Value Added Tax (VAT) exemption in the UK applies to specific goods and services where no VAT is charged at the point of sale. Around 15% of consumer spending in the UK falls on VAT-exempt items such as healthcare, education, insurance, postal services, and certain financial transactions.

For businesses, understanding VAT exemptions is critical for accurate pricing, compliance, and record-keeping, especially since the UK government collects over £160 billion annually from VAT revenues. For consumers, exemptions directly reduce the cost of essential services and everyday purchases. Knowing what is VAT exempt in the UK helps both individuals and companies navigate tax obligations more effectively.

Common VAT-Exempt Categories in the UK

-

Healthcare services provided by registered professionals and hospitals

-

Education and training offered by schools, colleges, and universities

-

Insurance and financial services (e.g., loans, credit, investment management)

-

Postal services supplied by Royal Mail

-

Betting, gaming, and lottery services

-

Fundraising events held by charities

-

Subscriptions to trade unions and professional bodies

What is VAT Exempt in the UK?

The simplest definition of a VAT-exempt supply is a good or service on which no VAT is charged to the customer. Crucially, the sale of an exempt item is completely outside the scope of the VAT system for the seller, meaning it is not a “taxable supply.” (VAT Notice 700).

💡 Not sure how much VAT you need to charge or reclaim? Use our free VAT Calculator to get accurate results in seconds!

Key Distinctions: Exempt vs. Zero-Rated

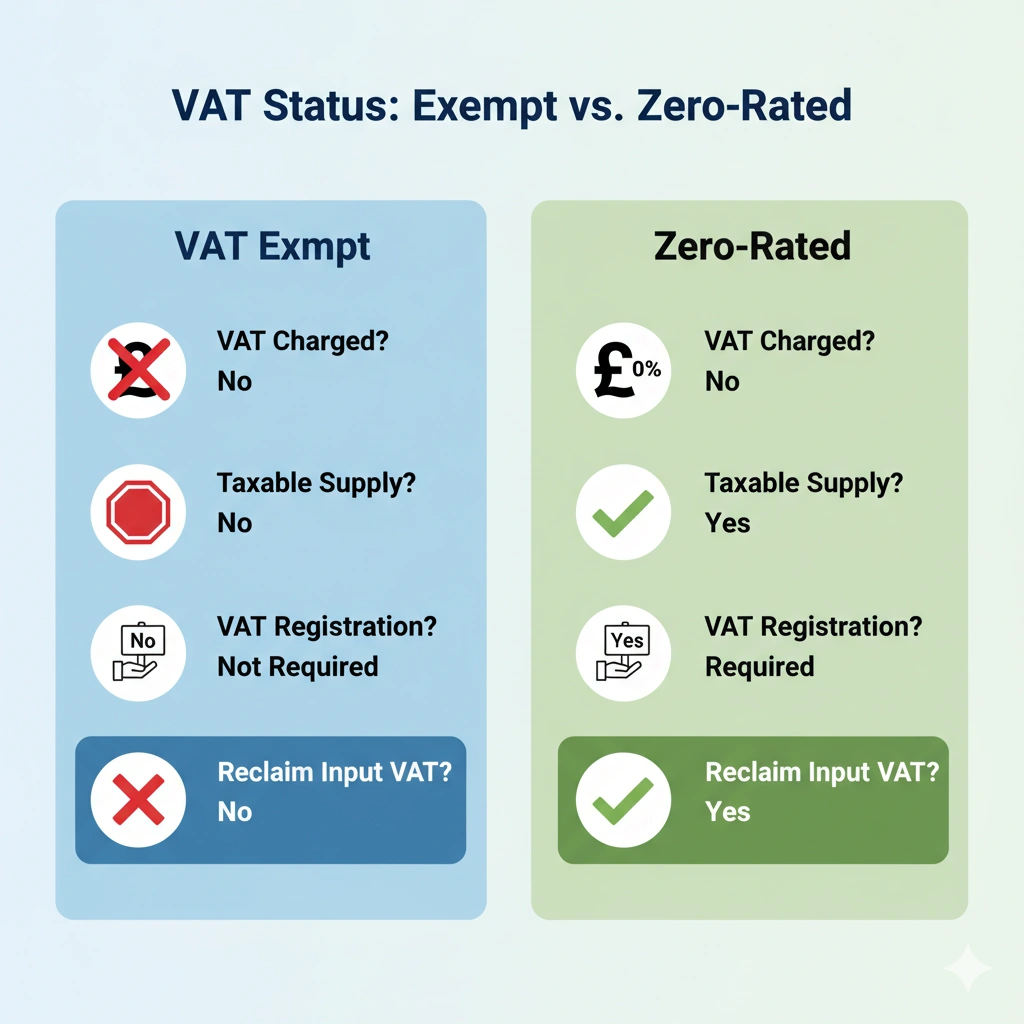

This is the most critical distinction to grasp in UK VAT law. While both exempt and zero-rated supplies result in the customer paying 0% VAT, their treatment for the supplying business is fundamentally different.

