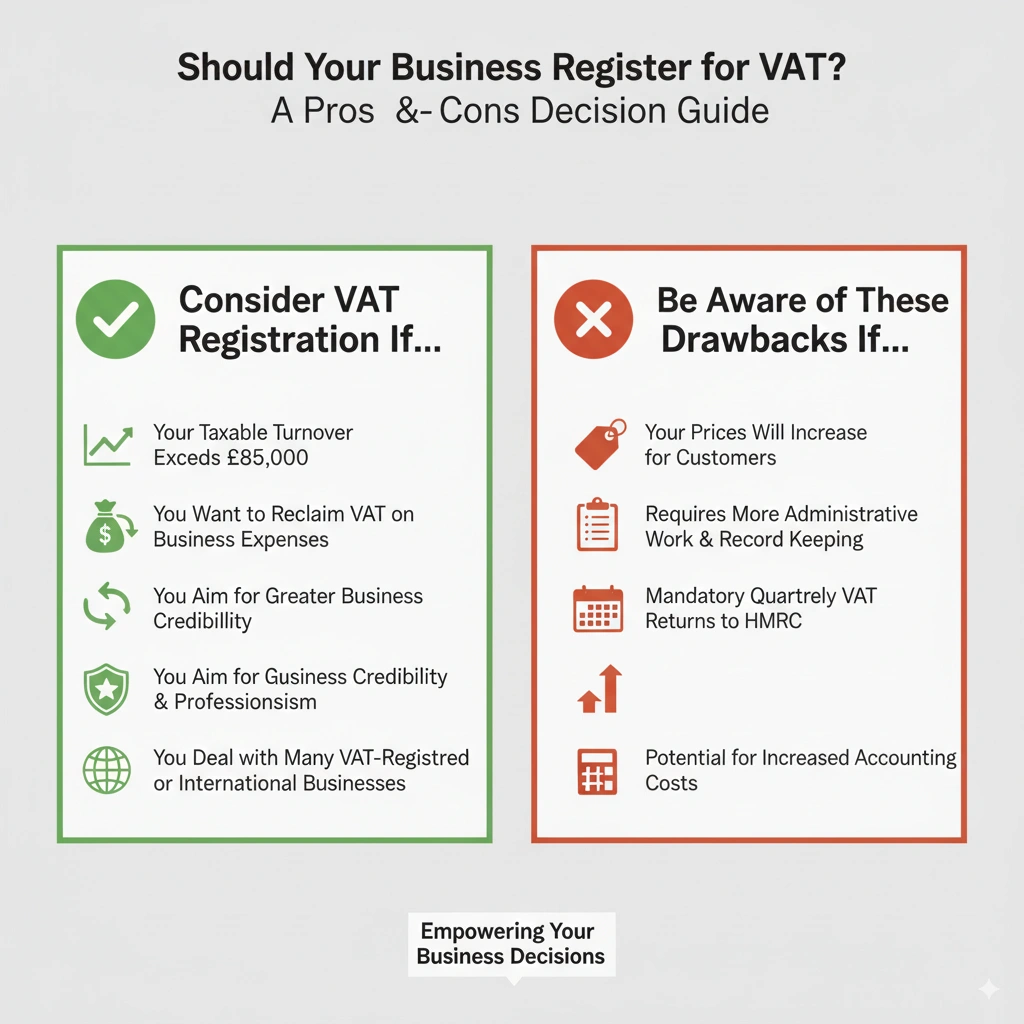

The Benefits of VAT Registration

While VAT registration comes with obligations, it also offers significant benefits for businesses.

- Reclaiming VAT on Business Expenses: This is one of the most significant advantages. Small Businesses can reclaim the VAT they have paid on purchases related to their operations. This can lead to substantial savings, especially for businesses with high initial capital expenditures or ongoing material costs.

- Increased Business Credibility: Having a VAT registration can make a small firm appear larger and more established. For many international companies, a VAT number is a prerequisite for business-to-business transactions, as it signifies a legitimate and compliant business.

- Access to New Markets: Being VAT-registered facilitates trade with other VAT-registered businesses, both domestically and internationally.

The Drawbacks of VAT Registration

Despite the benefits, VAT registration also comes with some notable drawbacks.

- Increased Prices for Customers: The primary disadvantage is that a VAT-registered company must charge VAT on all taxable sales. This can make goods and services appear more expensive, which may be a deterrent for customers, particularly if competitors are not VAT-registered.

- Administrative Burden and Extra Paperwork: VAT registration requires maintaining meticulous records of all VAT invoices and receipts. This can be time-consuming and often necessitates additional costs for accounting services to ensure compliance and proper submission of VAT returns.

- Quarterly VAT Returns: Businesses are required to submit quarterly VAT returns to HMRC, a process that requires accurate reporting of all sales and purchases. Failure to meet these deadlines or submit accurate returns can result in fines and penalties.

VAT Accounting and How to Reclaim Input Tax

After registering, a business must apply the applicable VAT rate to all taxable sales, known as “output tax.” While consumers pay this tax, the company is responsible for paying it to HMRC.

The other side of the coin is “input tax,” which is the VAT a business pays on purchases related to its operations. Businesses can reclaim this input tax from HMRC.

However, it’s crucial to understand what you can and cannot reclaim VAT on. VAT cannot be reclaimed for:

- Purchases for private use (for unincorporated businesses).

- Certain items like cars and entertainment expenses.

How is VAT Calculated?

What is VAT and how VAT works is essential when calculating taxes. VAT calculation is simple. To determine prices that include VAT:

- Multiply the price without VAT by 1.2 to add the standard 20% VAT.

- Multiply the price without VAT by 1.05 to add the 5% reduced VAT rate.

To determine prices excluding VAT:

- Divide the total price (including VAT) by 1.2 for the standard 20% rate.

- Divide the total price by 1.05 for the reduced 5% rate.

What is a VAT Number?

A VAT number, or VAT Registration Number, is a unique nine-digit code issued to VAT-registered businesses. In the UK, these numbers typically begin with “GB.”

This number is essential for submitting VAT returns and is displayed on the VAT registration certificate issued by HMRC. It’s vital to double-check your VAT number when submitting returns, as any errors may lead to delays or rejection of tax input claims.

Bottom Line

Understanding VAT is essential for individuals and businesses alike. As a consumption tax applied at every stage of a product’s production, it plays a vital role in government revenue worldwide.

While VAT registration offers benefits like tax reclaim and enhanced business credibility, it also comes with obligations such as rigorous record-keeping and regular tax returns.

By carefully considering the implications and responsibilities of VAT, businesses can ensure compliance, manage their finances effectively, and make informed decisions according to UK VAT laws that support their long-term growth.

The content provided on TaxCalculatorsUK, including our blog and articles, is for general informational purposes only and does not constitute financial, accounting, or legal advice.