Zero-rated sales, such as most food, children’s clothing, and books, are still considered taxable supplies by HMRC. This allows businesses that sell them to reclaim the Input VAT they pay on related business expenses—a significant financial advantage often leading to a VAT repayment from HMRC.

Conversely, a business dealing only in VAT-exempt supplies cannot register for VAT, and therefore cannot reclaim any Input VAT. This Input VAT becomes an added cost to the business, which must be factored into pricing. (VAT Notice 701/7)

The Business Implications of Solely Exempt Supplies

If your business provides only VAT-exempt supplies, your operational and administrative burdens regarding VAT are simplified, but your cost base increases. (VAT Notice 700/1)

Simplified Compliance

A business whose total turnover comes only from exempt supplies enjoys significant compliance relief:

- No Compulsory VAT Registration: You are not required to register for VAT, regardless of your annual turnover.

- No VAT Returns: You do not need to submit regular VAT Returns to HMRC.

- Simplified Accounting: You don’t need to track Output VAT or manage complex partial exemption calculations.

Read Our more Detailed Guides on VAT:

Is There VAT on Flowers in the UK?

How to Find VAT Number of a Business?

Is VAT Chargeable on Alcohol in the UK?

Is There VAT on Car Parking in the UK?

Is There VAT on Stamp Duty in the UK?

Can Charities Claim Back VAT in the UK?

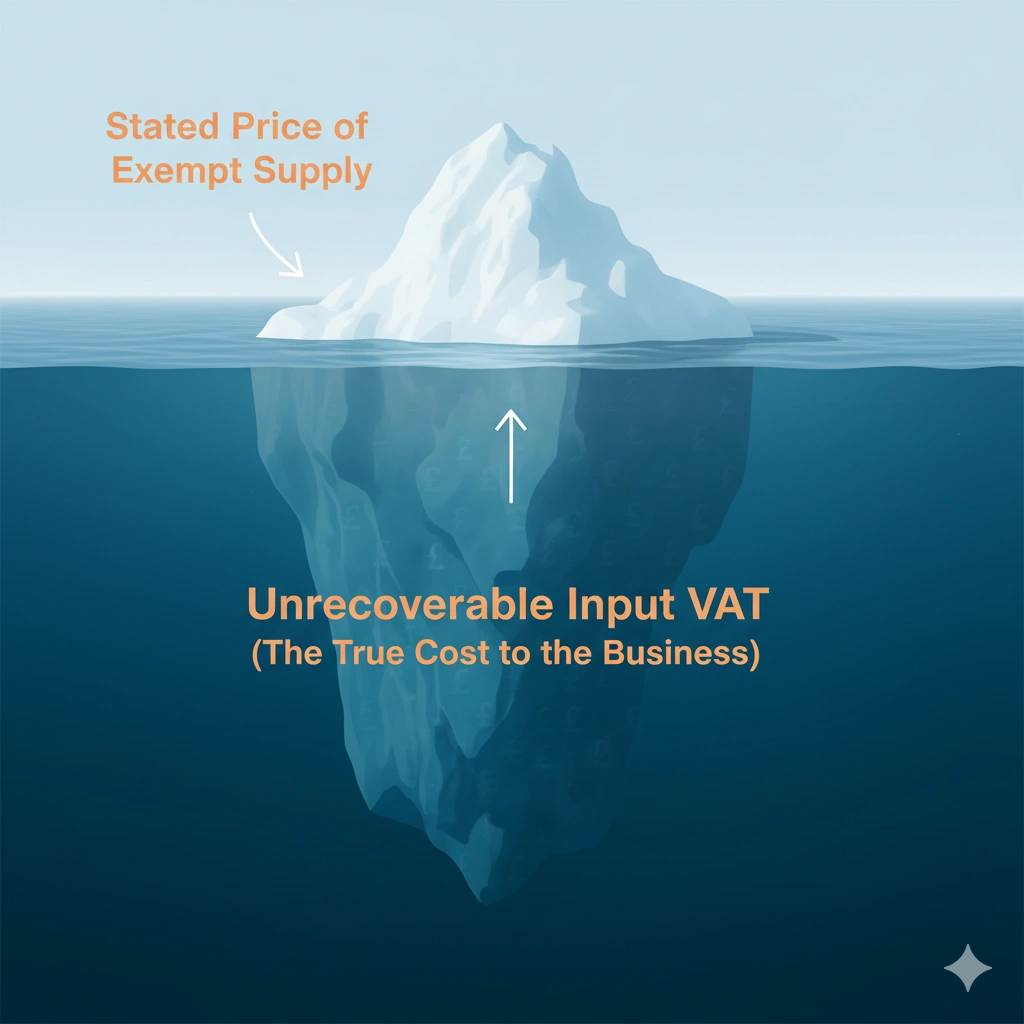

Increased Business Costs (Unrecoverable Input Tax)

The major drawback of exempt status is the non-recoverable Input VAT.

Example: A private educational college (VAT-exempt service) buys new computers for plus VAT at .

- If the college were standard-rated, they could reclaim the .

- Since the college is VAT-exempt, they cannot reclaim the . The effective cost of the computers to the business is .

This cost must be managed by the business, typically by increasing the price of its exempt service to maintain margins.

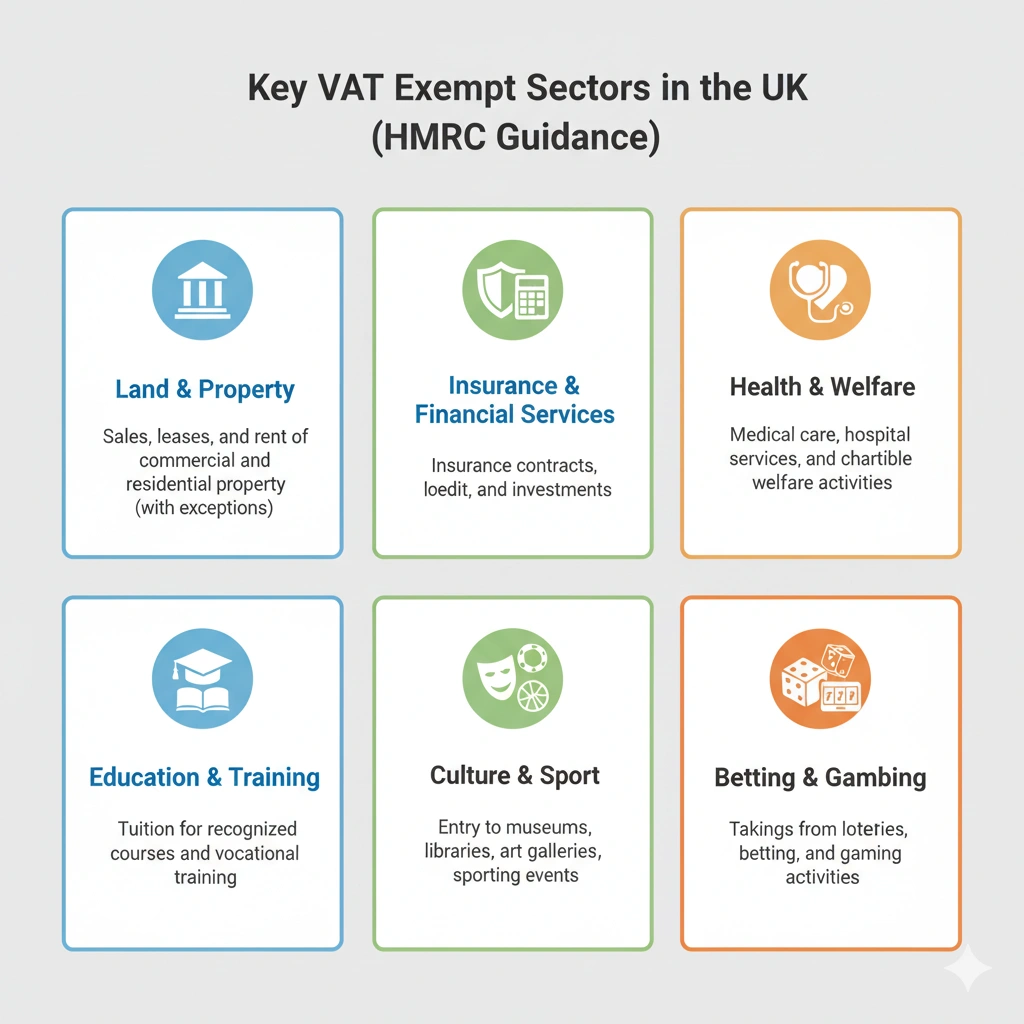

Common Categories of VAT Exempt Goods and Services

HMRC legislation defines specific sectors where supplies are typically VAT exempt.

It is imperative to consult the relevant Public Notices for detailed definitions, as exceptions and conditions frequently apply.

1. Land and Property (Specific Rules Apply)

The sale and rental of most land and buildings are VAT exempt. However, this is one of the most complex areas due to an option called the ‘Option to Tax’. (VAT Notice 742), (VAT Notice 742A)

- Residential Property: Generally exempt.

- Commercial Property Rental/Leasing: Exempt by default.

- Commercial Property Sales: Exempt by default.

The ‘Option to Tax’

A business owning or developing commercial property can choose to ‘Opt to Tax’ that property, making its sale or rental standard-rated (currently 20%). This allows the business to reclaim the Input VAT incurred on the purchase, construction, or maintenance of the property, which is often a significant amount. Once exercised, this decision is generally irrevocable for 20 years.

2. Insurance and Financial Services

These services are exempt to prevent the compounding of VAT (tax on tax) through complex financial chains, though the financial services sector is notoriously complex. (VAT Notice 701/36), (VAT Notice 701/49)

- Insurance: Services provided by insurance companies and intermediaries.

- Credit: Granting, negotiating, and managing loans, mortgages, and credit.

- Investment Services: The handling of financial instruments and shares.

- Banking: Most transactions concerning current, deposit, and savings accounts.

3. Health and Welfare

Services related to medical care are exempt to keep healthcare costs low for the public. (VAT Notice 701/31), (VAT Notice 701/57)

- Medical Care: Services provided by registered doctors, dentists, opticians, and other healthcare professionals.

- Hospital and Clinical Care: Services provided in a hospital or clinic setting.

- Welfare: Specific services provided by charities or statutory bodies to the elderly, sick, or disabled.

4. Education and Training

The exemption applies to ensure access to essential education. (VAT Notice 701/30)

- Eligible Bodies: Services provided by eligible bodies, which includes schools, universities, and colleges.

- Private Tuition: Tuition in a subject ordinarily taught in a school or university, provided by a sole trader or partner.

- Vocational Training: Specific types of job-related training, often subject to strict conditions.

5. Culture and Sport

- Cultural Services: Admissions to museums, galleries, theatres, and concerts provided by non-profit bodies or public institutions.

- Sport: Specific services supplied by non-profit making bodies that enable people to take part in or receive instruction in sport. (VAT Notice 701/47), (VAT Notice 701/45)

6. Betting and Gambling

Most forms of betting, lotteries, and gambling are exempt from VAT, though they are subject to other specific taxes (e.g., Gaming Duty, Lottery Duty). (VAT Notice 701/26)

Partial Exemption: The Most Common Business Challenge

The vast majority of businesses do not deal solely in exempt or solely in taxable supplies. If your business sells both taxable items (standard, reduced, or zero-rated) and exempt items, you are classified as partially exempt. (VAT Notice 706)

This status dramatically complicates VAT accounting because you must distinguish between:

- Directly Taxable Purchases: Input VAT can be fully reclaimed (e.g., raw materials for a standard-rated product).

- Directly Exempt Purchases: Input VAT cannot be reclaimed (e.g., marketing materials used only for the exempt service).

- Residual (Shared) Purchases: Input VAT must be apportioned (e.g., rent, utilities, general admin software used for both taxable and exempt activity).

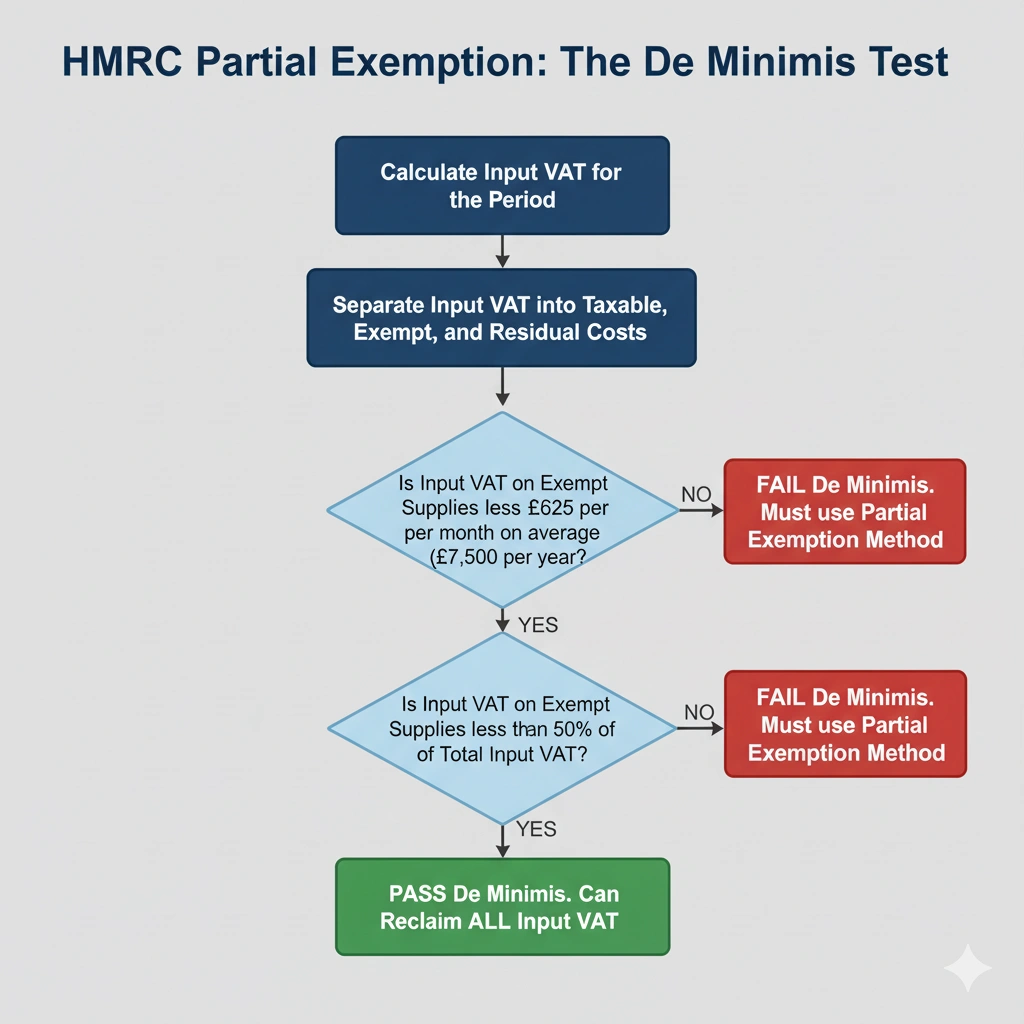

The Partial Exemption Test (De Minimis Rule)

A partially exempt business must perform a calculation at the end of each VAT period (or annually) to determine how much of its residual Input VAT can be reclaimed. However, if the amount of Input VAT relating to exempt supplies is very small, the business may be allowed to reclaim all its Input VAT. This is known as the De Minimis Rule. (VAT Notice 742A)

You are fully recoverable (can reclaim all Input VAT) if both of the following conditions are met:

- Total Input VAT attributable to exempt supplies is less than per month on average ( per year).

- Total Input VAT attributable to exempt supplies is less than 50% of your total Input VAT.

If you fail the De Minimis test, you must use a partial exemption method (often the standard pro-rata method based on the ratio of taxable sales to total sales) to calculate the recoverable proportion of your residual Input VAT. (VAT Notice 700)

Strategic Considerations and Expert Advice

Understanding your VAT status is not just a compliance issue; it’s a strategic financial decision.

The Strategic Decision to Opt to Tax

For commercial property owners, deciding whether to Opt to Tax is a key strategic decision.

- Pros: Allows the immediate recovery of significant Input VAT on the property purchase or development costs.

- Cons: The supply becomes standard-rated, meaning your tenant or buyer must pay VAT. If your tenant/buyer is also partially exempt, they may be unable to reclaim this VAT, making your property more expensive for them and potentially less competitive in the market.

Ensuring Accurate Categorisation and Compliance

The onus is always on the business to correctly categorise its supplies. Misclassification can lead to:

- HMRC Penalties: If you incorrectly treat a standard-rated supply as exempt, you under-declare VAT and will be subject to back-taxes, interest, and penalties.

- Lost Reclaims: If you treat a zero-rated supply as exempt and fail to register for VAT, you forgo the ability to reclaim Input VAT.

Best Practice for Partially Exempt Businesses:

- Maintain Excellent Records: All purchase invoices must clearly indicate whether the expense relates to taxable activity, exempt activity, or shared (residual) activity.

- Monitor the De Minimis Threshold: Regularly run reports to project your exempt Input VAT to ensure you do not unexpectedly cross the threshold and face complex apportionment calculations or retrospective adjustments.

- Consider Voluntary Registration: Even if your taxable sales are below the threshold, if you have significant zero-rated sales (e.g., exporting goods outside the UK) or very low exempt Input VAT, it is financially beneficial to voluntarily register to reclaim the Input VAT.

Understanding VAT Exempt Status for Businesses

If your business provides only exempt supplies, you:

- Don’t charge VAT on your sales

- Cannot reclaim VAT on your purchases

- Don’t need to register for VAT

- Are not required to submit VAT returns or keep VAT records

This can simplify your accounting processes, but it also means you won’t benefit from VAT reclaims. Use our VAT Calculator to compare exempt vs standard-rated sales impact on your margins.

Common VAT Exempt Goods and Services

According to HMRC guidelines, the following are commonly exempt from VAT:

- Education and training services

- Healthcare and medical treatments

- Insurance, finance, and credit

- Fundraising activities by charities

- Subscriptions to membership organisations

- Renting or leasing of commercial property (though this can be opted in for VAT)

Partial Exemption: What If You Sell Both Exempt and Taxable Items?

If your business sells both taxable and exempt items, it is considered partially exempt. This means:

- You can only reclaim VAT on goods and services used for taxable sales.

- VAT on shared costs must be apportioned using an approved method.

- Detailed records must be kept for both taxable and exempt transactions.

Key Differences Between VAT Exempt and Zero-Rated

It’s important not to confuse VAT exempt in the UK with zero-rated ones. Here’s a quick comparison:

| Feature | VAT Exempt | Zero-Rated |

| VAT Charged | No | No |

| VAT Registered Required | No | Yes |

| VAT Can Be Reclaimed | No | Yes |

| Included in VAT Turnover | No | Yes |

| Recorded in VAT Return | No | Yes |

So, while both exempt and zero-rated items are VAT-free to the customer, only zero-rated sales require VAT registration and can lead to VAT reclaims.

List of VAT Exempt Items in the UK

Here’s a simplified list of goods and services that are VAT exempt in the UK:

- Healthcare services by registered professionals

- Education services and private tuition

- Insurance and financial services

- Rental and sale of some property types

- Membership fees for non-profit organisations

- Gambling and betting

- Fundraising events run by charities

- Cultural services (e.g., museum admissions by non-profits)

Not sure if an item is exempt or taxable? Our VAT Calculator helps you instantly determine VAT impact by category and amount.

Can I Reclaim VAT on Exempt Goods?

If you’re dealing solely in VAT-exempt goods or services, you cannot reclaim any VAT paid on business purchases or expenses. However, if you’re partially exempt and meet specific HMRC thresholds, you might be eligible to reclaim a portion of the VAT.

Always maintain detailed VAT records and consider using digital tools, like our VAT Calculator, for better accuracy and compliance.

Summary and Final Thought

The term VAT exempt in the UK defines goods and services that are entirely outside the scope of VAT, crucially preventing the supplier from reclaiming Input VAT. This is the cornerstone difference when compared to zero-rated supplies, which are taxable at and do allow for Input VAT recovery.

For any business, especially those with mixed supplies (partially exempt), accurate classification and meticulous record-keeping are non-negotiable. Correctly determining your VAT obligations ensures you remain compliant with HMRC and, more importantly, that you are not losing money through unrecovered costs or incurring penalties from under-declared tax.

Try Our VAT Calculator Now!

💡 Need a quick VAT check?

👉 Try the VAT Calculator Now! to calculate VAT amounts for standard, reduced, and zero-rated goods in the UK. It’s fast, reliable, and updated according to HMRC rules.

The content provided on TaxCalculatorsUK, including our blog and articles, is for general informational purposes only and does not constitute financial, accounting, or legal advice.